So, how much does it actually cost to live in Ottawa? Let's get right to it. For a single person, you’re looking at an estimated monthly budget of around CA$3,872. If you're moving with a family of four, that number climbs to about CA$6,798.

These figures, based on current economic data, are your baseline—the starting point for understanding what it takes to call Canada's capital home, covering everything from your rent cheque to your weekly grocery run.

Your Quick Guide to Ottawa Living Expenses

Thinking about a move to Ottawa, or just curious how your city stacks up? Getting a handle on the cost of living is always the first, most critical step. Ottawa holds a unique spot in Canada; it has all the perks and energy of a major city but manages to dodge the eye-watering price tags you’d find in Toronto or Vancouver.

This guide is here to give you a real, no-fluff breakdown of the expenses you should expect. We'll dig into the numbers and give you the context needed to build a budget that actually works for you.

A Snapshot of Monthly Costs

To kick things off, let's look at the big picture. The numbers give a pretty clear idea of what to expect financially. Based on recent data, a single person’s budget is shaped heavily by three main players: housing, food, and transportation. For a family, those costs multiply, especially when you factor in things like childcare and the need for more space.

While these estimates are a great starting point for your planning, you can always dig deeper into how Ottawa compares on the world stage over at Expatistan.

Ottawa sits in a sweet spot. While it's considered moderately expensive globally, it's still a more affordable choice than other major Canadian cities. That affordability, paired with a rock-solid economy anchored by the government and tech sectors, makes it a seriously attractive place to live.

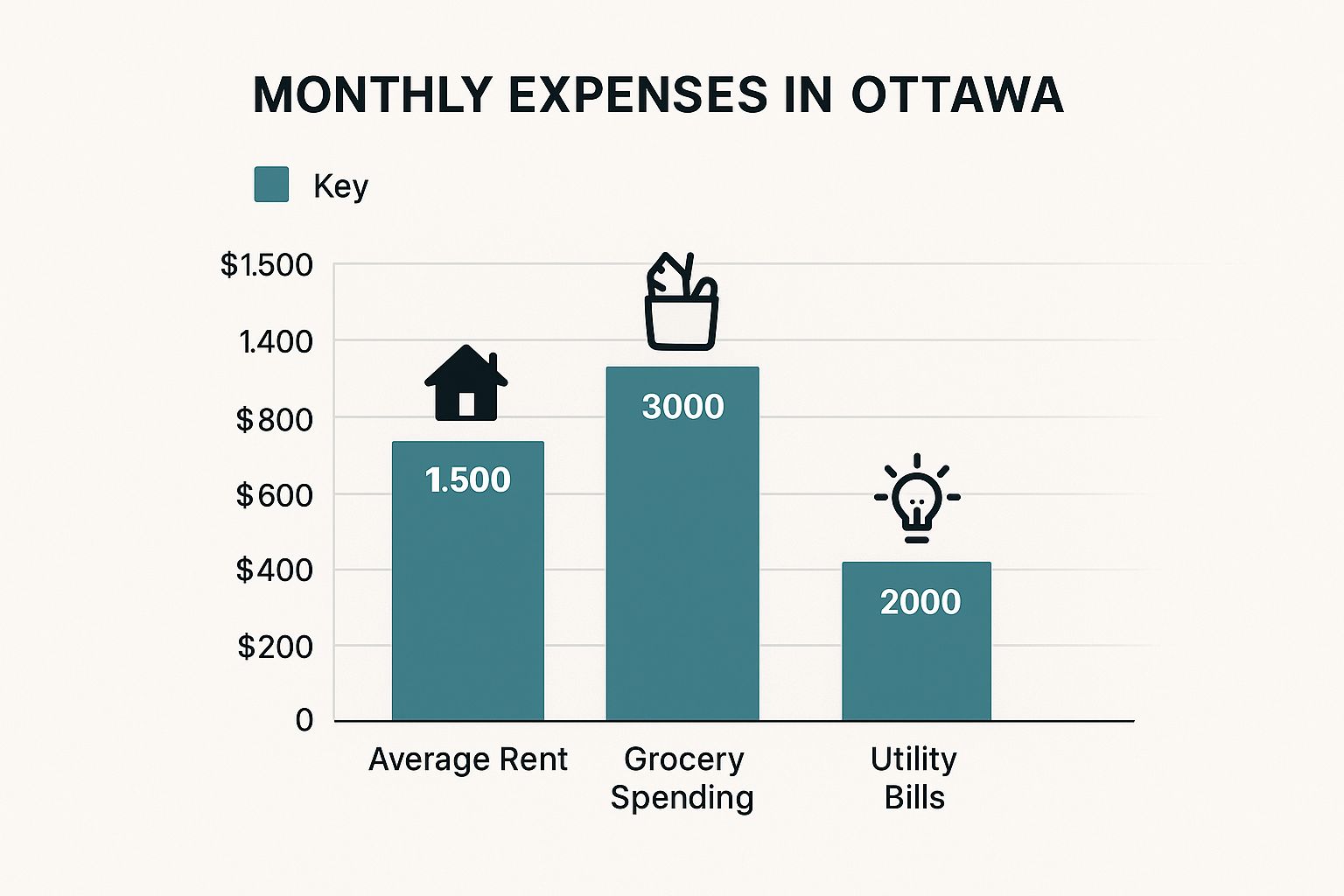

The chart below breaks down the three core monthly expenses that will form the foundation of any budget in Ottawa: rent, groceries, and utilities.

As you can see, housing is the undisputed heavyweight, taking the biggest bite out of your monthly budget compared to other essentials. No surprises there.

To help you visualize these numbers more clearly, here's a quick summary table.

Estimated Monthly Expenses in Ottawa at a Glance

This table breaks down the average monthly costs for both a single person and a family of four, giving you a side-by-side look at the key expense categories.

| Expense Category | Estimated Cost for a Single Person (Monthly) | Estimated Cost for a Family of Four (Monthly) |

|---|---|---|

| Rent & Utilities | CA$2,150 | CA$3,400 |

| Groceries | CA$450 | CA$1,100 |

| Transportation | CA$250 | CA$500 |

| Entertainment & Dining | CA$400 | CA$700 |

| Health & Fitness | CA$150 | CA$300 |

| Other (Shopping, etc.) | CA$472 | CA$798 |

| Total Estimated Cost | CA$3,872 | CA$6,798 |

These figures provide a solid framework, but keep in mind that personal spending habits will always play a huge role in your final monthly total.

What to Expect in This Guide

Think of this as just the introduction. We're about to dive much deeper into each of these spending categories. From the ins and outs of the housing market to the price of a monthly OC Transpo pass, we'll give you all the details you need to map out your finances with confidence.

For the most up-to-date numbers, be sure to check out our complete breakdown of the cost of living in Ottawa. It’ll give you the latest information to help you plan your next move.

Breaking Down Ottawa's Housing Market

Housing is almost always the biggest slice of anyone's budget, and getting a handle on Ottawa’s market is the first step to figuring out your overall cost of living. Whether you see yourself renting a downtown condo or buying a family home out in the suburbs, the city has a surprisingly wide range of options for different budgets and lifestyles.

Unlike Canada’s biggest cities, Ottawa’s housing market feels a lot more balanced and accessible. That sense of balance is a huge draw for new residents, offering a path to homeownership that just feels out of reach in many other places.

Renting in Ottawa: What to Expect

For most newcomers, renting is the logical first move. It gives you the flexibility to get to know the city’s different corners before you decide to plant deeper roots with a purchase. The rental market here is pretty dynamic, with prices that can swing wildly depending on the neighbourhood, apartment size, and building perks.

The city-wide average for an apartment sits around CA$2,124 per month, but don’t let that number scare you off. You can definitely find more affordable places. For instance, neighbourhoods like Alta Vista or Herongate can have rents as low as CA$1,580 a month. This really drives home the point that a bit of exploring can save you a lot of cash.

And if you’re trying to cut costs, especially in a popular central area, sharing a place is a super common solution for students, young professionals, and really anyone looking to keep their monthly expenses down.

The Homeownership Landscape

If you're ready to put down roots, buying a home in Ottawa is a far more realistic goal than in places like Toronto or Vancouver. The market is diverse, offering everything from slick downtown apartments to sprawling single-family homes, so buyers have plenty of choices.

Lately, the average price for a home in Ottawa is hovering around CA$670,260. That’s a 6.1% jump from last year, which tells us the market is healthy and growing. But even with that increase, Ottawa's housing costs are a fraction of what you’d find out west, making it a compelling option for would-be buyers. You can dig into a detailed analysis from Wisemove for more on affordability.

That relative affordability is a game-changer. It often makes owning a home a smarter financial choice than renting over the long run, which is a key factor for many people who decide to buy here.

How Neighbourhoods Shape Your Housing Costs

In Ottawa, your postal code has a massive impact on your housing bill. The city is a mosaic of unique neighbourhoods, each with its own vibe and price tag. Figuring this out is crucial to finding a spot that fits both your lifestyle and your wallet.

Here’s a quick snapshot of how costs can vary:

- The Glebe: Known for its historic charm and walking distance to downtown, this area comes with higher price tags for both renters and buyers.

- Kanata: As a major tech hub, Kanata is full of modern family homes and townhouses, with prices that reflect its great amenities and strong job market.

- Orléans: This family-friendly suburb in the east end offers more affordable housing, making it a go-to for people looking for more space for their money.

Choosing a neighbourhood is like choosing a lifestyle. The cost of living in Ottawa isn't just one number; it’s a range that shifts from the bustling downtown core to the quiet, leafy suburbs.

Taking the time to explore these different areas is a must. To help you get your bearings, check out our guide on the best neighbourhoods in Ottawa to see which community might be the perfect match for you.

Renting Versus Buying: A Practical Comparison

Deciding whether to rent or buy is a huge financial fork in the road. In Ottawa, the math often points toward buying as the better long-term bet, but the right choice really comes down to your personal situation.

Consider Renting If You:

- Are new to the city and want the freedom to move around.

- Aren’t quite ready for the commitment of a mortgage and property taxes.

- Would rather not deal with home maintenance and surprise repairs.

Consider Buying If You:

- Plan to stay in Ottawa for the long haul (think 5+ years).

- Want to build equity and see your home as an investment.

- Crave the stability and freedom that comes with owning your own space.

Ultimately, Ottawa's balanced market gives you solid options on both sides of the fence, letting you make a choice that actually aligns with your financial goals and where you are in life.

Managing Your Everyday Household Costs

While housing often grabs the headlines, it’s the steady drumbeat of everyday expenses that truly shapes your monthly budget. These recurring costs—from your grocery run to your hydro payment—are the nuts and bolts of living in Ottawa. Getting a handle on them is the key to building a realistic financial plan that actually works.

Once you’ve sorted out your rent or mortgage, it’s time to focus on these daily and weekly costs. They’re the non-negotiables that keep your home running, and understanding them gives you the full picture of your financial life in the capital.

Powering Your Home: A Utilities Breakdown

When you settle into your new place, you’ll need to set up a handful of essential utilities to keep things comfortable and connected. These costs can swing depending on your usage, the season, and how many people are in your home, but budgeting for them is a must.

Here are the main players you’ll be managing:

- Hydro (Electricity): This keeps your lights on and your gadgets charged. Expect this to tick up in the summer months when the air conditioning is working overtime.

- Heating (Natural Gas or Electric): A major expense during Ottawa’s chilly winters, your heating bill will likely be one of your most variable costs throughout the year.

- Water and Sewer: Billed directly by the city, this covers all your daily water needs. If you want to get into the nitty-gritty of how it’s calculated, you can learn more about the City of Ottawa water and sewer rates.

On top of these core services, you’ll also need to budget for modern must-haves like internet and mobile phone plans. Ottawa has a pretty competitive market here, so you’ll find plenty of providers offering packages to fit different needs and budgets.

For a small household of two or three people, you can generally expect your combined monthly utility bills to land somewhere between CA$250 and CA$400. This range gives you a solid baseline to work with.

This figure is a crucial piece of the puzzle, representing a significant monthly outlay right after your housing is covered.

Breakdown of Common Monthly Household Expenses

Let's take a closer look at what a typical monthly budget might look like for different household sizes in Ottawa. The following table breaks down average costs for essential expenses, giving you a clearer idea of where your money will go.

| Expense Item | Average Monthly Cost (Single Person) | Average Monthly Cost (Small Family) |

|---|---|---|

| Utilities (Hydro, Heat, Water) | CA$150 – CA$250 | CA$250 – CA$400 |

| Groceries | CA$400 – CA$600 | CA$800 – CA$1,200 |

| Internet & Mobile | CA$100 – CA$150 | CA$150 – CA$250 |

| Public Transit (OC Transpo Pass) | CA$128.75 | CA$250+ |

| Tenant/Home Insurance | CA$25 – CA$40 | CA$40 – CA$75 |

These numbers are a great starting point, but remember they can shift based on your personal habits, the size of your home, and the service providers you choose.

Stocking Your Pantry: The Cost of Groceries

Your grocery bill is one of the most flexible parts of your budget, and it’s heavily influenced by your lifestyle and where you shop. How much you spend can vary wildly depending on whether you’re a fan of local farmers’ markets, a loyalist to budget-friendly chains, or someone who prefers specialty and organic stores.

For a single person, a reasonable monthly grocery budget falls between CA$400 and CA$600. This can easily change based on your diet and how often you decide to eat out. A family, of course, will be looking at a much higher food bill.

Here are a few tips to keep your food costs in check:

- Shop at discount grocers. Stores like No Frills, Food Basics, and Real Canadian Superstore often have lower prices than their premium competitors.

- Explore local markets. Places like the ByWard Market or Parkdale Market offer fresh, local produce that can be a steal when it’s in season.

- Plan your meals. It sounds simple, but meal planning is one of the best ways to cut down on food waste and impulse buys, saving you real money each week.

Understanding Ontario’s Sales Tax (HST)

When you're budgeting for pretty much anything you buy, don't forget about Ontario's Harmonized Sales Tax (HST). This 13% tax is tacked onto most goods and services, from your morning coffee to a new pair of shoes.

It’s easy to overlook, but this tax adds up fast and directly impacts how far your dollar goes. For instance, an item priced at CA$100 on the shelf will actually cost you CA$113 at the checkout. Factoring HST into your budget for dining out, shopping, and entertainment is essential if you want to stay on track.

How to Get Around Ottawa Without Breaking the Bank

Figuring out how to navigate a new city is something you’ll do every single day, and your choice can make or break your budget. The good news? Ottawa has a solid mix of transportation options designed for different lifestyles and wallets.

Whether you're commuting daily or just exploring on weekends, getting a handle on these choices is the key to keeping your travel costs in check. It doesn't have to be a massive financial drain. By weighing the pros and cons of public transit versus owning a car, you can find a sweet spot between cost and convenience.

Riding with OC Transpo

For many locals, Ottawa’s public transit system, OC Transpo, is the obvious choice. It’s a pretty comprehensive network, combining a fleet of buses with the modern O-Train light rail transit (LRT) system to connect the city from one end to the other. If you work downtown, it's often the easiest way to get there, letting you skip the headache of traffic and the steep price of parking.

A single ride costs $3.80 when you tap your credit card or use a PRESTO electronic fare card, and that includes a generous transfer window. But if you’re a regular commuter, the monthly pass is where the real savings are.

An adult monthly pass for OC Transpo will set you back $128.75. That gets you unlimited travel on all buses and the O-Train, making it a fantastic deal for anyone using the system to get to work or school every day.

That fixed monthly cost makes your budget clean and predictable, saving you from the wild swings in expenses that come with car ownership.

The True Cost of Car Ownership

Sure, having your own car offers a ton of freedom, but that convenience comes with a hefty price tag. The sticker price is just the starting line; the actual cost of keeping a vehicle on the road in Ottawa involves a long list of recurring expenses that pile up fast.

If you’re planning to drive in the city, here’s a realistic look at what you need to budget for:

- Insurance: This is mandatory and can be a big monthly bill. Expect to pay anywhere from $100 to $200 or more, depending on your driving record and the car you own.

- Gasoline: With fuel prices always in flux, this is a variable cost that can easily top $200 per month for daily drivers.

- Maintenance: Routine stuff like oil changes and tire rotations, plus the inevitable surprise repairs, can easily add up to hundreds of dollars each year.

- Parking: This one’s a killer. A monthly parking spot downtown can run you $200 to $400, and even paying by the hour adds up quickly.

When you add it all up, relying solely on a personal car can easily cost over $500 per month—and that's before you even factor in a car payment. Suddenly, that monthly transit pass looks a lot more appealing.

Smart Alternatives for Getting Around

Beyond buses and cars, Ottawa has some other clever ways to get from A to B that are both easy on the wallet and good for the planet.

For shorter trips, especially when the weather is nice, cycling is a fantastic option. Ottawa is famous for its massive network of scenic bike paths and dedicated cycling lanes, making it a safe and genuinely enjoyable way to travel. The initial investment in a bike pays for itself pretty quickly when you see what you’re saving on gas or bus fare.

Ride-sharing services like Uber and Lyft are also everywhere for those one-off trips. While they’re not the cheapest for a daily commute, they’re perfect for the occasional ride when transit isn't practical. For a happy medium, car-sharing programs like Communauto give you access to a vehicle right when you need one, without all the financial baggage of actually owning it.

Budgeting for Your Lifestyle and Leisure in Ottawa

Your budget isn’t just about covering bills; it’s about what’s left over to actually enjoy your life. This is your discretionary spending—everything from a night out with friends to your weekend hobbies—and it’s what turns a city from just a place you live into a place you love.

Thankfully, Ottawa has a vibrant lifestyle that doesn't always come with a premium price tag. Figuring out how to budget for fun is a key part of your financial plan, and here you have a massive range of options, from upscale dining in the ByWard Market to totally free cultural experiences unique to the capital. This balance makes it possible to build a rich social life without constantly checking your bank account.

Dining, Drinks, and Entertainment Costs

Going out in Ottawa can be as affordable or as lavish as you want. The city’s food scene is incredibly diverse, offering everything from cheap and cheerful shawarma joints—an Ottawa staple—to high-end restaurants perfect for a special occasion.

To give you a rough idea of what to expect, here's a quick look at what a typical night out might cost:

- Casual Dining: A meal for one at an inexpensive restaurant or pub will generally run you $20 to $25.

- Mid-Range Restaurant: Planning a three-course meal for two at a nice spot? Budget around $80 to $120.

- Local Craft Beer: A pint of local craft beer at a pub typically costs between $8 and $10.

- Movie Tickets: Catching a new release at the cinema will set you back about $15 to $18 per ticket.

These prices are pretty standard for a major Canadian city, which means you can have regular nights out without completely derailing your budget.

Staying Active and Pursuing Hobbies

Keeping fit is a big part of the Ottawa lifestyle, and there are plenty of ways to do it, no matter your budget.

A standard monthly gym membership usually falls in the $50 to $70 range, with boutique fitness studios or specialized classes costing a bit more. But you definitely don't need a membership to stay active here. The city’s huge network of bike paths, parks, and recreational facilities offers endless opportunities for running, cycling, and sports, often for free.

One of the best things about Ottawa is how much of its culture and recreation is accessible to everyone. This blend of paid and free activities is central to the city's high quality of life.

This easy access means you can prioritize your health and hobbies without it becoming a major line item in your budget.

Embracing Ottawa's Free and Low-Cost Activities

This is where Ottawa truly shines. The city is packed with incredible experiences that cost little to nothing, allowing you to soak up Canadian culture and natural beauty without opening your wallet.

Here are just a few of the amazing, budget-friendly activities you can enjoy:

- Skate on the Rideau Canal: In the winter, the iconic Rideau Canal Skateway—a UNESCO World Heritage Site—offers a world-class skating experience that is completely free to access.

- Visit National Museums: Many of Ottawa's national museums, like the Canadian Museum of Nature and the National Gallery of Canada, offer free admission on Thursday evenings.

- Attend Community Festivals: The city hosts vibrant festivals like Winterlude, the Canadian Tulip Festival, and Canada Day celebrations all year long, and most are free to attend.

- Explore Gatineau Park: Just a short drive from downtown, this massive conservation park offers year-round hiking, swimming, and cross-country skiing for a minimal park entry fee.

By taking advantage of these opportunities, you can build a fulfilling and exciting lifestyle in Ottawa that is both rich in experience and easy on your wallet.

Planning Your Ottawa Budget: A Final Checklist

Let's pull all the pieces together. The cost of living in Ottawa isn't just a list of numbers on a spreadsheet; it's a real-world balancing act between your income, your career path, and the life you want to build here. How you fare financially in the capital will come down to those personal factors.

Sure, Ottawa isn't the cheapest city in Canada, but it consistently punches above its weight, offering a fantastic quality of life that feels far more within reach than in places like Toronto or Vancouver. If there's one key takeaway, it's that balance. Ottawa gives you a manageable cost structure without forcing you to give up the perks of a vibrant, thriving city. It's a place where a comfortable life is genuinely attainable for many people.

Your Income and Career Opportunities

Think of your earning potential as the engine that powers your budget. Luckily, Ottawa’s job market is a strong one. The city is firmly anchored by stable, well-paying federal government jobs and a tech sector that's so dynamic people have nicknamed it "Silicon Valley North." These industries create a solid economic floor and offer competitive salaries that directly feed into a better quality of life.

If you're landing a job in one of these key sectors, you’ll likely find that your income can comfortably handle the median living costs we've gone over. That economic stability is a massive draw for the city, providing a sense of financial security that can be tough to find elsewhere.

Final Takeaways and Budgeting Tips

Now it's time to shift from general numbers to a plan that's all your own. Your spending habits and personal priorities are what will ultimately shape your monthly expenses. After all, one person's must-have is another's luxury, and figuring out where you stand is the first step to building a budget that actually works.

The true cost of living in Ottawa is a personal calculation. It’s where the city’s market prices meet your individual choices. A smart budget is your roadmap for navigating that intersection with confidence.

To help you get started on your journey, here's a final checklist to guide your financial planning.

Your Practical Ottawa Budgeting Checklist

- Estimate Your Take-Home Pay: First things first, calculate your monthly income after taxes. This is the real number you have to work with.

- Track Your Current Spending: For one month, track every single dollar. This gives you a clear-eyed view of your habits before you even start packing.

- Research Neighbourhood Costs: Pick two or three neighbourhoods that feel like a good fit and dig into their specific rental or housing prices. A Glebe apartment costs a lot more than one in Vanier.

- Build a Mock Ottawa Budget: Use the averages in this guide to sketch out a sample budget. Plug in real numbers for housing, utilities, groceries, and transportation.

- Factor in One-Time Moving Costs: Don’t let moving day catch you off guard. Set aside funds for movers, security deposits, and maybe some new furniture.

- Plan for Discretionary Spending: Life isn't just bills. Allocate a specific amount for entertainment, dining out, and hobbies. This is non-negotiable for a balanced life.

- Create an Emergency Fund: This is a big one. Aim to have at least three months of living expenses saved up. This safety net is absolutely vital for any major life change.

We’ve covered a lot of ground, breaking down everything from housing to hydro. Now, it’s time to tackle some of the most common questions people have about Ottawa’s cost of living.

Think of this as the final check-in—a quick-hitter round of answers to fill in any gaps and help you lock in your budget with confidence.

What Is a Good Salary to Live Comfortably in Ottawa?

"Comfortable" means different things to different people, but we can definitely work with some solid benchmarks. For a single person, a salary in the CA$60,000 to CA$70,000 range is a pretty good target. That should let you cover all your essentials, put a little something away for savings, and still have enough left over for a healthy social life.

For a family of four, the picture changes. You’ll want to aim for a combined household income of CA$100,000 to CA$120,000 or more. That higher figure helps comfortably manage bigger costs like a larger home, childcare, and all the other expenses that come with raising a family in the city.

How Does the Cost of Living in Ottawa Compare to Toronto?

This is a question we hear all the time, and the answer is simple: Ottawa is significantly more affordable than Toronto. The single biggest reason? Housing.

Whether you're looking to rent or buy, housing prices in Toronto are in a completely different league. While daily costs like groceries and transit are fairly similar between the two cities, the massive savings on your biggest monthly expense in Ottawa make a world of difference. It allows for a comparable quality of life with far less financial pressure.

Are There Any Hidden Costs I Should Know About?

Yes, a couple of key expenses often catch newcomers by surprise. It’s best to factor them into your budget from the get-go.

Two often-overlooked costs in Ottawa are winter expenses and childcare. Ignoring these can throw even a carefully planned budget way off track.

Winter here means higher heating bills and the need for proper winter tires. While not legally mandatory across Ontario, they are a must for safe driving and are required if you cross the river into Quebec. On top of that, childcare can be a major line item for families, with daycare fees often running over CA$1,200 per month per child. The good news is that government subsidies are available for eligible families.

What Are Some of the Most Affordable Neighbourhoods in Ottawa?

If you're looking to make your money go further, several neighbourhoods offer more affordable housing without forcing you to compromise on quality of life.

- Vanier: Just east of the downtown core, this area is known for its more accessible rental and home prices.

- Herongate and Alta Vista: These southern neighbourhoods offer a good mix of affordable apartments and family homes.

- Nepean: Parts of this large, diverse suburb in the west end offer fantastic value, especially for families needing a bit more space.

The great thing is that these aren’t remote outposts. They’re well-serviced by public transit and have their own local amenities like parks, schools, and shopping, making them both practical and cost-effective places to live.

At ncrnow, we bring you the stories and information that matter most in the National Capital Region. For the latest news and insights on life in Ottawa, visit us at https://ncrnow.ca.