Figuring out your Ottawa property taxes boils down to a simple multiplication problem: your home's assessed value times the combined municipal and education tax rates for the year. That final number on your bill is your contribution to everything that makes the city tick, from keeping roads clear in the winter to funding libraries, paramedics, and public transit.

Getting a handle on this basic formula is the first step to truly understanding your responsibilities as an Ottawa homeowner.

How Your Ottawa Property Tax Bill Really Works

Think of your annual property tax bill like a recipe with just two core ingredients. First, you have your property's assessed value. Second, you have the tax rates. Mix them together, and you get the final amount you owe the city. It’s a straightforward system designed to fairly distribute the cost of running Ottawa among all property owners.

This money is the financial lifeblood of our city. It pays for the services and infrastructure we often take for granted. Every time you see a snowplough on your street, enjoy a local park, or count on fire and paramedic services, you're seeing your tax dollars at work.

The Two Pillars of Your Tax Bill

Your final bill stands on two distinct pillars, each managed by a different organization. Knowing who does what is key to understanding the whole picture.

- Property Assessed Value: This value is determined by the Municipal Property Assessment Corporation (MPAC). MPAC is an independent, not-for-profit corporation that assesses and classifies every single property in Ontario. Their job is to figure out what your property likely would have sold for on a specific, legislated valuation date, which is currently January 1, 2016.

- Tax Rates: These are set each year by two bodies: the City of Ottawa and the provincial government. The municipal portion, which City Council approved at a 2.5% increase for 2024, funds all our local services, while the education portion helps support local school boards.

So, in essence, MPAC tells the city how much your piece of the pie is worth, and City Council decides how big the entire pie needs to be to cover the year's budget.

It's crucial to remember that your property's assessed value isn't the same as its current market value. Due to a provincial decision, property assessments for the years 2021-2024 remain based on the January 1, 2016 valuation date, not what a real estate agent might tell you it's worth today.

Why Your Contribution Matters

Without the revenue from property taxes, the City of Ottawa simply couldn't operate. The system is built to provide a stable, predictable stream of funding needed to manage a modern, growing city.

A slice of your payment goes directly to public safety, keeping our police and fire departments ready to respond. Another chunk maintains critical infrastructure like roads, bridges, and the OC Transpo system. This funding model ensures our community’s essential needs are consistently met.

For a closer look at where every dollar goes, our guide to deciphering your property tax bill breaks it down even further. This kind of transparency helps connect the bill you pay to the tangible benefits you see in your neighbourhood every day. It's less about an obligation and more about investing in the community we all call home.

Breaking Down the Property Tax Calculation

Ever looked at your property tax bill and wondered where that final number actually comes from? Pulling back the curtain on the math is the best way to understand your bill, and the calculation itself is more straightforward than you might think. It really comes down to two main players: the Municipal Property Assessment Corporation (MPAC) and Ottawa City Council.

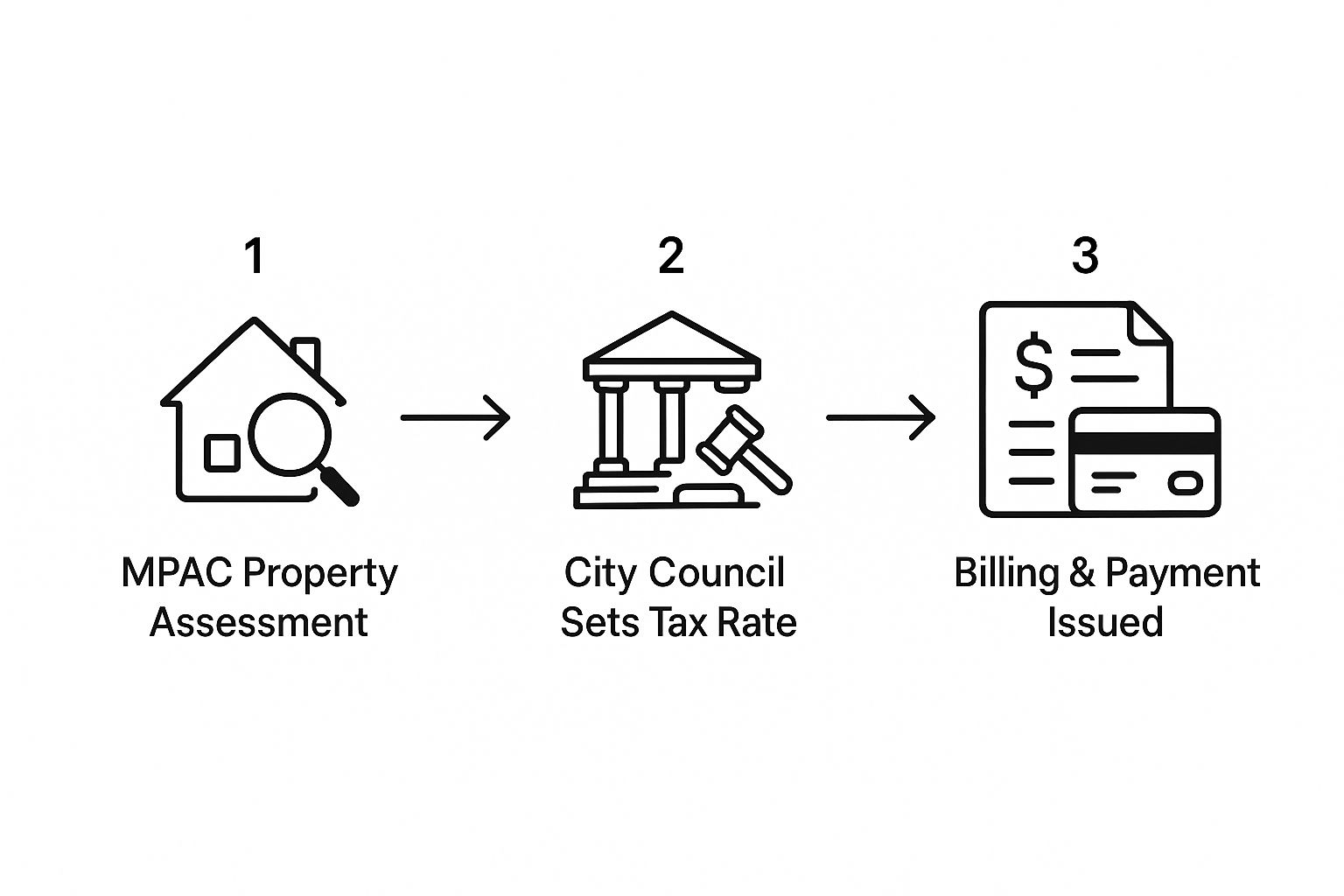

Each has a very specific job. Think of it like a two-step dance. First, MPAC takes the lead by figuring out your property's assessed value. Then, the City Council sets the tempo by establishing the tax rate needed to fund everything that keeps Ottawa running. This clear division of labour keeps the system fair and predictable for homeowners across the city.

This simple visual breaks down the journey from assessment to your final tax bill.

As you can see, the process moves from an independent valuation of your property to a democratically set budget, and finally, to the bill that arrives in your mailbox.

The Two Core Components of the Formula

The number on your tax bill isn't just pulled out of thin air; it’s the product of a precise formula. Let’s look at the two critical pieces that come together to create your total property tax.

- Assessed Property Value (Set by MPAC): This is the bedrock of your tax calculation. MPAC determines what your property would likely have sold for on January 1, 2016. It’s important to remember this value is strictly for taxation purposes and isn’t the same as the current market price a real estate agent might give you today.

- Combined Tax Rate (Set by the City & Province): This rate is actually a blend of two separate rates. The municipal tax rate, set by Ottawa’s City Council, is what funds local services like public transit, road maintenance, and emergency responders. The second part is the education tax rate, which is set by the Province of Ontario to fund local school boards.

These two numbers are then plugged into a simple formula to calculate exactly what you owe.

Unpacking the Property Tax Formula

The formula for your Ottawa property taxes is simple multiplication. It’s designed to ensure everyone contributes their fair share based on their property's value and the needs of the community.

The Formula: (Assessed Value x Municipal Tax Rate) + (Assessed Value x Education Tax Rate) = Total Property Tax

This equation is applied to every single property in the city. The City also uses different tax rates for various property classes, like residential, commercial, or industrial. This means a warehouse and a family home with the same assessed value will pay different amounts in property taxes because they fall into different classes with different rates.

A Practical Calculation Example

Let's walk through a real-world example to see how this all fits together.

To make this tangible, we can look at a simplified calculation for a hypothetical residential property in the urban area using 2024 rates.

Sample 2024 Ottawa Property Tax Calculation (Urban Residential)

| Component | Value/Rate | Calculation | Result |

|---|---|---|---|

| Assessed Property Value | $500,000 | N/A | N/A |

| Municipal Tax Rate | 1.050474% (0.01050474) | $500,000 x 0.01050474 | $5,252.37 |

| Education Tax Rate | 0.153000% (0.00153000) | $500,000 x 0.00153000 | $765.00 |

| Total Property Tax Bill | N/A | $5,252.37 + $765.00 | $6,017.37 |

This step-by-step breakdown shows exactly how each component contributes to the final amount you pay. By plugging in your own property's assessed value and the current tax rates, you can easily anticipate what your own bill will look like.

Across Ontario, the property tax system is the lifeblood of local government revenue. Data from Statistics Canada reveals that Ontario households typically spend around 2.9% of their family income on property taxes, which is right in line with national averages. This money funds the essential services we all rely on, from policing to public libraries. While home values here might be higher than the national average, the effective property tax rates in Ontario generally stay below 1.5%, reflecting a careful balance between property values and the tax rates needed to serve the community.

Historical Tax Trends and Current Rates

To really get a handle on your current Ottawa property taxes, it helps to look back at how we got here. The rates on your bill aren’t just random numbers; they tell a story about the city’s growth, its economic ups and downs, and the constant balancing act between funding the services we all rely on and keeping things affordable for homeowners.

Over the past decade, Ottawa has seen a steady, but carefully managed, rise in property tax rates. For 2024, Ottawa City Council approved a municipal tax increase of 2.5%, a move designed to address budget pressures while trying to limit the impact on residents. This is a direct reflection of a growing city’s expanding needs—more people means more demand for everything from public transit and road repairs to paramedics and firefighters.

A Decade of Gradual Change

Looking at the last ten years shows how these small, annual adjustments add up over time. The city’s game plan has been all about incremental increases instead of sudden, jarring spikes. The goal? To avoid giving homeowners a nasty surprise with a huge, unexpected bill.

This slow-and-steady approach is designed to keep pace with inflation and the rising costs of just about everything. Think about it: the price of asphalt for patching potholes, fuel for the city’s fleet, and salaries for staff all go up. These gradual tax adjustments ensure that service levels don’t have to be slashed, all without resorting to a massive tax hike.

Understanding this history is key, as it shows your tax bill is a living number tied directly to the city’s financial health and priorities. It’s also a big piece of the puzzle when you’re trying to figure out the overall cost of living in Ottawa, since property taxes are a major household expense.

Examining the Numbers from 2014 to 2024

The data paints a clear picture of a steady but moderate climb. Over the last decade, the combined municipal and education property tax rate has crept up. To keep the impact on residents manageable, the annual bumps have generally been kept below 3%. For example, the 2024 budget included a 2.5% municipal tax increase, continuing a trend of predictable changes.

While the city’s portion of the tax grew to fund local services, the education tax rate, which is set by the province, has remained relatively stable and even saw slight decreases during that time.

To put that in real-world terms, a property assessed at $500,000 (urban residential) would face a tax bill of about $6,017 in 2024. This number reflects the compounding effect of all those small, year-over-year increases.

If there’s one big takeaway from the historical data, it’s consistency. The City of Ottawa has steered clear of wild, unpredictable tax policies. Instead, it has stuck to a predictable model that lets homeowners plan ahead, which is a huge part of the city’s long-term financial strategy.

What Drives These Changes

So, what’s actually behind these year-to-year adjustments? A few key factors are always at play, and they all contribute to the final number you see on your bill.

- City Budget Needs: This is the biggest driver. The 2024 budget, for example, allocated significant funds to housing, transit, and infrastructure, all of which are supported by property taxes.

- Provincial Education Funding: The education slice of your tax bill is actually set by the Province of Ontario. The city collects the money, but it goes straight to our local school boards.

- Economic Conditions: Plain and simple, inflation hits the city’s wallet, too. When costs go up, the city needs more revenue just to maintain the status quo, which often means a tax rate increase.

- Big Infrastructure Projects: Major projects like the LRT expansion or building a new community centre require massive investments. A portion of that funding often comes from property tax revenues.

All these pieces come together to form a complex financial puzzle. By understanding the trends and the forces behind them, you can get a much better sense of what your Ottawa property taxes are all about and the vital role they play in shaping our city.

How Ottawa's Taxes Compare to Other Cities

Ever wonder how your Ottawa property taxes stack up against what homeowners pay in other major Canadian cities? It’s a classic Ottawa question, and the answer isn't as simple as just comparing tax rates. When you look across the country, you find a fascinating dance between tax rates and property values—and it's that combination that really determines your final bill.

Putting Ottawa in the national picture helps you see the true cost of homeownership here. A city might brag about a low tax rate, but if its property values are through the roof, homeowners there could be paying way more than you are. On the other hand, a city with a higher rate but more affordable housing might mean a surprisingly smaller tax bill. It’s all about what you actually end up paying.

Rates Versus Reality

The key thing to remember is that the tax rate is only half the story. The other, equally important half is the assessed value of your home. That’s why just looking at a list of tax rates can be so misleading.

Think of it like this: you have a 10% off coupon for a reliable family sedan, while your friend has a 5% off coupon for a luxury sports car. Your coupon has the better discount, but your friend is still going to spend a whole lot more money at the dealership. Property taxes work the same way—the final bill depends on both the "discount" (the tax rate) and the "price tag" (your home's value).

Ottawa's Position in Canada

When you crunch the numbers, you'll see that Ottawa often has one of the higher residential property tax rates among Canada's biggest cities. But hold on—that doesn't automatically mean Ottawa homeowners are paying the most.

Even with a relatively high municipal rate, many homeowners here pay less in actual dollars than their counterparts in Toronto. Why? Because property values in Ottawa are generally more grounded. The 2.5% municipal tax hike for 2024 was among the lowest of major Ontario cities, with Toronto approving a 9.5% increase and Hamilton at 5.7%.

Ottawa's commercial property taxes are also on the higher side, which is part of the city's strategy to keep its budget balanced for funding all those municipal services we rely on. For a deeper dive into these trends, check out this analysis of property tax changes across Canada.

The takeaway is clear: Ottawa's higher tax rate is balanced by its more moderate housing market compared to cities like Toronto or Vancouver. This unique position means residents often face a lower overall tax payment, even with a higher rate on paper.

A Comparative Snapshot

To really see how this plays out, let's put Ottawa's tax rate side-by-side with other major urban centres. The table below really drives home how much rates can vary across the country.

Property Tax Rate Comparison Major Canadian Cities

| City | Approx. Residential Tax Rate (2023) | Key Consideration |

|---|---|---|

| Vancouver | ~0.3% | The lowest rate, but offset by the highest average property values in Canada. |

| Toronto | ~0.6% | A low rate that is applied to very high property values, resulting in large tax bills. |

| Calgary | ~0.7% | A relatively low rate, reflecting a different provincial funding model for municipalities. |

| Ottawa | ~1.2% | A higher rate applied to more moderate property values, leading to a balanced tax burden. |

| Winnipeg | ~2.7% | One of the highest rates in the country, balanced by lower average home prices. |

This comparison makes it clear that Ottawa really occupies a middle ground. Our tax system is built differently than cities in other provinces—and even from our Ontario neighbours—because it’s designed for our local budget needs and our unique real estate market. At the end of the day, having that context is crucial for understanding the true cost of your Ottawa property taxes.

Navigating Payment Options and Deadlines

When it comes to your Ottawa property taxes, timing is everything. The city makes it fairly painless by splitting the year into two billing cycles, but knowing the key dates and payment methods is the best way to dodge late fees and handle one of your biggest household bills without breaking a sweat.

Think of it this way: your first bill of the year is an interim tax bill, which usually lands in your mailbox in February and is due in March. It’s essentially a down payment, calculated at 50% of what you paid the previous year. Then, in May, the final tax bill arrives. This one settles the score, using the current year's official tax rates minus what you’ve already paid, with a due date in June.

Key Deadlines to Remember

Miss a deadline, and you'll face a penalty. The city charges 1.25% on any overdue amount, and that charge repeats on the first day of every month your bill remains unpaid. Staying on top of these dates is the easiest way to keep your account in good standing.

- Interim Bill Due Date: Keep an eye out for a due date around the third week of March.

- Final Bill Due Date: This one typically falls in the third week of June.

Of course, always check the exact dates printed on your tax bills each year, as they can shift. A little planning around these two payments can save you a lot of last-minute stress.

Choosing Your Payment Method

The City of Ottawa offers a handful of ways to pay your property tax bill, so you can pick whatever works best for you. Whether you're a "set-it-and-forget-it" type or prefer to handle things manually, there's a secure option available.

For most homeowners, the Pre-Authorized Debit (PAD) plan is the clear winner. It's the simplest way to automate your payments, ensuring you never miss a deadline or get hit with a penalty. It’s hassle-free.

Let's break down the most popular ways to pay.

A Breakdown of Payment Options

Finding the right payment rhythm can make managing your Ottawa property taxes feel much less daunting.

Here’s a look at your choices:

- Pre-Authorized Debit (PAD) Plan: This is the city's go-to recommendation for a reason. You can have payments automatically pulled from your bank account on the two main due dates, or you can spread them out over ten monthly instalments from January to October.

- Online Banking: Just like any other bill, you can pay through your bank’s online or telephone service. Add the "City of Ottawa Property Taxes" as a payee and punch in your 19-digit tax roll number to get set up.

- By Mail: If you prefer the old-school approach, you can mail a cheque to the City of Ottawa. Just make sure to include the payment stub from your bill and send it well ahead of the due date to give it time to arrive.

- In-Person: You can always make payments in person at any City of Ottawa Client Service Centre. They accept cheque, debit, or cash.

Getting familiar with these deadlines and payment options puts you in the driver's seat, letting you manage your property tax obligations with confidence year after year.

Challenging Your Property Assessment

Getting that Property Assessment Notice from the Municipal Property Assessment Corporation (MPAC) in the mail can feel pretty final. But if you open it up and the number staring back at you seems way off, you absolutely have the right to question it. Think of it less like a fight and more like a conversation to make sure your Ottawa property taxes are based on fair and accurate information.

The appeals process exists for a reason—assessments are thorough, but they aren't perfect. Simple errors can happen, and new information can completely change the picture. This guide is your roadmap for navigating the process so you can build a strong case for the fair assessment you deserve.

Your First Step: Play Detective

Before you even think about a formal appeal, your first job is to do some digging. Grab your MPAC notice and pull up the detailed info on their online portal, AboutMyProperty.ca. This free tool shows you exactly what data MPAC used to land on your home's value.

You're looking for simple, factual mistakes that could throw the whole valuation off.

- Wrong Property Details: Is the square footage incorrect? Did they list a finished basement you don't actually have? Maybe they added an extra bathroom that doesn't exist?

- Shaky Sales Data: Take a hard look at the "comparable" properties MPAC used. Are they really similar to your home in size, age, condition, and location? A two-storey house isn’t a fair comparison for your bungalow, even if they're on the same street.

If you spot a clear error like this, getting it fixed might be surprisingly straightforward.

Filing a Request for Reconsideration

If your initial review doesn't clear things up and you still feel the assessment is too high, the first official step is to file a Request for Reconsideration (RfR) with MPAC. This is a totally free process designed to sort out disagreements without needing a formal hearing. Just be mindful of the deadline—it's usually March 31st of the tax year.

When you submit your RfR, your goal is to present clear, compelling evidence. This isn't about what you feel your house is worth; it's about facts. You'll want to gather documents that back up your claim, such as:

- Recent sales data for at least three comparable homes that sold for less than your assessed value.

- Photos that show your home's actual condition, especially if it needs major repairs that would lower its market value.

- A private appraisal from a certified appraiser, which gives you an expert, third-party valuation.

Think of your RfR as building a logical argument. You're giving MPAC new evidence and simply asking them to look at their conclusion again based on the facts you've provided.

Taking it to the Assessment Review Board

What if MPAC reviews your request but you still don't agree with their decision? You have one more avenue: escalating your case to the Assessment Review Board (ARB). The ARB is an independent tribunal that hears property assessment appeals from all over Ontario. This step is more formal—almost like a mini-court hearing—and there are fees involved.

You’ll need to present your evidence and make your case at a hearing, where an ARB member will issue a final, binding decision. Winning an appeal can lead to real savings on your Ottawa property taxes, so putting in the effort to build a solid case is well worth your time.

For those who own commercial or rental properties, managing these kinds of costs is a critical part of the business. You can find more information on related topics in our other guides, like this one on how to navigate small business tax deductions in Canada.

Frequently Asked Questions

Even after breaking down all the numbers, it's natural to have a few more questions about Ottawa property taxes. This is where we tackle some of the most common queries we get from homeowners just like you.

Think of it as a quick-fire round to clear up any lingering confusion and give you the confidence you need to manage your property tax bill.

Can My Property Taxes Be Reduced?

Yes, it’s definitely possible to lower your property tax bill, and you have a couple of avenues to explore. The most direct route is to challenge your property's assessed value if you believe it’s too high. You can do this by filing a Request for Reconsideration (RfR) with MPAC.

Beyond that, both the City of Ottawa and the province offer programs designed to provide some relief:

- Tax Deferral Programs: Aimed at low-income seniors and individuals with disabilities, these programs let you postpone tax payments until the property changes hands.

- Ontario Energy and Property Tax Credit: If you're a low- to moderate-income resident, you can claim this credit on your personal income tax return to help offset property tax costs.

- Charitable Organization Rebates: Registered charities operating out of commercial or industrial properties may qualify for a substantial tax rebate.

What Happens If I Don't Pay My Taxes?

Missing a property tax payment has immediate and costly consequences. The City of Ottawa applies a penalty of 1.25% on any outstanding amount the day after it’s due. That penalty is then added again on the first day of every month the balance remains unpaid, causing it to grow quickly.

If the taxes go unpaid for too long, the city can take more serious steps. This can escalate to a tax lien on your property, which legally allows them to sell your home to recover the overdue taxes and all the accumulated fees.

The easiest way to sidestep these penalties is by enrolling in the city’s Pre-Authorized Debit (PAD) plan. It ensures your payments are automatically made on time and in full, offering complete peace of mind.

How Do Renovations Affect Property Taxes?

Major renovations are almost guaranteed to affect your property taxes. Any project that adds significant market value to your home—like finishing a basement, adding an extra bathroom, or building an extension—will likely catch MPAC’s attention and trigger a reassessment.

When the city issues building permits for your project, MPAC gets notified. Once the work is done, they’ll update your home's assessed value to reflect the improvements. This new, higher value becomes the basis for your future Ottawa property taxes, meaning a bigger bill. On the flip side, smaller cosmetic upgrades usually don't move the needle on your assessment.

For the latest news and in-depth guides on living in Ottawa and the National Capital Region, stay connected with ncrnow. Visit us at https://ncrnow.ca for more.