If you’re trying to get a feel for the Ottawa real estate market, you need to understand its unique rhythm. It’s a market known for its steady growth and reassuring stability, not wild swings. According to the latest data from the Ottawa Real Estate Board (OREB) for May 2024, the composite benchmark home price is sitting at $651,600. While we see small ups and downs month-to-month, the bigger picture shows a consistent upward trend year after year.

This kind of resilience is exactly what makes Ottawa so attractive for both first-time homebuyers and seasoned investors who are playing the long game.

What To Expect In The Ottawa Housing Market

To really wrap your head around Ottawa's average house prices, you have to look beyond a single number. Think of the market as being split into different segments, with each property type telling its own story. As of mid-2024, the market is showing signs of a typical spring season—active but balanced—with prices varying quite a bit between detached homes, townhouses, and condos.

Let's break down the numbers to see what's happening on the ground. For a quick overview, here’s where the average prices stand for different types of homes in Ottawa.

Ottawa Average Home Prices at a Glance

| Property Type | Average Price (May 2024) | Year-Over-Year Change |

|---|---|---|

| Single-Family Home | $717,179 | +1.2% |

| Townhouse/Row Unit | $537,133 | +2.9% |

| Apartment/Condo | $432,604 | +3.4% |

As you can see, all property types are showing modest year-over-year growth. Condos have seen the strongest appreciation at 3.4%, while townhouses are up 2.9%. Single-family homes, the largest segment, saw a 1.2% increase from the previous year. If you want to dig deeper into the data, a great resource for Ottawa's housing trends is WOWA.ca.

Key Market Drivers

So, what’s the secret sauce that makes Ottawa’s real estate scene so distinct? It really boils down to a few core factors that keep demand steady.

- Stable Government Employment: The federal government is the city’s largest employer, and that means a massive base of stable, well-paying jobs. This acts as a buffer, insulating our market from the kind of volatility you see in other major Canadian cities.

- Growing Tech Sector: Ottawa isn’t just a government town anymore. It’s also home to a booming tech hub that attracts highly skilled talent and injects more high-earning households into the market, fuelling housing demand.

- High Quality of Life: Let's be honest, Ottawa is just a great place to live. With its abundant green spaces, top-notch schools, and family-friendly communities, it consistently ranks as one of Canada's best cities. That alone draws new residents from all over.

Ottawa's real estate market is best understood as a marathon, not a sprint. Its strength comes from deep-rooted economic fundamentals rather than short-term speculative booms, providing a reliable foundation for prospective buyers.

This blend of economic stability and lifestyle appeal creates a market that’s consistently strong. In the next sections, we’ll dive into how these factors play out in different neighbourhoods across the city.

The Story of Ottawa's Real Estate Growth

To really get a feel for today’s average house prices in Ottawa, you have to look back at how we got here. The city's real estate market didn't just explode overnight. It was built over decades, shaped by steady economic and social currents that created an incredibly stable foundation. This isn't a story of wild booms and busts, but one of measured, consistent growth.

Unlike cities that live and die by a single industry, Ottawa’s strength has always been its diverse and reliable economic base—think government, tech, and everything in between. This history shows a clear pattern of resilience, which is why Ottawa is so often seen as a safe bet for real estate investment.

A Journey Through the Decades

The story of Ottawa's housing market is one of impressive, long-term appreciation. Digging into the archives, the average house prices here have shown seriously strong growth, mirroring both local economic wins and broader national trends. Back in 1956, the average house price was a modest $13,351. By 1980, that number had jumped to $62,748.

The decade between 1980 and 1990 was a period of rapid acceleration, with the average home price more than doubling to $141,438. Fast forward to 2010, and the average price climbed to $327,225. By 2018, it hit $407,571, proving the market's stubborn upward trajectory. For a deeper dive into the numbers, you can check out this detailed Ottawa historical home prices report.

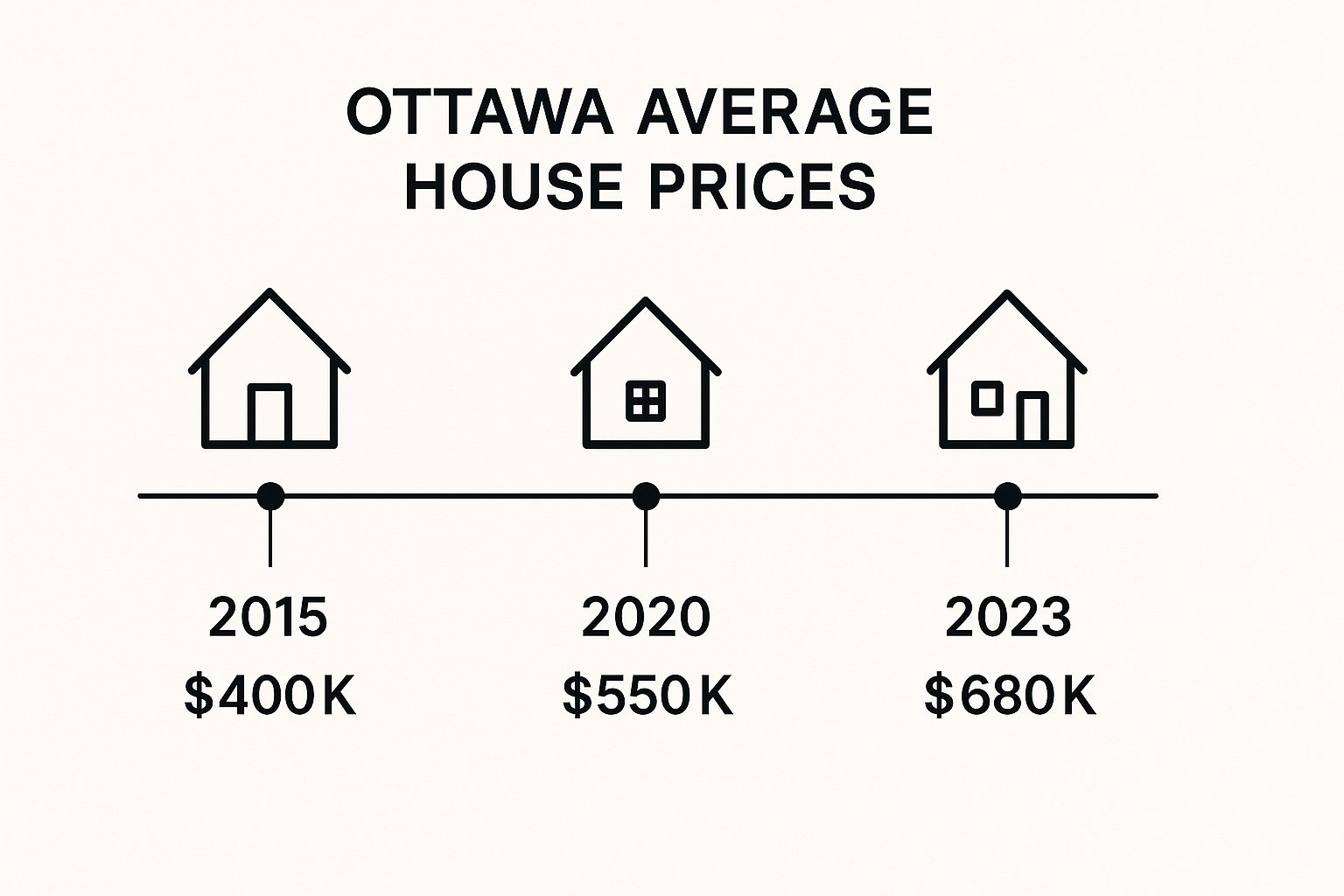

This timeline really puts the recent acceleration of Ottawa's average house prices into perspective.

As you can see, while growth has always been steady, the period between 2015 and 2023 saw a particularly sharp spike in property values. This recent surge points to some powerful market drivers that have really amplified Ottawa's appeal.

Modern Market Acceleration

So, what lit the fire under the market recently? The past decade, in particular, saw a perfect storm of factors that pushed average house prices higher than ever.

- Low Interest Rates: For much of this period, borrowing money was cheaper than it had ever been. This made it far easier for buyers to jump into the market and qualify for larger mortgages, fuelling demand.

- Population Growth: Ottawa has been a magnet for new residents, from skilled workers flocking to its booming tech sector to newcomers to Canada. All of them needed a place to live, putting pressure on supply.

- Shifting Work Dynamics: The rise of remote work, especially during the pandemic, was a game-changer. Suddenly, people wanted more space, and demand for single-family homes in the suburbs went through the roof.

The real story of Ottawa's market is its cyclical nature built on a stable foundation. While external factors can cause short-term acceleration, the underlying strength provided by government and tech employment ensures long-term resilience and growth.

Understanding this history gives you a vital perspective. It shows that today's prices aren't some random fluke but the result of decades of sustained development and rock-solid economic stability.

A Look at Ottawa’s Different Property Types

When you hear about the average house price in Ottawa, it’s easy to picture one single number. But the reality on the ground is far more interesting. That city-wide average is really just a starting point.

The real story unfolds when you start looking at the different types of homes available. Single-family homes, townhouses, and condos each march to the beat of their own drum, with unique price points, features, and buyer profiles. Getting to know these differences is the first step in finding a home that truly fits your budget and your life.

Think about it: a sprawling single-family home is perfect for a growing family that needs a backyard for the kids to play in. On the other hand, a sleek downtown condo is often the top pick for young professionals who value a short commute and zero lawn maintenance. Townhouses? They sit right in that sweet spot, offering a great mix of space and affordability that’s a magnet for first-time buyers.

The latest numbers from May 2024 really drive this home. While the city-wide benchmark price was $651,600, the breakdown tells a more nuanced story.

- Single-family homes commanded a benchmark price of $743,300.

- Townhouses, which are in high demand, had a benchmark price of $519,500.

- Condos remained the most accessible option with a benchmark price of $428,200.

It’s clear that what you buy is just as important as where you buy.

Who Buys What in Ottawa?

Every property type in Ottawa seems to have its own fanbase. This natural segmentation creates mini-markets within the larger city, each with its own supply and demand pressures that shape its pricing.

A single-family home is the classic dream for many—a long-term home with room to grow. They fetch the highest prices because you’re not just buying a house; you’re buying space, privacy, and access to neighbourhood perks like good schools and parks.

Townhouses have become the go-to for young families and couples. They offer more square footage than a condo without the hefty price tag of a detached home, making them a hugely popular choice. That popularity has also fuelled some serious price appreciation lately.

Condos are the gateway to homeownership for a lot of first-time buyers. They’re also a smart move for downsizers and investors looking for a foothold in prime urban locations. Their lower price point is a huge plus, but they can be more sensitive to changes in the rental market.

The choice between a house, a townhouse, or a condo in Ottawa isn't just about the price tag. It’s a lifestyle decision. This one choice ripples through your daily life, affecting everything from your commute and weekend chores to your long-term financial health.

Before you jump in, it’s worth thinking about the hidden costs. A bigger home is great, but it also means bigger utility bills and more maintenance. These factors play a huge role in your overall budget, a topic we dive into in our guide to the cost of living in Ottawa.

Comparing Ottawa Property Types Side-by-Side

To make things even clearer, let's break down the main property types in a simple table. This should help you quickly see how they stack up against each other based on price, features, and who they’re best for.

| Property Type | Average Price Range | Key Characteristics | Best Suited For |

|---|---|---|---|

| Single-Family Home | $700,000+ | Detached structure, private yard, more square footage, full ownership of land. | Growing families, established professionals, and anyone prioritizing space and privacy. |

| Townhouse | $500,000 – $650,000 | Attached to one or more homes, often multi-level, small yard or patio, may have condo fees. | First-time buyers, young couples, and small families needing more space than a condo. |

| Condominium | $400,000 – $550,000 | Apartment-style unit in a larger building, shared amenities (gym, pool), monthly condo fees. | Young professionals, downsizers, investors, and buyers focused on location and low maintenance. |

Ultimately, weighing these factors will help you narrow down your search and make a choice that you’ll be happy with for years to come.

How Ottawa Neighbourhoods Influence Prices

Talking about the "average house price" in Ottawa is a bit like discussing the average temperature for the whole year. Sure, it gives you a general idea, but it completely misses the story of a sweltering July afternoon versus a bone-chilling January night. To really get what's going on with property values, you have to see the city for what it is: a collection of distinct micro-markets. Your postal code can shape the price tag just as much as the house itself.

In Ottawa, "location, location, location" isn't just a tired real estate slogan—it's the absolute truth. A home's price is deeply woven into the fabric of its surroundings. Things like the reputation of local schools, how painful the daily commute is, the buzz of nearby shops and restaurants, and access to parks all play a massive role in what buyers are willing to shell out.

This creates a fascinating patchwork of prices across the city.

A Tale of Two Neighbourhoods

Let’s make this real by comparing two well-known Ottawa communities. First, you have The Glebe, a historic, central neighbourhood famous for its charming century homes and the lively shops along Bank Street right next to Lansdowne Park. Here, a detached single-family home can easily soar past the $1 million mark. Buyers are paying a premium not just for the bricks and mortar, but for a walkable lifestyle and a prestigious address.

Now, let's head south to the family-friendly suburb of Barrhaven. It’s packed with newer, larger homes, great schools, and all the community amenities you could ask for. While it's still a very desirable spot, a similar-sized detached home might be priced closer to the $750,000 range. The trade-off for that affordability is often a longer commute to the downtown core.

These differences perfectly illustrate how lifestyle priorities directly influence the average house prices in Ottawa from one community to the next.

The price of a home in Ottawa reflects more than just its physical structure; it’s an entry fee into a specific lifestyle. A buyer in Westboro is investing in a trendy, urban-village feel, while a buyer in Kanata is often purchasing access to top tech jobs and suburban comfort.

The Suburban Appeal

The suburban communities of Kanata and Orléans tell a similar story. Kanata, home to Canada's largest technology park, has a constant flow of professionals looking to live close to work. This steady demand keeps its housing market strong and competitive.

Over in the east end, Orléans offers a compelling mix of affordability and a tight-knit community feel, with plenty of francophone schools and services. Its connection to downtown via the O-Train has also made it a hot spot for commuters looking for more bang for their buck. If you're curious about these areas, you can dive deeper in our guide to the best neighbourhoods in Ottawa.

To break it down:

- Urban Core (e.g., The Glebe, Westboro): Expect the highest price points. People pay for walkability, historic charm, and being close to the action.

- Established Suburbs (e.g., Nepean, Alta Vista): You'll find mid-to-high range prices here, in areas known for mature trees, bigger lots, and excellent school districts.

- Growing Suburbs (e.g., Barrhaven, Stittsville): These areas have more accessible pricing, making them a magnet for young families with their modern homes and new community centres.

At the end of the day, understanding the unique personality of each neighbourhood is what it's all about. It’s about finding that sweet spot where the price tag matches the lifestyle you're chasing.

The Key Forces Driving Ottawa's Real Estate

Ottawa’s housing market isn't strong by accident. While other major Canadian cities often ride a rollercoaster of dramatic peaks and valleys, Ottawa's real estate scene is anchored by powerful economic forces that give it a unique stability. Getting a handle on these drivers is the key to understanding market trends and seeing why the average house prices in Ottawa have been so resilient over the years.

Think of the market as a sturdy ship. While big waves like interest rate hikes might cause it to rock, its deep, heavy anchors keep it from getting tossed around. For Ottawa, those anchors are its unique economic fundamentals.

The Government Anchor Effect

The single biggest stabilizing force is the federal government. As the city's largest employer, it provides a massive and steady base of secure, well-paying jobs. This creates a constant, reliable pool of homebuyers who are largely shielded from the economic shocks that can rattle other industries and cities.

This "anchor effect" means that even when the national economy cools down, housing demand in Ottawa stays surprisingly strong and predictable. It’s the foundation that supports consumer confidence and, in turn, property values.

Ottawa's real estate market is fundamentally cushioned by its public sector employment. This reliable demand ensures that even when the market cools, it rarely freezes, providing a level of security not often seen in other major metropolitan areas.

The Booming Tech Sector

But Ottawa is more than just a government town. It has also carved out a serious reputation as a major technology hub, earning the nickname "Silicon Valley North." This thriving sector brings a totally different kind of energy—and wealth—into the city. Unlike the steady-as-she-goes government jobs, the tech industry introduces high-earning professionals and attracts global talent, adding another powerful layer to the economy.

This dual-engine economy—stable government employment paired with a dynamic tech sector—creates a potent mix. One provides a solid floor for the market, while the other fuels growth and drives demand for all kinds of housing, from downtown condos to sprawling suburban family homes.

Population Growth and a Squeezed Housing Supply

Like any major city, Ottawa’s real estate market ultimately comes down to the classic tug-of-war between supply and demand. The city’s high quality of life, excellent schools, and incredible green space make it a magnet for new residents, from immigrants to people relocating from other parts of Canada. This steady flow of people constantly fuels the demand for housing.

- Steady Inflow of Residents: Ottawa consistently attracts new people, which means more buyers and renters are always entering the market.

- Limited Housing Supply: While new construction is always happening, it often struggles to keep up with the pace of population growth. This puts upward pressure on prices for existing homes.

This gap between a growing number of households and a slower-growing housing stock is a major reason why property values continue to climb. Of course, the cost of living is also a huge factor, as it shapes how far a homebuyer's budget can actually stretch. For a deeper dive, check out our in-depth analysis of the cost of living in Ottawa. Once you grasp these key forces, you start to get a much clearer picture of what makes Ottawa's real estate market tick.

So, what's next for Ottawa real estate?

If you're trying to figure out where the market is headed, you're not alone. While nobody has a crystal ball, we can look at the signs to get a pretty good idea of what's coming. Think of it like a weather forecast—you can't stop the rain, but you can definitely see the clouds gathering and decide whether to bring an umbrella.

A few big things are on the horizon. First up, interest rates. They're always a major player. When borrowing costs change, it directly impacts how much buyers can afford and how hot the market gets. A drop in rates could easily fire up demand, while an increase might pump the brakes a little.

Then there's immigration. Canada has some ambitious national targets, and Ottawa remains a top destination for newcomers thanks to its stability and high quality of life. This steady stream of new residents creates a constant demand for housing—a demand that builders often struggle to keep up with, which naturally pushes prices upward.

What to Keep an Eye On

To get a real feel for the market's pulse, you'll want to watch a few key indicators. These are the signals that give us clues about where property values might be going.

- Infrastructure Projects: Keep an eye on big-ticket items like the O-Train LRT expansion. When new transit lines connect neighbourhoods, property values in those areas tend to get a serious boost.

- Government Spending: Pay attention to federal budget announcements and hiring sprees. More government jobs and investment signal a strong local economy, which almost always fuels a more active housing market.

- Housing Inventory Levels: This is classic supply and demand. The number of homes for sale versus the number of active buyers tells you a lot. When inventory is low, you get more competition and—you guessed it—higher prices.

At the end of the day, Ottawa's real estate market is defined by one thing: resilience. It has a powerful one-two punch of stable public sector employment and a booming tech scene. This strong economic backbone helps insulate it from the wild swings we often see in other major Canadian cities.

By watching these trends, you can start thinking strategically, whether you're looking to buy or sell. It’s these dynamics that reinforce Ottawa's reputation as a consistently strong and reliable market, making it a smart bet for both long-term investment and finding a place to call home.

Frequently Asked Questions

Digging into Ottawa’s real estate numbers can leave you with more questions than answers. What do all these averages and trends actually mean for you? Here are some of the most common questions we get from buyers and sellers trying to make sense of the market.

How Much Does A House Actually Cost In Ottawa?

While the city-wide average gives you a good starting point, the real price tag depends heavily on what you’re buying. A classic detached single-family home will typically run you over $700,000.

If you're looking for something a bit more accessible, a townhouse is a great option, usually landing somewhere between $500,000 and $650,000. For first-time buyers or downsizers, condos are still the most affordable way to get into the market, with prices often in the $400,000 to $550,000 range.

Of course, location is everything. Those prices can climb much higher in sought-after areas like The Glebe, while you’ll find more budget-friendly options in family-friendly suburbs like Barrhaven or Orléans.

What Is A Good Salary To Buy A House In Ottawa?

There’s no magic number here—it really depends on the home you want, how much you’ve saved for a down payment, and what other debts you’re carrying. But as a solid rule of thumb, most financial experts suggest your total housing costs shouldn't eat up more than 32% of your gross monthly income. That includes your mortgage, property taxes, and utilities.

Let’s put that into perspective. To comfortably afford a home around the city’s average price of $650,000, a household would likely need a combined income well north of $140,000 per year, assuming they have a standard down payment and manageable debt levels.

Is Ottawa's Housing Market Overvalued?

It's a fair question, especially when you see headlines about housing bubbles in other major Canadian cities. The good news? Ottawa's market is generally seen as being built on a much stronger foundation.

Our city’s stability comes from two key places: steady federal government employment and a buzzing tech sector. This creates real, consistent demand for housing from people who actually live and work here, rather than from speculative investors.

While prices have definitely climbed, that growth is backed by a healthy job market and a growing population. This makes our market much more resilient and less likely to face the dramatic boom-and-bust cycles seen elsewhere.

For the latest news and deeper insights into Ottawa and the National Capital Region, from real estate trends to community events, trust ncrnow. Stay informed by visiting us at https://ncrnow.ca.