When you're thinking about a move, the first question that pops into your head is almost always about the cost. What's the bottom line? For Ottawa, the answer is pretty encouraging. You get the perks of big-city life without the eye-watering price tags you’d find in Toronto or Vancouver, which makes it a really attractive option for a lot of people.

When we talk about the cost of living in Ottawa, it's generally considered quite reasonable for a major Canadian city.

So, is Living in Ottawa Affordable?

What does it actually take to live comfortably in Canada's capital? Think of it like putting together a personal budget—you start with the big picture and then dive into the nitty-gritty details. Ottawa really hits a sweet spot, offering access to top-tier government and tech jobs while keeping day-to-day expenses more manageable.

For a single person, a good life in Ottawa is definitely within reach. That means covering all the essentials like rent, groceries, and transportation, and still having enough left over for a bit of fun and some savings.

Let's look at what the numbers say. To give you a clear baseline for your financial planning, here’s a quick summary of what you can expect to spend each month, based on recent data.

Monthly Living Expenses in Ottawa at a Glance

| Demographic | Estimated Monthly Cost (Excluding Rent) |

|---|---|

| Single Person | CA$1,540 |

| Family of Four | CA$5,520 |

These figures give you a solid starting point. They show that while it's not the cheapest city in the country, it's far from the most expensive, offering a balanced financial picture for both individuals and families.

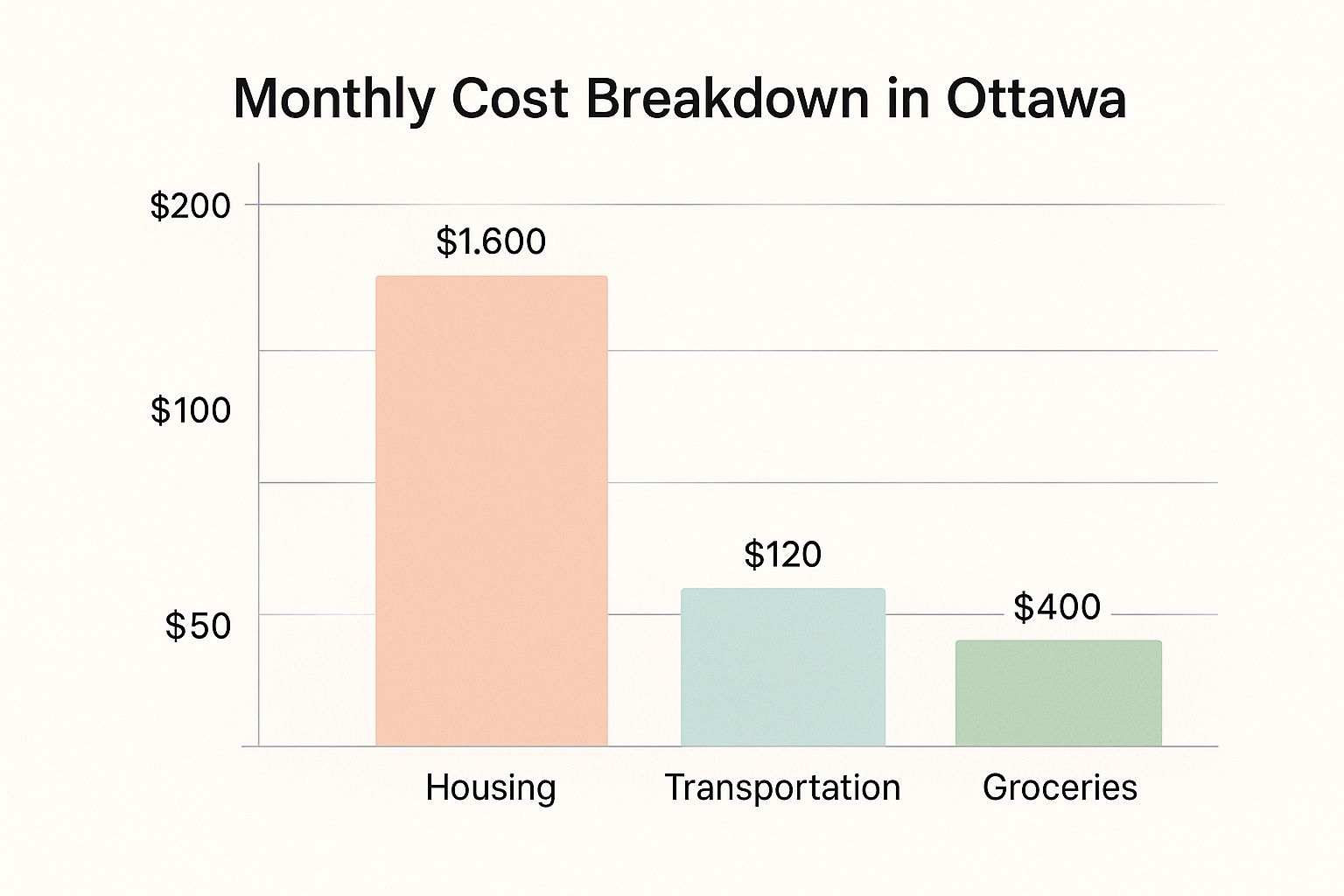

This infographic breaks down some of the core monthly expenses you might expect.

As you can see, housing takes the biggest slice of the pie, which is pretty standard for any major city. But when you start comparing these numbers to other urban hubs, Ottawa's relative affordability really starts to shine.

How Ottawa Compares

When you stack it up against other Canadian cities, Ottawa often lands in that perfect middle ground. It delivers a high quality of life, fantastic job opportunities, and a lively cultural scene, all without the intense financial pressure you might feel elsewhere.

This unique blend of career potential and manageable living costs is a huge part of what defines the experience of life in Canada's capital. That financial breathing room allows people to actually enjoy everything the city has to offer, from its stunning parks to its national museums. It's a place where you can truly build both a career and a life.

Navigating the Ottawa Housing Market

For almost everyone, housing is the biggest slice of the budget pie, and Ottawa is no different. Getting a handle on the city’s real estate and rental landscape is the first real step to building a budget that works. It's a market of contrasts, with everything from slick downtown condos to sprawling family homes in the suburbs.

Your choice of whether to rent or buy will be the single biggest factor shaping your cost of living in Ottawa. It all comes down to your finances, long-term plans, and the kind of lifestyle you're after. Both paths have their own costs and benefits, and it’s worth weighing them carefully.

The Rental Scene

Renting is how most newcomers get their start in the city. It offers flexibility and doesn't require the massive upfront cost of buying. Ottawa’s rental market is always buzzing, with a ton of options across its diverse neighbourhoods. Whether you're looking for the energy of an urban centre or the quiet of a tree-lined street, you’ll find something that fits.

The real key is knowing the average costs and where you can find the best value. Prices can swing wildly depending on the neighbourhood, the size of the unit, and what amenities the building offers.

Ottawa’s rental market is a breath of fresh air compared to other major Canadian cities. This relative affordability gives people the freedom to choose a neighbourhood that actually fits their lifestyle, not just one they can barely afford.

Housing is a big ticket item, no doubt. Recent data shows the average rent for an apartment hovers around CA$2,124 per month. But if you're working with a tighter budget, you can find more affordable spots in neighbourhoods like Alta Vista and Herongate, where rents can be as low as CA$1,580. This range gives renters at different income levels a real shot at finding a great home. For a closer look at the numbers, you can dig into the data on Ottawa’s living expenses on wisemove.ca.

The Path to Homeownership

For those ready to put down roots, buying a home in Ottawa is a major milestone, but it’s an achievable one for many. While the market is competitive, it's far more approachable than what you'll find in Canada's biggest cities like Toronto or Vancouver. This makes homeownership a realistic goal for many professionals and families here.

Lately, the average home price in Ottawa is sitting around CA$655,000, which is a 2.6% increase from last year. That number shows demand remains steady, but it’s still worlds away from cities like Vancouver, where prices can easily be double that. This price gap is a huge reason why so many people are drawn to the National Capital Region.

Smart Strategies for Managing Housing Costs

Whether you rent or buy, there are always ways to be smart about your housing expenses. A little creative thinking can lead to some serious savings.

- Look Beyond Downtown: Don’t just zero in on the core. Neighbourhoods like Orléans, Barrhaven, and Kanata offer more affordable homes and have fantastic amenities and strong community vibes.

- Consider a Roommate: For singles or students, sharing an apartment or house is a tried-and-true way to slash your living costs. Platforms like Kijiji and Rentals.ca are the go-to spots for finding roommates and shared places.

- Factor in Your Commute: That cheaper rent or mortgage in the suburbs might get eaten up by transportation costs. Do the math on your potential commute to make sure your total housing and transit budget stays in balance.

Building a Realistic Monthly Budget

So, you've figured out the big-ticket item—rent—but what does a typical month of spending really look like in Ottawa? Think of creating a budget as drawing a map for your new financial life here. It’s the tool that shows you exactly where your money needs to go, helping you navigate the city with a lot more confidence and a lot less stress.

Let's break down the everyday costs that make up your monthly spend. By putting together a sample budget, we can move past vague estimates and get a much clearer picture of how all those little expenses add up.

Core Monthly Expenses for a Single Person

Let’s get into the nitty-gritty. For a single person living in a one-bedroom apartment, you’re looking at an average rent of around CA$1,960 in the city centre. On top of that, you can expect to pay about CA$160 for basic utilities like hydro and heating, CA$500 for groceries, and CA$125.25 for a monthly transit pass.

Tallying those up, your essential monthly costs will land somewhere near CA$2,745. This number is a solid starting point and lines up well with what we're seeing on the ground. For a bit more perspective on what to expect, you can check out this helpful guide on the pros and cons of moving to Ottawa from letsgetmoving.ca.

To make it even clearer, here’s a sample budget that lays out a potential month of spending.

Sample Monthly Budget for a Single Person in Ottawa

This table breaks down a typical monthly budget, giving you a tangible idea of where your money might go.

| Expense Category | Average Monthly Cost (CA$) |

|---|---|

| Rent (1-Bedroom, City Centre) | $1,960 |

| Utilities (Hydro, Heat, etc.) | $160 |

| Groceries | $500 |

| Transportation (Monthly Pass) | $125.25 |

| Phone & Internet | $110 |

| Entertainment & Dining | $350 |

| Estimated Total | $3,205 |

Of course, this is just a starting point. Your actual costs will depend entirely on your lifestyle—how often you eat out, your subscription services, and your weekend habits—but it gives you a realistic baseline to build from.

Earning Potential in Ottawa’s Job Market

Knowing your costs is only one side of the coin; you also need to know what you can earn. Ottawa's job market is famously stable, anchored by the federal government and a booming tech sector, which helps make these living expenses manageable.

One of the best things about living in Ottawa is the healthy relationship between average salaries and the cost of living. Unlike other major Canadian cities where wages are constantly playing catch-up with sky-high expenses, Ottawa offers a balanced environment where a comfortable life is actually within reach for most professionals.

The average annual salary in Ottawa hovers around CA$74,000. If you're earning CA$85,000 a year, you're sitting comfortably above the average, with plenty of room to cover your costs, save for the future, and still enjoy a great quality of life.

For a more detailed look at the numbers, our guide on how much you need to survive in Ottawa breaks it down even further. Ultimately, this balance between earning power and affordability is what makes Ottawa so appealing.

Your Guide to Transportation Costs

Figuring out how to get around a new city shouldn't feel like solving a financial puzzle. In Ottawa, your daily commute cost can swing wildly depending on whether you're hopping on a bus, getting behind the wheel, or pedalling your way through town. Getting a real handle on the expenses for each option is the key to managing your budget and truly settling in.

For most newcomers, the first big transportation decision boils down to public transit versus car ownership. Each has its own rhythm, its own set of costs, and its own conveniences. The right choice for you will really depend on your lifestyle, your budget, and where you'll be living and working.

Public Transit with OC Transpo

For a lot of Ottawans, the public transit system, OC Transpo, is the most sensible and wallet-friendly way to navigate the city. The network is a solid mix of an extensive bus system and the modern O-Train light rail, connecting you to the major neighbourhoods and job hubs without the headache of traffic.

The whole system runs on the reloadable Presto card, which is basically a digital wallet for your fares. You can either load it with funds and pay as you go or grab a monthly pass for unlimited travel. An adult monthly pass for OC Transpo will run you $125.25, which gives you a predictable and easy-to-budget transportation cost.

Opting for a monthly transit pass over driving can be one of the smartest financial moves you make each month. It transforms a fluctuating expense like gas and parking into one simple, fixed cost.

It’s an approach that not only saves you money but also frees you from the daily grind of traffic jams and the hunt for a parking spot.

The Cost of Owning a Car

There’s no denying the freedom a car offers, but that freedom comes with a hefty price tag that goes way beyond the sticker price. When you start adding up all the associated costs, driving is easily the most expensive way to get around Ottawa.

Here’s a realistic breakdown of what you need to budget for:

- Car Insurance: Ontario has some of the highest insurance rates in Canada. In Ottawa, you can expect to pay an average of $115 to $150 per month, depending on your driving history and vehicle.

- Gasoline: Fuel prices are always a moving target, making this a significant and often unpredictable weekly expense.

- Parking: Finding a spot downtown can be a pricey endeavour. Monthly passes for parking lots frequently cost $200 or more, and even street parking adds up faster than you’d think.

Tally it all up, and owning a car can easily add $400 to $600 (or more!) to your monthly bills—and that’s before you even think about maintenance or unexpected repairs.

Other Ways to Get Around

Ottawa is also a fantastic city for cyclists, with an ever-expanding network of bike paths, including some absolutely beautiful routes along the Rideau Canal and Ottawa River. For those shorter trips or the odd day you really need a car, ride-sharing services like Uber and Lyft are everywhere, offering a great alternative without the long-term financial commitment.

In fact, many people find a hybrid approach works best. Using public transit for the daily commute and ride-sharing for occasional trips can strike the perfect balance between affordability and convenience.

Budgeting for Lifestyle and Entertainment

Your budget for living in Ottawa isn't just about rent and hydro bills; it’s also about what you do for fun. Life in the capital is defined by its vibrant culture, great food scene, and beautiful natural spaces, so you'll want to make sure you can actually enjoy it. Factoring in some "play money" is key to building a fulfilling life here.

The good news is that enjoying Ottawa doesn't have to drain your bank account. A night out can be as affordable or as upscale as you like. A casual meal for two at a pub in a neighbourhood like the Glebe might cost around $60-$80, while a three-course dinner at a mid-range restaurant in the ByWard Market will likely be closer to $100-$150.

Everyday Entertainment Costs

Beyond dining out, other common fun expenses are pretty reasonable. Catching the latest blockbuster at a Cineplex theatre typically costs about $15.50 per ticket. If staying active is more your style, a monthly gym membership usually falls in the $50 to $70 range, depending on the facility and what it offers.

These individual costs are manageable on their own. But the real secret to enjoying Ottawa is mixing in paid activities with the incredible number of free and low-cost options the city offers. Finding that balance allows for a rich social life without the financial pressure.

One of the best parts about living in Ottawa is that quality of life isn't directly tied to how much you spend. The city is designed for access, with world-class experiences available to everyone, regardless of their budget.

Enjoying Ottawa on a Budget

Building a fun and active social life here is easy when you know where to look. Ottawa is absolutely brimming with activities that cost little to nothing, letting you save money while still feeling connected to the city's pulse.

Here are a few ways to enjoy Ottawa without breaking the bank:

- Explore National Museums: Many of Ottawa's national museums, like the Canadian Museum of Nature and the National Gallery of Canada, offer free admission on Thursday evenings. It's a perfect way to soak in some culture.

- Cycle the Capital Pathway: Ottawa boasts over 800 kilometres of stunning recreational pathways. A bike ride along the Rideau Canal or the Ottawa River offers breathtaking views and is completely free.

- Picnic in Major's Hill Park: Pack a lunch and enjoy unparalleled views of the Parliament Buildings and the Ottawa River. The city's many parks, like Gatineau Park just across the river, provide endless opportunities for hiking, picnicking, and relaxing.

Staying on top of what's happening is the best way to find these gems. For a current list of festivals, community gatherings, and other great local happenings, checking out a guide to events in Ottawa can help you plan a fantastic weekend that aligns with your budget.

Alright, let's get into the nitty-gritty. Moving to a new city always brings up a few big questions. To wrap things up, we're tackling some of the most common ones we hear from people planning a move to Ottawa. Think of this as your final checklist for sorting out the key details around money, work, and life in Canada's capital.

What Salary Do You Need to Live Comfortably in Ottawa?

"Comfortable" means something different to everyone, but we can definitely sketch out a financial baseline. For a single person, a salary somewhere between CA$65,000 and CA$75,000 a year is a pretty good target for a comfortable lifestyle. That's enough to cover your rent, utilities, and groceries without having to penny-pinch, leaving you with money for savings, entertainment, and the odd weekend getaway. It’s that sweet spot where you can actually enjoy the city, not just survive in it.

Now, for a family of four, the numbers naturally shift. With bigger housing needs, childcare, and more mouths to feed, you'll need a higher household income.

A combined household income of CA$120,000 or more is a solid benchmark for a family to live comfortably in Ottawa. This ensures you can manage the major costs and really thrive here.

The good news? With Ottawa's strong and stable job market, especially in high-paying sectors, these salaries are well within reach for many professionals and dual-income families.

Is Ottawa Cheaper Than Toronto or Montreal?

This is a great question, and the answer is a bit of a tale of two cities.

When you stack Ottawa against Toronto, the answer is a clear yes—Ottawa is significantly more affordable. The biggest factor here is housing. Both renting and buying a home will cost you substantially less in the capital, and that alone can free up thousands of dollars a year.

Compared to Montreal, Ottawa is generally a bit pricier. You’ll likely find that rent, dining out, and other daily expenses are a little higher here. But—and this is a big but—Ottawa's average salaries are also higher, particularly in government and tech. That stronger earning potential often balances out the higher day-to-day costs, meaning your actual purchasing power can be better in Ottawa.

Ultimately, Ottawa sits in a financial sweet spot. You get the big-city job opportunities and amenities at a much more reasonable price than Toronto, but with a more robust job market than you might find in Montreal.

What Are the Main Job Opportunities in Ottawa?

Ottawa's job market is one of its biggest draws—it's known for being incredibly stable and full of diverse opportunities. The city's economy really stands on a few key pillars.

- Federal Government: No surprise here. As the nation's capital, the federal government is the largest employer in town. It offers a massive number of secure, well-paying public service jobs across countless departments.

- Technology Sector: Ottawa is a serious tech hub, earning the nickname "Silicon Valley North." The city has a buzzing ecosystem of companies in software, telecom, life sciences, and cleantech, which means skilled tech professionals are always in high demand.

- Healthcare and Education: Home to major hospitals, research institutes, and two large universities (University of Ottawa and Carleton University), the healthcare and education sectors are huge employers here.

- Tourism: Being the capital city means attracting millions of visitors every year. This fuels a vibrant tourism industry with plenty of jobs in hospitality, services, and at our fantastic cultural institutions.

This mix means there are great jobs across a whole spectrum of fields, making Ottawa an attractive place for professionals at any stage of their career.

For the latest news, events, and insights into life in the National Capital Region, stay connected with ncrnow. We are your go-to source for everything you need to know about Ottawa. Explore more at https://ncrnow.ca.