Let's be honest, the words "tax season" can make even the most organized person break out in a cold sweat. But filing your taxes in Canada doesn't have to be a nightmare. At its core, the process is pretty straightforward: you gather your income slips (like the T4 from your employer), pick a way to file, claim every deduction and credit you're entitled to, and send your return off to the Canada Revenue Agency.

The big date to circle on your calendar? For most people, that's April 30 of each year.

Getting Started Without Getting Overwhelmed

Before you do anything else, get familiar with the Canada Revenue Agency (CRA) website. It’s your official source for every form, guide, and service you’ll need. Think of it as your home base for navigating your tax obligations effectively.

The whole system revolves around the Canada Revenue Agency (CRA), the federal agency that manages our tax laws. Whether you’re getting a refund or have a balance owing, the CRA is the organization you’ll be interacting with.

Who Actually Needs to File a Tax Return?

Technically, you only have to file a tax return if you owe money or if the CRA specifically asks you to. But here’s a pro tip: almost every adult in Canada should file a return, even if you had zero income.

Why? Because filing is the key to unlocking a ton of financial benefits.

- Getting your money back. If your employer took too much tax off your paycheques, filing is the only way to get a refund.

- Accessing benefits and credits. Payments like the GST/HST credit and the Canada Child Benefit are calculated based on your tax return. No return, no money. It's that simple.

- Building your RRSP room. Your tax return determines how much you can contribute to your Registered Retirement Savings Plan in the future. Filing now helps you save for later.

Your Social Insurance Number and Those Critical Deadlines

Your Social Insurance Number (SIN) is everything when it comes to taxes in Canada. You absolutely need it to file your return. If you're a newcomer, getting your SIN should be at the top of your to-do list—it's a foundational part of your new financial life here. We touch on this and other key experiences in our guide to life in Canada.

Canada’s tax system runs on a pretty strict clock. Missing the deadlines isn't just an inconvenience; it can lead to some painful financial penalties.

The most important date for most filers is April 30. That's the deadline to both file your return and pay any taxes you owe.

If you're self-employed, you get a bit of a break—your filing deadline is June 15. But watch out for the catch: your payment is still due on April 30. If a deadline ever lands on a weekend or holiday, the CRA gives you until the next business day.

Gathering Your Essential Tax Documents

A smooth tax season has less to do with the software you use and everything to do with being organized. Seriously. Getting all your documents in one place before you even think about filing is the single best thing you can do to make the process painless. It ensures you file accurately and—more importantly—claim every dollar you're entitled to.

Think of it as your pre-flight checklist. For most employees, the journey starts with the T4, Statement of Remuneration Paid. Your employer must provide this to you by the last day of February, and it breaks down your total income and all the tax that was already deducted at the source.

But let’s be real, most of our financial lives are more complicated than just one job. That’s where the rest of the T-slips come in.

Beyond the Basic T4 Slip

Many Canadians earn income from different places, and each one comes with its own specific tax slip. Keeping track of them all is crucial for getting your return right the first time.

You might also get slips like:

- T4A, Statement of Pension, Retirement, Annuity, and Other Income: This is the catch-all for everything from freelance income and scholarships to pension payments and government benefits.

- T4E, Statement of Employment Insurance and Other Benefits: If you were on EI at any point during the year, this slip shows that income.

- T5, Statement of Investment Income: This one details any investment income—like interest or dividends—that topped $50 from a single financial institution.

- T3, Statement of Trust Income Allocations and Designations: It’s a lot like a T5, but it’s for income you earned from trusts or mutual funds.

Missing even one of these can trigger a dreaded reassessment letter from the CRA later on, so it pays to be thorough.

The absolute easiest way to make sure you have every slip is to log into your CRA My Account. The CRA gets copies of most of these slips directly, so you can see and download them right from your account. It takes all the guesswork out of it.

This is a complete game-changer. It’s not just a time-saver; it’s your final backstop against a slip that got lost in the mail or sent to an old address.

Receipts That Reduce Your Taxes

Collecting your income slips is only half the story. The other, more rewarding half, is rounding up all the receipts for things that can actually lower your tax bill. These are the documents that unlock deductions and credits.

Make sure you hunt down the records for:

- RRSP Contributions: Your bank or investment firm will send official receipts. Remember, contributions made in the first 60 days of the year can be applied to either the current or the previous tax year.

- T2202, Tuition and Enrolment Certificate: If you’re a student, your school provides this form (usually online) so you can claim your tuition fees as a non-refundable credit.

- Medical Expenses: Keep every receipt for prescriptions, dental work, glasses, and other eligible costs that weren't covered by an insurance plan.

- Charitable Donations: You'll need the official tax receipts from registered charities to claim this powerful credit.

- Child Care Expenses: Receipts from your daycare or caregiver are essential for claiming this deduction.

- Business or Employment Expenses: If you're self-employed or an employee with eligible expenses, you need detailed records—from invoices and receipts for supplies to meticulous vehicle mileage logs.

Getting these papers sorted into simple categories before you start will make filing your taxes in Canada so much easier. Whether you use digital folders or good old-fashioned paper ones, a little organization now prevents a massive headache later.

Alright, with all your documents gathered and organized, it's time to decide how you're actually going to get your return to the Canada Revenue Agency. These days, Canadians have more options than ever, and each method has its own vibe and set of perks. The best choice for you really boils down to your comfort level with technology, how complex your financial life is, and frankly, how quickly you want that refund in your bank account.

The vast majority of us now file our taxes online. It's just faster, more accurate, and a whole lot simpler than the old-school paper-and-pen routine. But "filing electronically" isn't a one-size-fits-all term, so let's break down what your real options are.

Using NETFILE-Certified Tax Software

For most Canadians, this is the way to go. NETFILE is the CRA's secure portal that lets you send your completed tax return directly to them using certified software. It's the ultimate DIY digital route, and it's no surprise that a huge number of Canadians choose this method.

You’ve got a ton of programs to choose from. Some are completely free and perfect for straightforward returns, while others are more robust paid versions designed to handle trickier situations like investment income or rental properties.

- Best for: Individuals and families with simple to moderately complex taxes who are comfortable using a computer.

- How it works: You’ll answer a series of questions as the software guides you through entering your information. It does all the math, double-checks for common errors, and then—with just a click—sends your return straight to the CRA through the NETFILE service.

The real game-changer with NETFILE software is its accuracy. These programs are built to catch mistakes and can even use the CRA's "Auto-fill my return" feature to pull in the data directly from your T-slips. That means fewer typos and less manual entry.

Trust me, that auto-fill feature is a massive time-saver and seriously cuts down on the risk of a simple typo holding up your return.

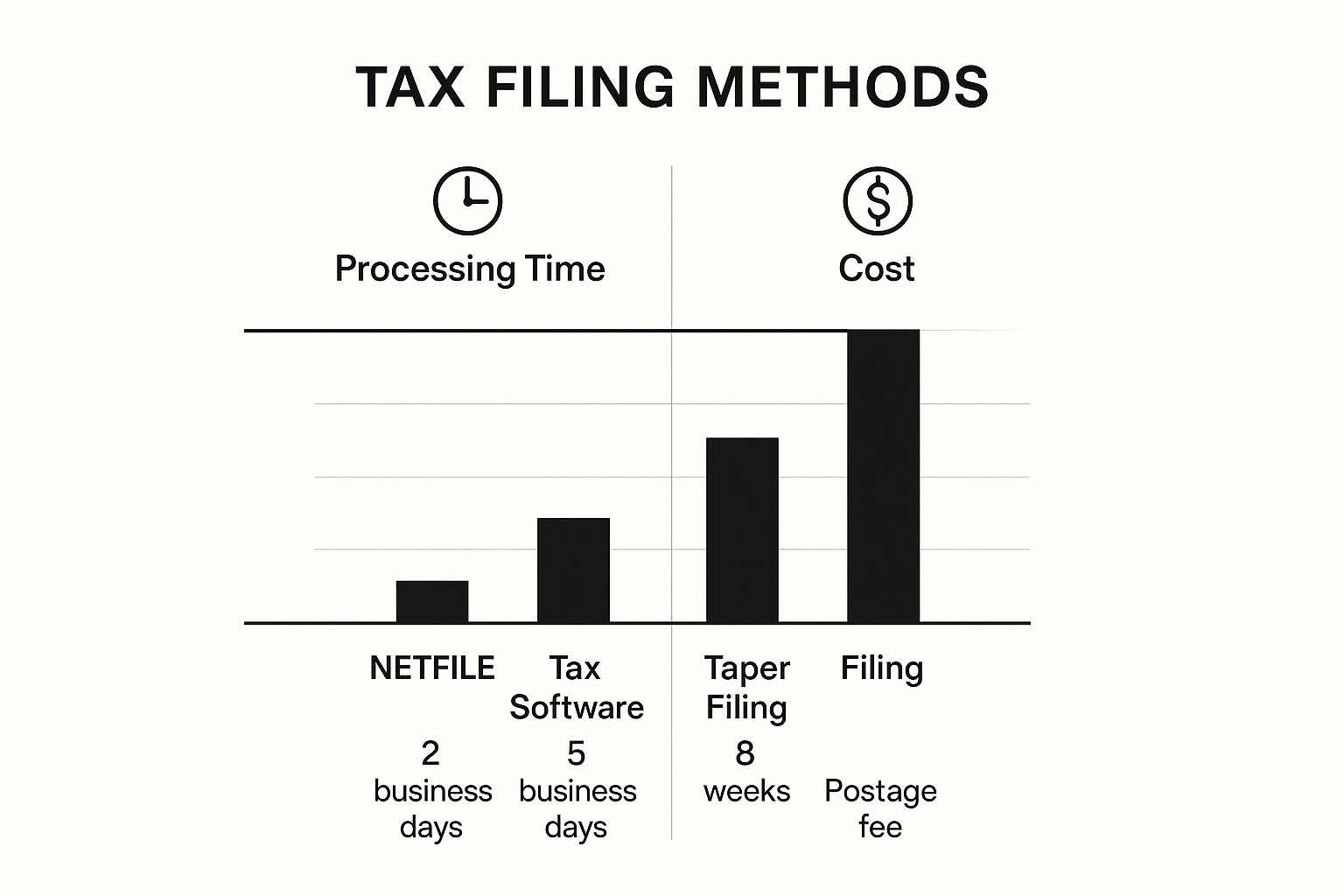

Before we dive into the other methods, let’s quickly compare the most common ways to file. This table gives you a snapshot of what to expect in terms of cost, speed, and who each method is really built for.

Comparison of Tax Filing Methods in Canada

| Filing Method | Best For | Cost | Processing Speed | Key Feature |

|---|---|---|---|---|

| NETFILE Software | DIY filers with simple to moderate returns who are comfortable with tech. | Free to ~$100+ | Online: ~2 weeks | Auto-fill My Return feature for speed and accuracy. |

| Tax Professional (EFILE) | Complex situations (business, investments) or those wanting expert guidance. | ~$75 to $400+ | Online: ~2 weeks | Professional expertise and peace of mind. |

| Paper Filing (Mail-in) | Individuals without internet access or those uncomfortable with digital tools. | Price of postage | ~8 weeks or more | The traditional, non-digital option. |

As you can see, your choice has a big impact, especially on how long you'll be waiting for that notice of assessment and any potential refund.

Filing by Mail with a Paper Return

The classic method—filling out a physical T1 General tax package and mailing it in—is still around, though it’s become much less common.

You might go this route if you’re just not comfortable with computers or if your tax situation is so unique that software can't quite handle it. If you do, just be ready for a bit of a wait. The CRA aims to process paper returns within eight weeks, but it can take longer. Plus, you’ll have to cover postage and you won't get that instant confirmation that your return was received, which can leave you wondering for a while.

Using a Tax Professional and EFILE

If your finances feel a bit tangled—maybe you're self-employed, have a rental property, or deal with a lot of investments—then bringing in a pro is often the smartest move.

Tax preparers use a different system called EFILE to submit returns for their clients. While not all preparers are Chartered Professional Accountants (CPAs), they are experts who know the tax code inside and out. They’ll make sure you're claiming every credit and deduction you're entitled to and can handle any back-and-forth with the CRA if questions come up. You’re essentially paying for expertise and peace of mind, and for many, that investment is well worth it.

Alright, you've gathered your documents and picked your filing method. Now comes the main event: actually filling out the tax return. This is where all those slips and receipts get translated into the numbers that will decide whether you get a refund or have a balance owing. It might seem daunting with all the line numbers and jargon, but let's break it down.

To make this real, let’s follow a simple scenario. Meet Alex. He's a single employee with a T4 slip from his job, a receipt for his RRSP contribution, a T2202 for a part-time course he took, and a couple of receipts from charitable donations. We'll trace his info through the key sections of the return to see how it all fits together.

Identifying Yourself and Your Situation

First things first, the Canada Revenue Agency (CRA) needs to know who you are. The first few pages of the T1 General Income Tax and Benefit Return are all about your personal details: name, address, Social Insurance Number, and marital status. This part is pretty straightforward, but getting it right is crucial so the CRA can identify you and apply the correct rules.

You'll also answer questions about your residency and whether you have a spouse or common-law partner. These details have a direct impact on certain credits you can claim, so accuracy is everything. In our example, Alex will enter his SIN and check the box for "single."

Reporting Your Total Income

This is where your T-slips get their moment in the spotlight. The goal here is to report every penny you earned from every source. Thankfully, most tax software is smart enough to guide you right to the correct lines.

- Employment Income (Line 10100): Alex will grab his T4 slip and enter the amount from Box 14 right here. For most people, this is the starting point.

- Other Income (Various Lines): If Alex had any side-hustle income (which would be on a T4A) or some investment income (from a T5), he'd plug those numbers into their own specific lines. For now, his income is just from his job.

Once every income source is accounted for, it all adds up to your Total Income on line 15000. Think of this number as the gross amount you earned before we start chipping away at it with deductions.

Finding Your Net and Taxable Income

Now for the good part—making that income number smaller. We get to subtract certain expenses to lower the amount of income you’ll actually be taxed on. This happens in two main steps: calculating your Net Income (line 23600) and then your final Taxable Income (line 26000).

Deductions are your reward for certain life expenses.

Key Insight: The difference between Net and Taxable Income can seem small, but it matters. Net Income is used to calculate eligibility for benefits like the Canada Child Benefit or GST/HST credit. Taxable Income is the final number the government uses to figure out your federal and provincial tax bill.

Remember Alex’s RRSP contribution? He’ll claim that deduction on line 20800. The amount he contributed gets subtracted directly from his Total Income, which immediately lowers his Net Income. If he had other common deductions, like childcare expenses or union dues (which are often on the T4), he'd claim them in this section, too.

Calculating Your Non-Refundable Tax Credits

This section feels like a bit of a treasure hunt. Non-refundable tax credits are fantastic because they directly slice into the amount of tax you owe. The big one that almost every Canadian taxpayer can claim is the Basic Personal Amount (BPA) on line 30000. For the 2023 tax year, this was $15,000 at the federal level, though it can be lower for high-income earners. This means the first chunk of your income is effectively tax-free.

This is where Alex’s other receipts come into play:

- Tuition Fees (Line 32300): He'll use the amount listed on his T2202 form here.

- Charitable Donations (Line 34900): He adds up the totals from his donation receipts and enters the full amount.

- Medical Expenses (Line 33099): If he had qualifying medical costs, this is where they would go.

These credits are incredibly powerful; each one chips away at your tax bill. The impact of getting this right is huge on a national scale. For the 2023 tax year, the CRA processed over 32 million individual returns. Of those, about 17.6 million people received a refund, with the average refund being approximately $2,263. It really shows how much money is on the table when you file accurately. You can see more Canadian tax statistics and understand the broader picture.

After all your income is reported, deductions are subtracted, and credits are applied, the software (or the paper form) does the final math. It calculates your total federal and provincial tax and then compares it to the tax your employer already withheld (that’s on your T4). If you paid more than you owe, you get a refund. If you paid less, you have a balance to pay.

Unlocking Credits and Deductions to Maximize Your Refund

Successfully filing your taxes is one thing, but getting the biggest possible refund is the real goal. This is where a solid understanding of tax credits and deductions comes into play. These are the two main tools the Canadian tax system provides to lower your tax bill, but they work in completely different ways.

Think of it this way: tax deductions shrink your total taxable income. The less income you're taxed on, the lower your overall tax bill becomes. Tax credits, on the other hand, are subtracted directly from the taxes you owe. Getting comfortable with both is the secret to making sure you don't leave any of your hard-earned money on the table.

The Power of Tax Deductions

Deductions are incredibly valuable because they directly reduce the income figure the Canada Revenue Agency (CRA) uses to calculate your tax. It’s a dollar-for-dollar reduction before any tax rates are even applied, which can have a massive impact.

Some of the most common—and often missed—deductions include:

- Moving expenses: Did you move at least 40 kilometres closer to a new job or to attend a post-secondary school full-time? You can likely deduct your eligible moving costs.

- Union and professional dues: If you pay annual dues to maintain a professional status required for your work, these are almost always deductible. You’ll find this amount in Box 44 of your T4 slip.

- Child care expenses: This is a major one for working parents. You can claim payments for caregivers, daycares, or day camps that allow you to work, run a business, or attend school. The cost of living and child care is a huge financial pressure, and this deduction provides significant relief. In fact, it's a key part of figuring out how much money you need to survive in Ottawa and other Canadian cities.

Claiming Every Credit You're Entitled To

While deductions lower your taxable income, tax credits directly chop down your final tax bill. Credits fall into two main categories: non-refundable and refundable.

Non-refundable credits are great, but they can only reduce your tax payable to zero—you can’t get a refund from them. Refundable credits are the real gems because they can result in a payment to you even if you owe no tax at all.

Pro Tip: Keep meticulous records. For every single credit and deduction you claim, from the disability tax credit to your child’s daycare receipts, you need proof. The CRA can ask to see those documents for up to six years after you file.

Here are a few crucial credits to look for:

- Disability Tax Credit (DTC): This is a non-refundable credit for people with a severe and prolonged physical or mental impairment. It’s a substantial credit that also unlocks other related benefits.

- Canada Workers Benefit (CWB): A refundable tax credit specifically designed to help low-income individuals and families.

- Climate Action Incentive Payment (CAIP): If you live in an eligible province, this is a tax-free amount meant to help offset the cost of federal pollution pricing.

The key to a truly optimized tax return is finding every credit and deduction that applies to your specific life situation—whether you're a parent, a student, a senior, or a new homeowner. A quick look at CRA data shows a very diverse taxpayer population, with many Canadians falling into lower federal tax brackets. This makes claiming every available credit, especially those tied to the basic personal amount, absolutely critical. You can even explore the detailed statistics on Canadian taxpayers to see how these claims play out across different income levels and provinces.

Your Top Canadian Tax Questions Answered

Even with the best guides, tax season always brings up a few tricky questions. We get it. That's why we’ve put together some straight-up answers to the most common queries we hear from Canadians, so you can tackle these situations with confidence.

What Happens If I Miss the Tax Filing Deadline?

This is a big one. If you file your return late and you owe the government money, the Canada Revenue Agency (CRA) will hit you with a late-filing penalty.

Right off the bat, that penalty is 5% of whatever you owe. On top of that, they'll add another 1% for every full month your return is late, for up to 12 months.

And if you’ve been charged a late-filing penalty in any of the last three years, that penalty can actually double. To make matters worse, interest starts piling up daily on your unpaid balance. It can get expensive, fast.

The flip side? If you’re getting a refund, there’s no penalty for filing late. But here’s the catch: you won’t see a cent of that refund—or any of your benefit payments like the GST/HST credit—until you finally get that return filed.

Do I Have to File a Tax Return with No Income?

The short answer is yes, you absolutely should. While you’re not required to file if you don’t owe any tax, skipping it means you’re almost certainly leaving money on the table.

Filing your taxes is the only way to get access to some really valuable credits and benefits.

- GST/HST Credit: This is a tax-free payment sent out four times a year to help people with low or modest incomes offset the sales tax they pay.

- Canada Child Benefit (CCB): A huge one for parents. This is a monthly payment, and the amount you get is calculated based on the income you report on your tax return.

- RRSP Contribution Room: Filing your return is how you build up your RRSP deduction limit. Even if you can't contribute now, you're creating that room for future savings.

Think of it this way: not filing is like turning down free money. It’s always worth the effort, even if your income was zero. We often cover financial updates that affect Canadians in our news roundups, like in this piece about the top news stories from May 5.

How Long Should I Keep My Tax Records?

The official CRA rule is pretty clear on this: you need to hang onto your tax records and all supporting documents for at least six years from the end of the tax year they relate to.

This means all your T-slips, receipts for donations and medical expenses, and any other paperwork you used to fill out your return.

The CRA can ask you to back up any claim you’ve made on your return. Keeping your records organized, whether in a shoebox or a digital folder, will save you a massive headache if they ever come knocking for a review.

Can I Change My Return After I File It?

Definitely. It happens all the time—you hit "submit" and then find a forgotten T4 slip under a pile of mail. Don’t panic. The CRA has a simple process for making adjustments.

The easiest way is to use the "Change my return" feature right in your CRA My Account online. You can also mail in a paper form called T1-ADJ, T1 Adjustment Request.

A good rule of thumb is to wait until you get your Notice of Assessment back before you try to make any changes. You have a generous window to do this—you can go back and adjust returns from any of the last 10 calendar years.

Stay informed on all the local news that matters in Ottawa and the National Capital Region with ncrnow. From financial updates to community events, we keep you connected. Visit us at https://ncrnow.ca to see what's happening now.