Ready to launch your Ontario business? The good news is the entire registration process is now streamlined online through the province's official portal. It essentially comes down to three key steps: picking a business structure, choosing a name that meets legal standards, and completing the correct digital forms.

Let's walk through the process together. This guide will break down each part so you can navigate the Ontario Business Registry with confidence.

Your Starting Point for Ontario Business Registration

Before you dive into the paperwork, you need to make a few foundational decisions that will significantly shape your company's future. This isn't just about ticking boxes; these early choices determine your legal obligations, how much personal liability you're taking on, and how you'll be taxed.

Think of it like drawing up the blueprint for a house before you even think about pouring the concrete.

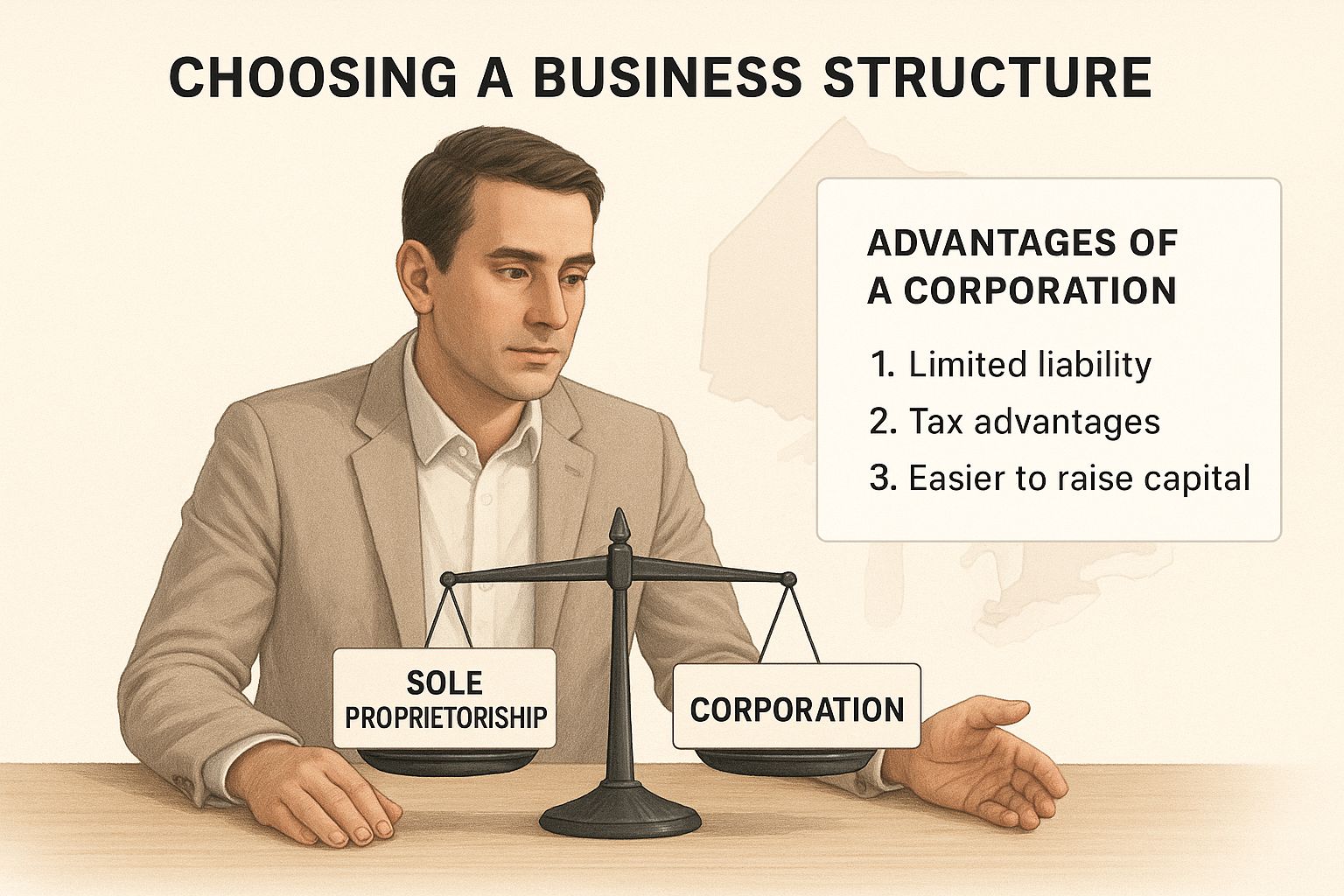

Getting this right from the start saves a world of headaches later. You’re essentially choosing between operating as a sole proprietorship, teaming up in a partnership, or creating a separate legal entity by incorporating. Each path has its own pros and cons, and it's crucial to understand what you're signing up for.

Key Decisions on Your Path to Registration

Before you can hit that "register" button, the Ontario government needs a few key pieces of information. Get these sorted out first, and the rest of the process will be much smoother.

- Business Structure: Are you a sole proprietor, a partnership, or a corporation? This is the big one. It impacts your liability, your taxes, and your administrative workload.

- Business Name: Have you picked a name that's unique and follows Ontario's rules? A corporation, for example, has much stricter naming requirements and needs a formal name search.

- Official Address: You'll need a physical address in Ontario. This is where the government will send any legal documents and official mail.

The image below gives you a great visual of how these structures stack up, from the simplicity of a sole proprietorship to the more complex (but more protected) world of a corporation.

As you can see, there's a trade-off between how easy it is to run your business and how much legal protection you have. For a wider look at this, our guide on how to start a small business in Canada is a great resource that covers the national picture.

I see it all the time: new entrepreneurs rush through the registration without really thinking about the long-term impact of their business structure. Slow down. Taking a little extra time now to understand your options can save you a ton of money, stress, and legal trouble down the road.

Choosing the Right Business Structure

Alright, the first big decision you'll make on your way to registering your business in Ontario is picking a structure. This isn't just about filling out a form; it's a choice that will shape your taxes, personal liability, and even how you handle your day-to-day admin. Getting this right from the start lays a solid foundation for your company's legal and financial future.

Let’s walk through the most common options and what they actually look like in the real world.

The Simplicity of a Sole Proprietorship

For most people starting out on their own, the sole proprietorship is the go-to. Think of a freelance web developer, a home-based baker, or a consultant testing the waters. Its biggest selling point is how ridiculously easy it is to set up. Legally, you and your business are one and the same.

That means your business income is just your personal income, which makes tax time a whole lot simpler. But that seamless connection is also its biggest risk. If your business racks up debt or gets sued, your personal assets—your house, your car, your savings—could be on the line.

A sole proprietorship is perfect for launching a business idea with minimal cost and fuss. Just go into it with eyes wide open, knowing there's no legal wall between your business finances and your personal ones.

Teaming Up with a General Partnership

So, what happens if you’re launching that web development agency with a friend? That's where a general partnership comes in. It’s pretty much like a sole proprietorship, but for two or more owners. The registration process is just as simple, and profits flow through to the partners to report on their personal tax returns.

The real challenge here is the shared liability. You aren't just on the hook for your own actions, but for your partner’s too. If one partner makes a bad call or decides to bail, it can get messy fast, both legally and financially. Even though it's not required for registration, I always tell people to get a partnership agreement drafted by a lawyer. Don't skip this.

Building a Shield with Incorporation

For any business with big growth ambitions, plans to seek investors, or that operates in a higher-risk industry, incorporation is usually the smartest path. When you incorporate, you create a completely separate legal entity. In the eyes of the law, your company becomes its own "person."

That separation is what gives you a vital liability shield. If the corporation gets into financial trouble, your personal assets are generally protected. Corporations can also offer some tax advantages, since corporate tax rates are often lower than the higher personal income tax brackets.

Of course, this protection comes with more responsibility. Incorporating costs more upfront and involves a lot more administrative work, like filing a separate corporate tax return and keeping a corporate minute book updated.

To help you visualize the trade-offs, here’s a quick breakdown of how these structures compare. Nailing this choice is a massive part of figuring out how to register a business in Ontario that truly fits your long-term goals.

Comparing Ontario Business Structures

Deciding which legal structure is the right fit can feel overwhelming. This table breaks down the key differences between a sole proprietorship, a general partnership, and a corporation to help you compare them side-by-side.

| Feature | Sole Proprietorship | General Partnership | Corporation |

|---|---|---|---|

| Liability | Unlimited personal liability. Your personal assets are at risk. | Unlimited and shared personal liability among partners. | Limited liability. Personal assets are protected from business debts. |

| Taxes | Business income is reported on your personal tax return. | Each partner reports their share of income on their personal return. | Files its own corporate tax return. Potential for tax deferral. |

| Setup Cost | Lowest. $60 for name registration (valid for 5 years). | Low. $60 for name registration (valid for 5 years). | Highest. Starts at $300 plus a mandatory name search report. |

| Admin Effort | Minimal ongoing paperwork. | Low, but a partnership agreement is strongly advised. | High. Requires annual filings and a corporate minute book. |

At the end of the day, there's no single "best" option. It's all about which structure is best for you and your business right now. Think hard about your tolerance for risk, your plans for growth, and whether you see partners in your future.

Getting to Know the Ontario Business Registry and Naming Rules

Alright, you've picked your business structure. The next stop on this journey is the Ontario Business Registry (OBR). Think of this online portal as your command centre for getting your business officially on the books. While it’s built to be pretty straightforward, knowing the lay of the land before you dive in can save you a ton of headaches. Your first practical move is to create an account to get access to all the forms and services you'll need.

One of the first hurdles I see entrepreneurs stumble over is the business name. It’s not just about picking something catchy; it’s about making sure it follows the rules. A simple mistake here can get your application bounced, causing delays and frustration. It's really worth taking the time to understand the naming game before you get too attached to a particular idea.

Legal Names vs. Trade Names

First off, it’s crucial to understand the difference between a legal name and a trade name. Your legal name is the official, government-registered name of your business. For a sole proprietor, that might just be your own name— "John Smith." For a corporation, it's the full name that includes a legal ending like "Inc.," "Ltd.," or "Corp."

A trade name is what most people call a "doing business as" (DBA) name. It's the name your customers will actually see and know you by. For instance, a corporation with the legal name "1234567 Ontario Inc." might run a coffee shop called "The Daily Grind." You have to register "The Daily Grind" as a trade name and officially link it to your legal corporate entity.

The NUANS Report: Your Name’s Background Check

If you’re incorporating with a specific name (and not just a generic numbered company), you can't just pick one out of a hat. You need to prove it's distinct by getting a NUANS (Newly Updated Automated Name Search) report. This is a deep dive into a national database of existing corporate names and trademarks to make sure your proposed name isn't a carbon copy or confusingly similar to another business.

The government requires this to avoid confusing the public and to protect the brands that are already out there. For named corporations, this isn't optional—your application will be dead on arrival without a valid NUANS report.

A rejected name is more than just an administrative hiccup; it costs you real time and money. Here’s a pro tip I always share: come up with a list of three to five names you love and run preliminary searches on them before you pay for the official NUANS search. This massively boosts your odds of getting a green light on the first try.

Your Unique Company Key

Once you’re in the system, one of the most important pieces of information you’ll manage is the Company Key. This is a secure, nine-digit number that acts like a PIN for your business profile on the OBR. It’s what gives you—and only you—the power to access your records online to file updates, make changes, or even dissolve the business down the road.

This security measure is becoming even more critical. As of October 19, 2021, every business registered in Ontario requires a Company Key to access its online profile. This move was part of a major digital modernization effort to beef up security against fraud and give you direct control over your official information. You can get more details on how changes to the Company Key will affect your business.

Getting a handle on these naming rules and registry tools like the NUANS report and Company Key is a core part of learning how to register business ontario the right way. Nail these details from the get-go, and you’ll set yourself up for a smooth, secure, and successful registration without getting tangled in red tape.

The Registration Process: A Step-by-Step Guide

Alright, you’ve nailed down your business structure and picked the perfect name. Now comes the final leg of the race: getting your registration filed with the province.

Before you even think about opening the Ontario Business Registry website, take a moment to get all your ducks in a row. I always tell new entrepreneurs to think of this as their pre-flight checklist. Having every piece of information and every document ready to go makes the actual application process incredibly smooth. Trust me, a few minutes of prep now will save you a massive headache later.

There's nothing more frustrating than getting halfway through the online forms only to realize you’re missing a critical detail. It breaks your momentum and can lead to unnecessary delays.

Your Essential Information Checklist

No matter what kind of business you're setting up, you'll need a few core details. Everyone needs a valid email address and a clear, simple description of what your business actually does—think "residential landscaping services" or "graphic design consulting."

From there, the specifics will change based on your business structure.

- Director and Partner Information: If you're launching a partnership, you’ll need the full legal names and home addresses for every single partner. For corporations, the same rule applies to all directors.

- Official Business Address: This is a big one. You must provide a physical address in Ontario where legal documents can be delivered. A P.O. Box is not acceptable for this, though you can use one as a separate mailing address if you like.

- Articles of Incorporation: This applies only if you're incorporating. You'll need to have your Articles of Incorporation fully prepared. This is the foundational document that outlines your company’s purpose, its share structure, and other key corporate details.

Pro Tip: Compile all of this info into a single document or folder before you start the online registration. It turns what can feel like a complicated task into a simple data-entry exercise.

The provincial government has poured a lot of effort into making its online systems more efficient. According to recent reports, ServiceOntario completed over 58 million transactions in 2023-24, with 90% of customers reporting satisfaction with the overall quality of service. You can dig into these stats in the Ministry of Public and Business Service Delivery's 2024-2025 plan.

Understanding the Fees and Timelines

The last piece of the puzzle is the cost. Government fees are set in stone and depend entirely on the type of business you're registering.

Current Registration Fees:

- Sole Proprietorship: You're looking at $60 to register online for five years.

- General Partnership: Also $60 for an online filing, valid for five years.

- Incorporation: This is the most expensive, starting at $300 for the filing fee. That doesn't include the cost of your mandatory NUANS name search report, so budget for that as well.

As for how long it takes, online registrations for sole proprietorships and partnerships are often processed almost instantly. You'll usually get your Business Identification Number (BIN) within a day or two.

Incorporations take a little more time, typically a few business days, as the government needs to review your Articles of Incorporation. Knowing these timelines helps you map out your next moves, like opening a business bank account or applying for permits.

Your Responsibilities After Registration

Congratulations, your business is officially registered in Ontario! That's a massive milestone, but don't pop the champagne just yet. Think of it like getting the keys to a new car; you still need to sort out the insurance and learn the rules of the road before you can start driving.

Now comes the crucial part: setting up the backend systems to keep your business compliant and in good standing with the government. Getting these next steps right from the get-go will save you a world of headaches, fines, and operational roadblocks down the line. Let's get it sorted.

First Things First: Get Your Federal Business Number

Your provincial registration is just one piece of the puzzle. Your very next move should be getting a Business Number (BN) from the Canada Revenue Agency (CRA). This is a unique nine-digit number the feds use to track your business for all things tax-related.

You absolutely need this BN before you can open any specific tax accounts. It’s the key that unlocks everything else, from payroll to GST/HST, so make it your top priority.

Setting Up Your Must-Have Tax Accounts

With your BN in hand, it's time to figure out which CRA program accounts you actually need. This isn't a one-size-fits-all deal; your specific business activities will determine your obligations.

Here are the big ones you’ll likely encounter:

- GST/HST Account: This is non-negotiable if your business makes more than $30,000 in worldwide revenue over four straight calendar quarters. Once you cross that line, you are legally required to register for, collect, and send in the GST/HST.

- Payroll Deductions Account: Planning to hire anyone? Even a single employee (and yes, that includes paying yourself a salary from your corporation) means you need a payroll account. This is how you'll handle deductions for things like CPP and EI.

A classic rookie mistake is waiting until you've already hit the $30,000 GST/HST threshold to register. Be proactive. The moment you see your business is on track to cross that mark, get registered. It looks professional and saves you from a last-minute scramble to get compliant.

Other Critical Compliance Steps

Beyond the CRA, there are a couple of other key agencies to deal with. If you have employees in Ontario, registering with the Workplace Safety and Insurance Board (WSIB) is mandatory for most industries. It’s the system that provides benefits to your workers if they get hurt on the job. Don't skip it.

And don't forget to think local. Depending on what you do—whether you're running a food truck, a hair salon, or a home-based consultancy—you might need specific municipal licenses or permits to operate legally in your city or town.

Staying on top of these obligations is fundamental to building a resilient business, especially when the economy feels shaky. Keeping an eye on local support systems, like the one detailed in our article about the low-income bus pass, can also offer a broader perspective on community resources available.

The Ontario Chamber of Commerce recently reported that while business confidence doubled in 2024, nearly half of all businesses were still nervous about the economic outlook, citing affordability and rising costs. You can read more about these economic insights to understand why nailing your compliance from day one is so critical for long-term stability.

Your Top Questions About Ontario Business Registration

When you're ready to make your business official, a few practical questions always pop up. Getting these sorted out early helps you budget, plan your timeline, and just generally move forward with a lot more confidence. Let's break down the most common things new entrepreneurs ask.

How Much Does It Cost To Register?

The government fee really depends on the path you take. It's not a one-size-fits-all situation.

- Sole Proprietorships and Partnerships: These are the most straightforward and budget-friendly. You're looking at $60 to register your business name online, which is valid for a five-year period.

- Corporations: Incorporating is a more formal legal process, and the price reflects that. The government fee starts around $300, and that's before you pay for the mandatory NUANS name search report, which is a separate cost.

Do I Need a Lawyer to Register?

For the simpler structures, probably not. You can usually register a sole proprietorship or a general partnership yourself directly through the Ontario Business Registry without needing a lawyer to hold your hand.

But when it comes to incorporation, getting legal advice is a very smart move. A lawyer will make sure your Articles of Incorporation, shareholder agreements, and company bylaws are set up properly right from the get-go. Getting this wrong can lead to some seriously expensive headaches later on.

The decision to hire a lawyer often comes down to complexity. If you're setting up a straightforward sole proprietorship, you can likely handle it. If you're incorporating with multiple shareholders, professional guidance is a wise investment.

How Long Does the Registration Take?

The timeline hinges on your business structure, but thankfully, the online system is pretty quick.

- For sole proprietorships and partnerships, the online process is often instant. As soon as you hit submit and pay, you can get your proof of registration almost immediately.

- Incorporations take a bit more time. It usually takes a few business days for the government to review everything and give its official approval.

Business Name Registration vs. Incorporation

This is a big one, and it trips up a lot of new founders. Registering a business name as a sole proprietor or partner simply gives you the legal right to operate under that name. But the key thing to remember is that it offers no liability protection. The law sees you and your business as the same entity.

Incorporating, on the other hand, creates a brand new, separate legal entity. That separation is what builds a "corporate veil"—a liability shield that protects your personal assets (like your house and car) from business debts.

Once you're officially registered, getting a grip on your finances is the next critical step. To get a head start, check out our detailed guide on small business tax deductions in Canada.

Ready to keep up with the latest news and insights impacting businesses in the National Capital Region? Follow ncrnow for updates that matter. Visit us at https://ncrnow.ca.