So you've got an idea for a business in Canada. That's the easy part. Before you even think about business plans, financing, or registering a name, you need to do the groundwork. You have to make absolutely sure your brilliant idea is actually viable before you sink your time and money into it.

This early work is what separates a sustainable business from a forgotten passion project.

Is Your Business Idea Actually Good for the Canadian Market?

A great idea is just the start. The most critical first step in launching a small business in Canada is validation—proving there’s a real, paying audience for what you want to sell. Skipping this is like building a house without a foundation. It’s a recipe for disaster.

This is where you get out of your own head and into the real world to see if your idea has legs.

Get Your Hands Dirty with Real-World Market Research

Forget theories and spreadsheets for a moment. Effective market research is about gathering cold, hard data to understand your potential customers, the actual demand for your product, and the competition you're about to face.

Luckily, there are some powerful, free tools to help you paint a clear picture.

- Statistics Canada (StatCan): This is a goldmine. You can dig into demographics, consumer spending habits, and industry trends for specific cities and provinces. Thinking of opening a high-end pet grooming service in Ottawa? StatCan can show you household income levels and pet ownership stats right down to the neighbourhood.

- Google Trends: This tool is your crystal ball for public interest. Are searches for "vegan meal prep delivery" on the rise in Ontario? Is "custom woodworking" a hot search in British Columbia? The data will tell you if you’re catching a rising wave or chasing a fad that’s already peaked.

Size Up the Competition

Looking at your competitors isn't about copying what they do. It’s about finding their weaknesses and spotting the gaps they’ve left wide open in the market. Check out their pricing, read their customer reviews (especially the bad ones), and look at their marketing. What are people constantly complaining about? What are they not offering?

That gap? That's your opportunity. Maybe the local bakeries make amazing cakes but their online ordering system is a nightmare. Or perhaps all the consultants in your field only cater to huge corporations, completely ignoring the needs of small businesses.

A business idea isn't great because it's unique; it's great because it solves a specific problem for a specific group of people better than anyone else. That’s the heart of validation.

This is also a great time to start talking to actual people. Heading to local industry meetups can be incredibly insightful. You can learn more about making valuable connections at business networking events in Ottawa.

Nail Down Your Unique Value Proposition

After all this digging, you should be able to answer one simple question with confidence: "Why should a customer choose me over everyone else?"

Your answer is your unique value proposition (UVP). It’s the promise you make to your customers. A strong UVP is specific and hits home. It’s not "we offer high-quality service." It's "we provide on-site tech support for seniors in the National Capital Region with a guaranteed 24-hour response time." See the difference?

This validation phase can feel slow, but trust me, it’s the most important work you’ll do. Small businesses are the engine of our economy, making up 98.1% of all employer businesses and employing over 10.3 million Canadians. They contribute over 40% of Canada's GDP.

But the risks are real. Statistics Canada data shows that 35.1% of new businesses in the goods-producing sector fail within their first five years. Doing your homework upfront is your best defence.

The chart below breaks down just how vital small and medium-sized businesses are in Canada.

This data shows the massive number of small businesses out there and their huge contribution to jobs. It’s a crowded field, which is exactly why having a well-researched, validated idea is the only way to stand out and succeed.

Building a Business Plan That Actually Works

Let's be honest: the thought of writing a business plan sounds about as exciting as filing taxes. Most people picture a dusty, 50-page binder that gets written once for a loan officer and then shoved in a drawer forever.

Forget that. A modern business plan is your living, breathing playbook. It’s the strategic guide you'll use to make smart decisions, stay focused when things get chaotic, and actually measure what’s working. Think of it less like a novel and more like a lean, actionable roadmap you'll turn to again and again.

From Theory to Concrete Strategy

A classic starting point is the SWOT analysis—Strengths, Weaknesses, Opportunities, and Threats. But just making lists is a waste of time. The real magic happens when you connect the dots to build an actual strategy.

Here’s a real-world example. Say you're launching an e-commerce store based in Toronto. Your strength might be your knack for digital marketing, but your weakness is a total lack of logistics experience. You see an opportunity in the growing demand for sustainable products, but a threat in the ever-rising cost of shipping across Canada.

A weak plan just lists these four points. A strong plan connects them: "We'll lean on our digital marketing strength to spotlight our sustainable products (the opportunity), justifying a slightly higher price that helps absorb the rising shipping costs (the threat)." See the difference? You've just turned a passive list into an active game plan.

Building Realistic Financial Projections

This is where many new entrepreneurs freeze up, but it’s arguably the most important part of your plan. You need to get brutally honest with the numbers.

Start by mapping out every single startup cost. Don’t guess. Research each line item as if you were buying it today.

- One-Time Costs: Think business registration fees ($60 – $200+), website development, and any equipment you need to buy outright.

- Recurring Monthly Costs: This includes software subscriptions (like accounting or marketing tools), rent, inventory, salaries, and insurance.

Once your costs are clear, you can start forecasting revenue. It might feel like pulling numbers out of thin air, but you can ground it in reality. For a new Calgary-based consulting firm, this could mean estimating how many clients you can realistically land each month and multiplying that by your average service fee. An online store can look at industry data, where a 1-2% conversion rate is pretty standard, and apply that to their projected website traffic.

Your financial projections are a hypothesis, not a guarantee. The goal is to figure out your break-even point—the minimum you need to sell just to cover your costs—and set achievable targets for your first year.

Projecting Cash Flow and Setting Prices

Here's a hard truth: profit is an accounting concept, but cash is the oxygen your business breathes. Your cash flow projection is often more critical than your profit forecast because it tracks the actual money moving in and out of your bank account each month.

This simple exercise helps you see lean months coming and plan for big expenses. You could be "profitable" on paper, but if a major client pays their invoice 60 days late, a cash shortfall could easily sink your business.

Pricing is the other piece of this puzzle. Your price has to do three things: cover your costs, generate a profit, and make sense in the Canadian market. Sure, look at what your competitors are charging, but don't just copy them. Your price should tell a story about the value you offer. If your service is faster, your product is higher quality, or your experience is more convenient, you can—and should—charge more.

Defining KPIs You Will Actually Use

Finally, your business plan needs to identify your Key Performance Indicators (KPIs). These are the specific, measurable numbers you’ll track to see if you're actually making progress. Steer clear of "vanity metrics" like social media likes; they don't pay the bills.

Focus on the numbers that directly reflect the health of your business:

- Customer Acquisition Cost (CAC): How much do you spend on marketing and sales to land one new customer?

- Customer Lifetime Value (CLV): On average, how much revenue does a single customer bring in over their entire relationship with you?

- Monthly Recurring Revenue (MRR): For any subscription-based business, this is your lifeblood.

- Gross Profit Margin: After you subtract the direct cost of what you sold, what percentage of revenue is left?

Picking just a handful of these crucial KPIs will keep you laser-focused on what truly drives growth. Your business plan transforms from a static document into your dynamic guide for navigating the wild, exciting journey of building a business in Canada.

Getting the Money to Make It Happen

Let's be real: a brilliant business plan is just a nice document until you have the cash to back it up. Finding the money is often the biggest hurdle for new entrepreneurs, and the whole process can feel like a maze. But don't worry, once you know your options, you can find the right path for your business.

Where Does the Money Come From?

For a lot of founders, the first investor they pitch to is the one in the mirror. Using your own savings—what we call bootstrapping—is the most straightforward way to get going. You keep 100% control, no strings attached. The next closest source is often friends and family. This can be a great option, but treat it like a real business deal with clear, written agreements to keep relationships intact.

Taking Advantage of Government Support

Thankfully, you don't have to fund your entire dream out of your own pocket. The Canadian government has some fantastic programs that help new businesses get loans from banks and credit unions. They basically share the risk, which makes lenders more willing to say "yes."

Two of the big ones you need to know about are:

- The Canada Small Business Financing Program (CSBFP): This isn't a direct loan from the government. Instead, the government guarantees a portion of the loan you get from a traditional lender. It’s designed to help you finance things like buying equipment, a commercial property, or making leasehold improvements.

- The Business Development Bank of Canada (BDC): Think of the BDC as a lender that fills the gaps traditional banks might leave. They're a Crown corporation specifically created to support entrepreneurs. They offer everything from startup financing and working capital loans to invaluable business advice.

Crafting a Loan Application That Gets Approved

Walking into a bank or the BDC with just an idea won't cut it. They need to see a solid, viable business run by someone they can trust. Your business plan is your ticket in the door, but it’s the financial projections they'll really zero in on.

Lenders will pick apart your cash flow forecasts, your break-even analysis, and the logic behind your revenue numbers. Be ready to back up every single figure with solid market research. They want to see you've done the work.

Don’t forget about your personal credit history. Lenders view it as a direct reflection of how you handle money. A good credit score tells them you’re responsible, giving them the confidence to lend you theirs.

It's also worth noting the bigger economic picture. While the Bank of Canada has begun to ease interest rates in mid-2024, the economic outlook remains cautious. Showing lenders you're aware of these conditions can strengthen your application. You can learn more about the key economic trends influencing Canadian SMEs to better position your application.

Setting Up a Solid Financial Foundation

Getting the funding is a huge win, but it’s just the start. What you do next is what really counts. The day that money lands in your account, you need a system ready to manage it properly.

First things first: open a dedicated business bank account. Mixing your personal and business finances is a nightmare waiting to happen, creating accounting messes and potential legal headaches. A separate account keeps things clean and professional.

Next, get yourself some accounting software. Tools like QuickBooks, Xero, or Wave are lifesavers for tracking expenses, sending invoices, and understanding your financial health. Don't put this off. Starting with good financial habits from day one is the key to building a business that lasts.

Choosing Your Business Structure and Registering

Making your business official is a huge milestone, but it involves some critical legal choices that will shape your company's future. This isn't just about paperwork; it’s about setting up the right foundation for liability, taxes, and how you'll operate day-to-day. Let's break down how to choose a legal structure and get your business registered here in Canada.

Think of picking a business structure like choosing the right vehicle for a road trip. A small scooter is perfect for zipping around the city, but you wouldn't take it cross-country. Similarly, the structure you pick needs to match your business's size, risk level, and long-term goals.

Picking the Right Legal Structure

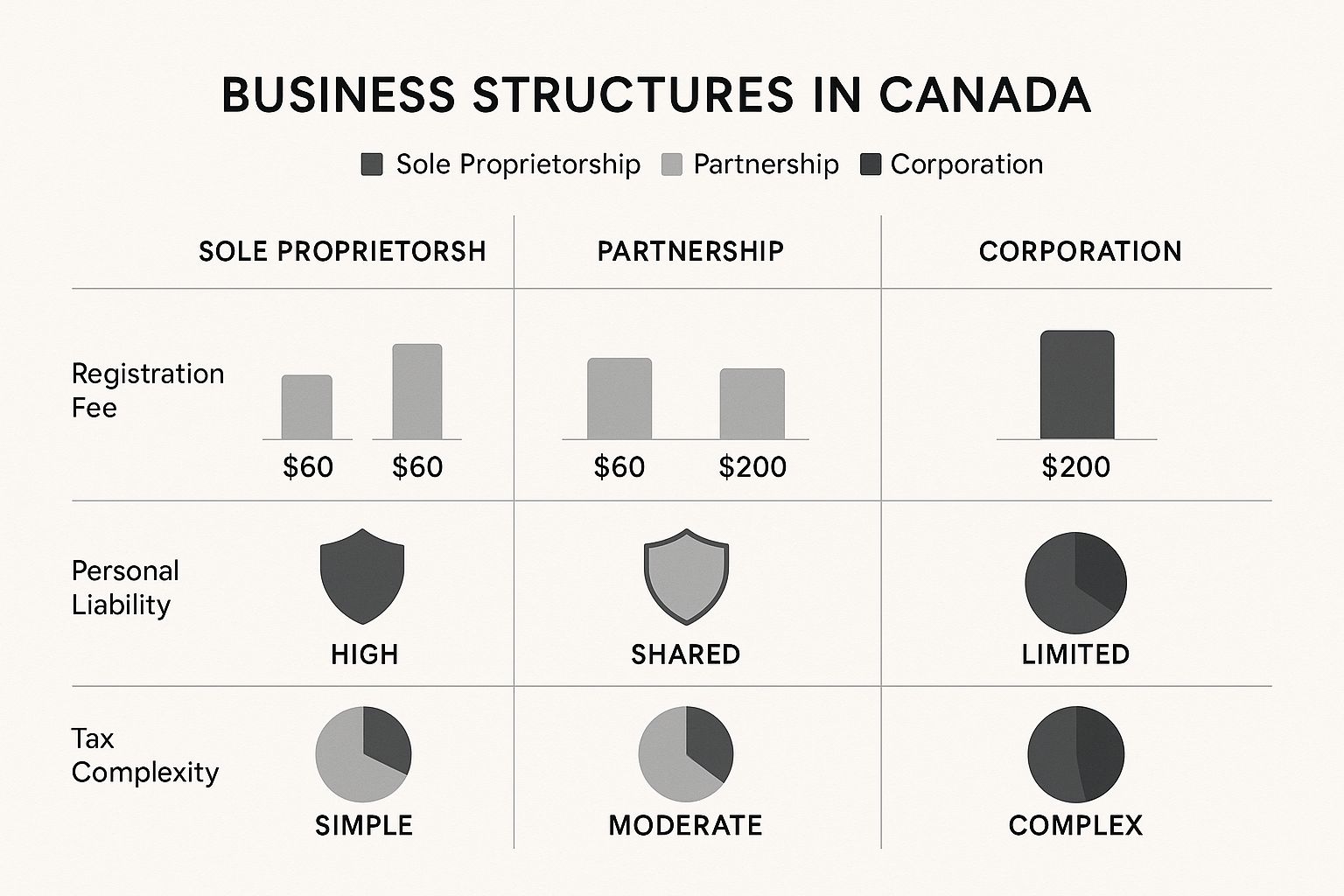

The three most common paths for small businesses are the sole proprietorship, the partnership, and the corporation. Each comes with its own set of rules, benefits, and headaches, especially when it comes to protecting your personal assets and handling taxes.

A freelance graphic designer in Ottawa, for instance, might start out as a sole proprietorship. It's the simplest and cheapest to set up, and the income just gets reported on their personal tax return. The catch? There's no legal separation between them and the business, which means their personal assets are on the line if the business runs into debt.

Now, let's say that designer teams up with a web developer to offer full-service branding packages. They might form a partnership. This structure is great for pooling resources and talent. But, just like a sole proprietorship, it usually comes with unlimited personal liability—and they're on the hook for each other's business-related actions.

Finally, if two entrepreneurs are opening a bustling cafe in the ByWard Market, they'll almost certainly choose to incorporate. A corporation is a separate legal entity, completely distinct from its owners. This structure offers the best personal liability protection (your home and savings are safe from business debts) but it’s more complex to set up, costs more, and comes with stricter record-keeping rules.

As you can see, while incorporating has higher upfront costs, it’s the only option that shields your personal assets by providing limited liability—a crucial safeguard for many business owners.

Canadian Business Structures at a Glance

Choosing the right legal structure is one of the most important decisions you'll make when starting your business. To simplify things, here's a quick comparison of the three main options.

| Structure | Liability Protection | Taxation | Administrative Complexity |

|---|---|---|---|

| Sole Proprietorship | None (unlimited personal liability) | Business income is reported on your personal tax return. | Low (simplest and cheapest to set up) |

| Partnership | Usually none (partners are personally liable) | Each partner reports their share of income on personal tax returns. | Moderate (requires a partnership agreement) |

| Corporation | High (separate legal entity, protects personal assets) | The corporation files its own tax return at a corporate rate. | High (more complex, costly, and requires annual filings) |

Each structure has its place. Your choice really depends on your comfort with personal risk, your financial situation, and where you see your business going in the next few years.

Navigating the Registration Process

Once you’ve settled on a structure, it’s time to make it official. The specific steps can vary a bit depending on your province and whether you incorporate federally or provincially, but the core process is fairly consistent across the country.

First up is choosing and clearing a business name. If you're a sole proprietor not operating under your own legal name, you'll need to register your "operating as" or trade name. For corporations, this involves a NUANS (Newly Updated Automated Name Search) report to make sure your proposed name isn't already taken or confusingly similar to an existing one.

Think of the NUANS search as your business name's background check. It’s a mandatory step for incorporation in many jurisdictions, including Ontario and at the federal level, to protect against trademark conflicts.

With your name cleared and structure chosen, the next step is formal registration. You can register your business provincially (in Ontario, for example) or federally. Federal incorporation lets you operate under the same name across Canada, while provincial registration limits that right to the specific province. The registration fee for a federal corporation is $200 online, while a sole proprietorship in Ontario costs just $60.

Getting Your Government Accounts in Order

With your business officially registered, the Canada Revenue Agency (CRA) will issue you a Business Number (BN). This nine-digit number is your business's single account for all your dealings with the federal government.

Your BN is the root number for several key accounts you might need to open:

- GST/HST Program Account: You absolutely must register for this if your business earns more than $30,000 in revenue over four consecutive quarters.

- Payroll Program Account: This is mandatory the moment you hire employees, as you'll need to handle payroll deductions like CPP and EI.

- Corporate Income Tax Account: If you've incorporated, this account is opened for you automatically.

Be prepared, because it's a competitive world out there for new entrepreneurs. The number of new businesses being created in Canada has faced headwinds, influenced by economic uncertainty and higher interest rates. This makes strong planning and differentiation even more crucial for survival and growth.

Finally, don’t forget about the local rules. Depending on your business type and where you're located, you may need municipal licences or permits to operate legally. This is especially true for any business with a physical location, which will often need to meet specific zoning and safety standards. To learn more about what's required for commercial spaces, check out our guide on how to get a building permit in Ottawa. Getting these registrations right from the start puts your business on solid legal footing, letting you focus on what really matters—growing your company.

Sorting Out Your Legal and Tax Obligations

Alright, so your business is officially registered. Congratulations! That’s a huge milestone. But now the real work begins. Operating a legal, compliant business in Canada is more than just having a Business Number—it’s about getting a handle on the permits, taxes, and rules that protect you and your customers.

Getting this right from day one isn't just a good idea; it's non-negotiable. It saves you from headaches and costly fines down the road and builds a solid, trustworthy foundation for your company. It can feel like a lot, but thankfully, there are some great tools out there to help you sort through it all.

Finding the Right Permits and Licences

Every business is different, and so are its licensing needs. The permits you need really depend on what you do, where you're located, and how you operate. A freelance consultant in Halifax has a completely different checklist than a retail shop in Vancouver.

A fantastic place to start is the BizPaL tool. It’s a free online service from the federal, provincial, and municipal governments that takes the guesswork out of the equation. You just answer a few simple questions about your business, and it spits out a personalized list of every single permit and licence you’ll need from all levels of government.

Think about a restaurant, for instance. They'll need a whole stack of them:

- A municipal business licence to even open their doors in their city.

- Provincial food handling permits and, if they're serving alcohol, a liquor licence.

- Federal registrations if they’re importing specialty ingredients from abroad.

Getting a Grip on Your Tax Responsibilities

Taxes are just part of the deal when you're in business, and you absolutely need to know your obligations to the Canada Revenue Agency (CRA). One of the first major tax responsibilities for many small businesses is the Goods and Services Tax (GST) or Harmonized Sales Tax (HST).

Here's the key number to remember: $30,000. Once your business earns more than $30,000 in worldwide taxable revenue over four straight calendar quarters, you are required to register for, collect, and remit GST/HST. This means you have to start charging the tax on your sales and sending that money to the CRA, usually quarterly or annually.

A classic rookie mistake is waiting until you've already blown past the $30,000 mark to register. Don't do it. Keep a close eye on your revenue and get registered as soon as you think you’re getting close. It’ll save you from a world of penalties for late filing.

Beyond sales tax, you need a rock-solid system for tracking every dollar that comes in and goes out. Meticulous records are your best friend when it's time to file your annual income tax return. For a more detailed walkthrough, check out our guide on how to file your business taxes in Canada.

What Happens When You Hire a Team

Bringing on employees is an exciting sign of growth, but it comes with a whole new layer of legal duties. As an employer, you're on the hook for more than just a paycheque.

You have to get payroll deductions right. This means withholding Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums, and income tax from your employees' pay. Then, you remit those amounts—plus your own employer contributions—to the CRA.

You also have a legal duty to provide a safe work environment. Every province and territory has its own workplace health and safety regulations you must follow. This could involve everything from providing safety training to ensuring proper equipment is used and having clear procedures in place for emergencies.

Protecting Your Business and Your Brand

Finally, let's talk about protecting all the hard work you've put in. Running a business without the right safeguards is a massive gamble.

-

Business Insurance: This is non-negotiable. At the bare minimum, you need Commercial General Liability (CGL) insurance. This protects you if someone gets injured or their property is damaged because of your business operations. You might also need professional liability (errors and omissions), commercial property, or cyber liability insurance, depending on what you do.

-

Trademarks: Your name, your logo, your slogan—these are your brand's crown jewels. Registering them as trademarks gives you legal protection across Canada, stopping others from using them and watering down your brand identity.

-

Privacy Compliance: In Canada, the way you handle customer information is governed by the Personal Information Protection and Electronic Documents Act (PIPEDA). You have to be upfront about the data you collect, get consent to use it, and keep it secure. This is especially critical for any business with an online presence.

Common Questions About Starting a Business

Getting a new business off the ground always comes with a million questions. To save you some time—and hopefully a few headaches—I've put together straightforward answers to the questions I hear most often from entrepreneurs just starting out in Canada.

Getting these fundamentals right from the beginning makes everything else a lot smoother down the road.

How Much Money Do I Need to Start a Small Business in Canada?

There's no single magic number for this. The real answer is: it depends entirely on your business.

A home-based consulting or freelance writing business might only need a couple of thousand dollars to get going. But if you're planning to open a physical retail shop in a busy neighbourhood, you could easily be looking at $100,000 or more once you factor in rent, renovations, and inventory.

Your first move should be to map out a detailed startup budget inside your business plan.

Don't leave anything out. Think about:

- One-Time Costs: Things like business registration fees, hiring a lawyer for an hour or two, buying a laptop, or paying a designer for your website.

- Ongoing Expenses: These are your monthly bills—software subscriptions, rent, marketing ads, and insurance payments.

- A Cash Cushion: This one is critical. You need enough working capital to cover at least three to six months of operating expenses. Most businesses aren't profitable on day one, and this buffer is what will keep you afloat.

Once you have this list, you'll have a realistic funding target to aim for.

Can a Non-Resident Start a Business in Canada?

Yes, absolutely. But you have to play by a specific set of rules. For the most part, non-residents can set up a sole proprietorship or a partnership without running into too many roadblocks. Where it gets tricky is when you want to incorporate.

Federal corporations, for instance, have a strict rule: at least 25% of your directors must be resident Canadians. Some provinces are a bit more relaxed—British Columbia, Saskatchewan, and Quebec are examples—but you need to know the specific requirements for where you're setting up shop.

This is not something to DIY. The rules around visas, corporate structures, and taxes are complex. I always advise people to speak with a Canadian immigration lawyer and an accountant first. They'll help you pick the right structure and ensure you're fully compliant from the get-go.

Getting this right from the start will save you a world of trouble later on.

Do I Need to Charge GST or HST Right Away?

Not necessarily. The Canada Revenue Agency (CRA) gives small businesses a bit of a runway. You're only legally required to register for, collect, and remit GST/HST once your business makes more than $30,000 in taxable revenue worldwide over four straight calendar quarters.

Until you cross that line, the CRA considers you a "small supplier."

That said, you can choose to register voluntarily before you hit the $30,000 threshold. Why would you? The biggest perk is claiming Input Tax Credits (ITCs). These credits let you get back the GST/HST you pay on your own business expenses—things like supplies, equipment, software, and even rent. For a new business, getting that cash back can make a real difference.

At ncrnow, we keep you informed about the latest business trends and news in Ottawa and the National Capital Region. Stay ahead of the curve by visiting us at https://ncrnow.ca.