Figuring out the cost of living in Ontario is a bit like looking at a tale of two provinces. On one hand, you have the bustling, high-demand cities; on the other, vast, quieter rural landscapes. It creates a real contrast.

For a single person, you’re likely looking at monthly expenses somewhere between $3,200 and $3,800. If you’re a family of four, that number jumps to between $6,500 and $7,800 just to cover the basics. Of course, where you decide to plant your roots and how you live will swing those numbers wildly.

Average Monthly Living Expenses in Ontario

To give you a clearer picture, here’s a quick snapshot of what you might expect to spend each month depending on your household. Think of this as a starting point for building your own budget.

| Household Type | Estimated Monthly Cost Range (CAD) |

|---|---|

| Single Person | $3,200 – $3,800 |

| Couple (No Children) | $4,500 – $5,500 |

| Family of Four | $6,500 – $7,800 |

These numbers are just estimates, but they help paint a picture of the financial landscape you’ll be navigating in Ontario.

Getting a Grip on Ontario's Economy

To really plan a budget that works in Ontario, you need to look past the price tags on groceries and rent. The province is a living, breathing economy where things like wages, inflation, and the ever-present housing crunch are constantly doing a dance that directly hits your wallet.

Whether you're thinking about moving here or you've been an Ontarian for years, understanding these big-picture forces is the first step. It’s like setting your financial starting line before you get into the nitty-gritty of your monthly bills.

The Tug-of-War Between Wages and Inflation

One of the biggest financial hurdles for anyone living in Ontario is the constant race between what you earn and what things cost. Your paycheque might be growing, but those gains often feel like they’re being gobbled up by the rising price of everything from gas to bread. It’s a tough spot for many households.

Recent numbers really bring this to life. As of mid-2024, Ontario's annual inflation rate sits around 2.6%, which, while lower than previous peaks, still puts pressure on household budgets. On the flip side, average wages are predicted to grow by around 3.45%. That sounds like a win, right? The problem is, that growth isn't spread evenly across all jobs, so a lot of people still feel like they're falling behind.

And then there's housing. The relentless pressure from sky-high demand and not enough supply keeps pushing costs up, making it the biggest piece of the puzzle. You can get a deeper dive into Ontario's economic forecast to see what it all means for residents.

Understanding this balance is key. It’s not just about how much you earn, but how much purchasing power that income truly holds against the backdrop of a growing economy.

At the end of the day, what you actually spend will come down to a few key things:

- Location: Living in a major hub like Toronto will cost you a whole lot more than setting up in a smaller city or a rural town.

- Household Size: Your expenses will naturally scale up from a single person to a couple or a family with kids.

- Lifestyle Choices: How much you spend on fun stuff—like eating out, entertainment, and vacations—will make a huge difference in your monthly budget.

Navigating the Ontario Housing Market

Let's be blunt: for most people, housing is the line item that makes or breaks their budget in Ontario. It’s the anchor expense, and just how heavy that anchor is depends entirely on where you decide to drop it.

A downtown Toronto condo carries a completely different financial weight than a family home in a GTA suburb or a house in a smaller city. To really get a handle on the market, you have to look past the headline-grabbing prices and understand the tug-of-war between supply and demand that shapes life for both renters and homebuyers across the province.

The Great Divide: Renting vs. Buying

Your first big decision is whether to rent or buy, and in Ontario, both paths come with their own set of hurdles. The rental market, especially in the big cities, is fiercely competitive. On the other hand, the road to homeownership is a long one, often demanding years of saving for a massive down payment in an incredibly pricey market.

Housing costs are the dominant financial reality here. In Toronto, the average home price hovers around a staggering $1.1 million as of mid-2024, cementing its status as one of Canada's most expensive places to live. That figure stands out even as the national average home price sits closer to $700,000.

Despite the sky-high costs, demand is relentless. Recent market data shows a steady stream of sales and listings, proving just how heated the market remains. For a closer look at national trends, wisemove.ca offers some great insights.

The reality of the Ontario housing market is a constant tug-of-war between high prices and even higher demand. This dynamic ensures that whether you're renting or buying, housing will claim the largest portion of your monthly income.

This high-stakes environment can be a tough pill to swallow for anyone just starting out—new grads, newcomers to Canada, or entrepreneurs trying to get a business off the ground. Juggling personal housing costs while launching a new venture is a serious balancing act. If that's you, our guide on how to register a business in Ontario might offer some helpful direction.

A Tale of Three Cities: Market Variations

Saying "the cost of living in Ontario" is almost meaningless without specifying where. The difference in housing costs from one city to another isn't just big; it's massive.

-

Toronto: As the province's economic engine, Toronto's prices are in a league of their own. Renting a one-bedroom condo in the downtown core can easily set you back more than $2,500 a month. Thinking of buying a detached home? You'll likely need a budget well over $1.5 million.

-

Ottawa: The nation’s capital offers a bit more breathing room. The market is still competitive, no doubt, but average rents and home prices are noticeably lower than in Toronto. It strikes a good middle ground for many professionals and families.

-

Smaller Cities (e.g., Kingston, London): Once you move away from the major metro hubs, the picture changes dramatically. In cities like these, both renting and buying become far more affordable. You'll often find you get more space for your money and a completely different pace of life.

Budgeting for Daily Life in Ontario

Once you’ve got a roof over your head, the next layer of the cost of living in Ontario starts to show up in your day-to-day life. These are the recurring expenses—the groceries, the hydro bill, your phone plan—that really shape your budget month after month.

Think of these as the operating costs of your life. While your rent or mortgage is a big, predictable chunk, these everyday expenses can ebb and flow. Getting a handle on them is the secret to building a budget that actually works in the real world, not just on a spreadsheet.

Stocking Your Pantry: The Grocery Bill

What you spend on food is one of the most personal parts of any budget. It all depends on your household size, what you like to eat, and your shopping habits. Still, we can set a pretty realistic baseline to help you plan.

A single person should probably budget somewhere between $350 and $500 a month for groceries. For a family of four, that number easily climbs to $1,000 to $1,400 or more, especially with growing kids. These numbers assume you're cooking at home most of the time with a few meals out sprinkled in.

Your grocery bill isn’t just a number—it’s a direct reflection of your lifestyle. Things like meal planning, buying what's in season, and hitting up discount stores can seriously slash this expense, freeing up cash for other things.

This is where your choices make a huge difference. Sticking to a list, using loyalty programs, and cutting down on food waste are simple moves that can have a big impact on your bank account every single month.

Keeping the Lights On: Utility Costs

Utilities are the non-negotiables that keep your home comfortable and connected, and they can add up faster than you’d think. You absolutely have to factor these into any real budget for living in Ontario.

Here’s a quick breakdown of what you can expect to pay each month:

- Hydro (Electricity): For a typical apartment or smaller home, plan for about $70 to $120. This can jump quite a bit in larger houses or during a summer heatwave or a winter cold snap when the AC or furnace is working overtime.

- Heating (Natural Gas): This one is all about the seasons. Your bill might be as low as $30 in the summer, but don't be surprised if it shoots past $150 during the coldest winter months.

- Water: Water is usually billed every few months, but it typically averages out to $50 to $80 per month for a standard household.

- Internet and Mobile: Let's face it, these are essentials now. A decent high-speed internet plan will run you $70 to $110, and a single cell phone plan with data usually lands between $60 and $90.

When you add them all up, these daily life expenses are easily the second-biggest drain on your wallet after housing. Tracking them closely is the key to building a resilient budget that truly reflects the cost of living in Ontario.

The Real Cost of Getting Around Ontario

How you get from point A to point B is a massive piece of your monthly budget puzzle. Transportation costs can seriously impact the cost of living in Ontario, and they swing wildly depending on one big choice: owning a car versus riding public transit.

Driving gives you freedom, no doubt. But it comes with a long receipt of expenses that goes way beyond the monthly car payment. On the flip side, city transit offers a predictable, fixed cost, though it might not fit everyone's lifestyle.

Let's break down what you're really paying for each option.

The True Expense of Car Ownership

Owning a car isn't just about the sticker price; it's a whole bundle of ongoing costs. These expenses can change a lot depending on where you live. For example, car insurance in the Greater Toronto Area is notoriously higher than in most other parts of the province.

A realistic monthly budget for a car owner needs to account for a few key things:

- Insurance: This is a big one. Expect to pay anywhere from $150 to over $300 a month, especially if you're a new driver or live in a busy urban centre.

- Fuel: Gas prices are always in flux, so budgeting $200 to $400 a month is a safe bet for the average commuter.

- Maintenance and Repairs: Tucking away $50 to $100 a month is a smart move. It’ll help cover routine oil changes, new tires, and those lovely unexpected repair bills.

- Parking: In cities like Toronto or Ottawa, a monthly parking spot can easily tack on another $150 to $300 to your tab.

Navigating Public Transit Systems

For anyone living in Ontario's major cities, public transit is a compelling alternative to driving. The cost is predictable, and you get to skip the headaches of traffic jams and the endless hunt for a parking spot.

Each major transit system has its own fare structure. A monthly pass for Toronto's TTC will run you about $156, while in Ottawa, an OC Transpo pass is around $125.50. If you're commuting between cities, a GO Transit pass can range from $200 to over $500, depending on how far you travel each day. These systems are the lifeline that connects millions of residents to work, school, and everything else city life has to offer.

Choosing between a car and a transit pass is a classic trade-off: convenience versus cost. While a vehicle offers flexibility on your own schedule, the consistent, lower monthly expense of public transit is a powerful budgeting tool for many Ontarians.

Many municipalities also have programs to make transit more affordable. For instance, you can learn more about initiatives like the low-income bus pass, which can offer significant savings to eligible residents. Taking the time to weigh these transportation options is a crucial step in getting your budget under control.

Understanding Healthcare, Taxes, and Other Hidden Costs

The sticker price of living in Ontario doesn't always tell the whole story. After you’ve budgeted for the big things like rent and groceries, you’ve got to account for the less obvious costs that quietly take a bite out of your paycheque—especially healthcare and taxes. These aren’t optional expenses; they’re a fundamental part of life here and need to be in your budget from day one.

While the Ontario Health Insurance Plan (OHIP) is a huge relief, it’s not a blank cheque for all your health needs. Think of it as your safety net for the big stuff—doctor’s visits, emergency room care, and hospital stays. But for many day-to-day health services, you’re on your own.

What OHIP Doesn’t Cover

Getting a handle on what you’ll be paying for out-of-pocket is key. For most households, these expenses are a regular part of the cost of living in Ontario.

Here’s a quick rundown of what OHIP generally won’t pay for:

- Prescription Drugs: Unless you're under 25, over 65, or qualify for specific government programs, you'll be paying for your medications yourself.

- Dental Care: This is a big one. Routine check-ups, cleanings, fillings, and more serious dental work are not covered.

- Vision Care: Eye exams for most adults, plus the cost of glasses and contact lenses, come straight out of your pocket.

- Paramedical Services: Need a physiotherapist, chiropractor, or massage therapist? Those services are typically not covered by the provincial plan.

To bridge this gap, many Ontarians get supplementary health insurance through their employer. If you’re self-employed or your job doesn’t offer a benefits package, you’ll need to look at private insurance, which can run anywhere from $100 to over $300 a month, depending on your age and how much coverage you need.

Decoding Ontario's Tax System

Your gross salary is one thing; what you actually take home after taxes is another story entirely. Your disposable income is heavily shaped by Ontario’s tax system, which is a mix of provincial and federal taxes. It’s a progressive system, which just means the more you earn, the higher the percentage of tax you pay.

Taxes aren't an afterthought—they're a fixed, non-negotiable part of your budget. To really know what you can afford each month, you have to understand how income tax brackets and sales tax will affect your bottom line.

And it doesn’t stop with income tax. Almost every time you pull out your wallet, you’re paying the 13% Harmonized Sales Tax (HST). This combined federal and provincial tax is added to most goods and services—from your morning coffee to a new pair of shoes. It directly impacts your daily spending power, so factoring it into your financial plan isn't just smart, it's essential.

How Ontario Cities Compare In Cost

It’s no secret that where you decide to plant your roots in Ontario will have a massive impact on your wallet. The gap in the cost of living in Ontario between a massive city and a smaller town isn't just a few bucks here and there—it's a whole different financial ballgame. This regional difference touches everything, from your rent cheque to how much it costs to get to work every day.

Take a look at monthly household spending, and the picture becomes crystal clear. A single person could need anywhere from CA$3,200 to CA$3,800 a month, while a family of four is looking at a budget between CA$6,500 and CA$7,800 just to cover the basics. Of course, these numbers swing wildly depending on your address, which is exactly why a city-by-city comparison is so crucial before you pack any boxes. You can get more details on household spending in Ontario on spergel.ca.

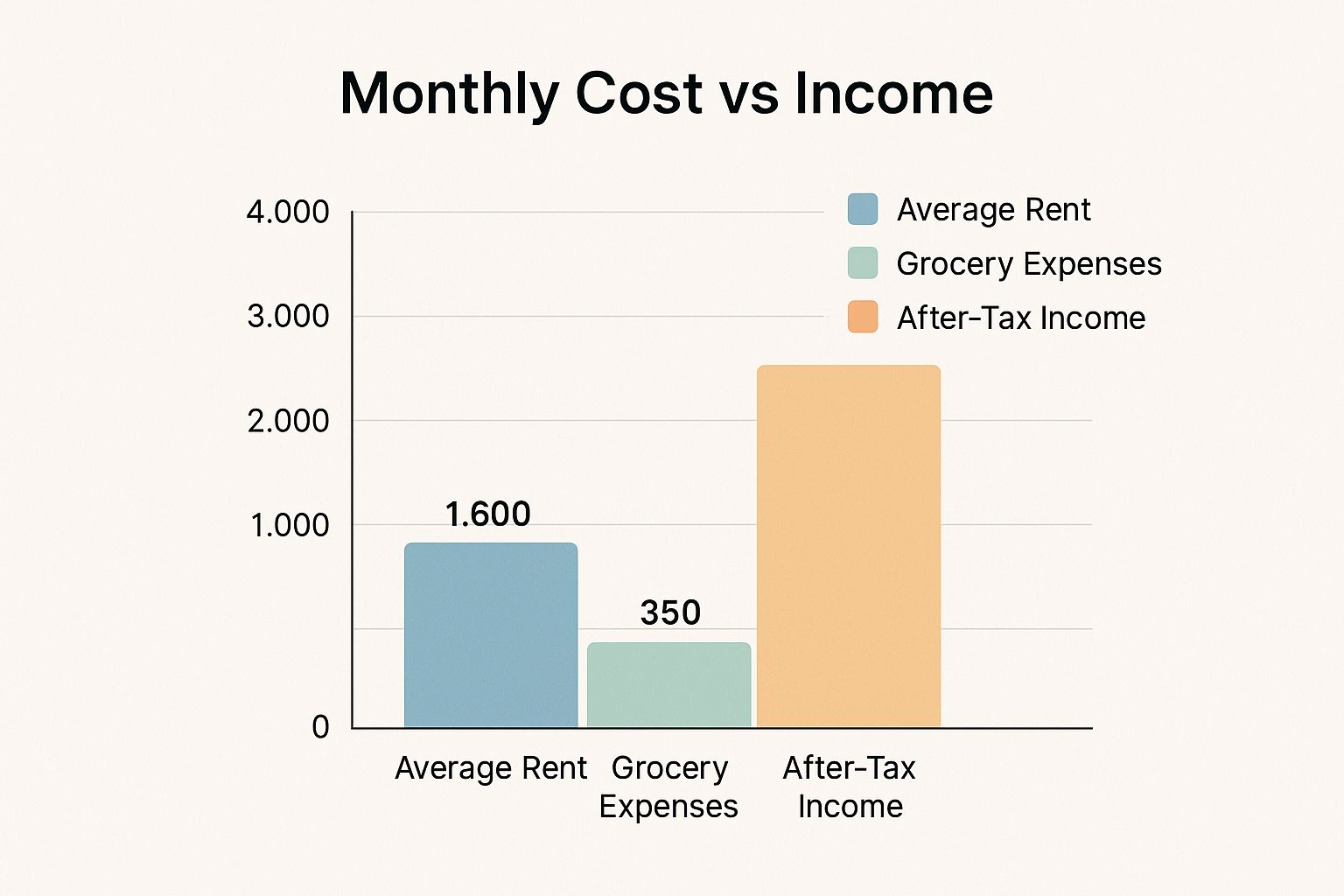

This simple graphic breaks down a few key monthly costs, showing just how they measure up against a sample take-home pay.

It’s a stark reminder of how quickly a major expense like rent can eat up a huge slice of your income. It really drives home the financial trade-offs that come with choosing one city over another.

Cost Of Living Snapshot Across Ontario Cities (Monthly Estimates)

To give you a clearer idea of how costs vary across the province, here’s a quick look at some key monthly expenses in different cities. This table highlights just how much your budget can change depending on where you live.

| City | Average 1-BR Rent (CAD) | Monthly Transit Pass (CAD) | Basic Utilities (CAD) |

|---|---|---|---|

| Toronto | $2,500+ | $156 | $170 – $220 |

| Ottawa | $1,800 – $2,100 | $125.50 | $150 – $200 |

| Hamilton | $1,700 – $1,900 | $112.20 | $160 – $210 |

| Kingston | $1,500 – $1,700 | $80 | $140 – $190 |

As you can see, the differences are significant, especially when it comes to housing. These figures underscore the importance of looking beyond salary and considering the full financial picture of a potential new home.

Big City Budgets Versus Smaller Centre Savings

To really get the full story, let's put a few key hubs head-to-head. The numbers don’t lie—they paint a pretty clear picture of affordability and lifestyle across Ontario.

-

Toronto: As Canada’s biggest city, Toronto is also its most expensive. Finding a one-bedroom apartment for under $2,500 a month is a real challenge, and a monthly TTC pass will set you back $156. The endless opportunities and vibrant energy come with a hefty price tag.

-

Ottawa: Our nation's capital strikes a much better balance. Rent is more reasonable, and the overall pace of life is less chaotic than in Toronto. For a more detailed breakdown, be sure to check out our guide on the cost of living in Ottawa.

-

Hamilton: "The Hammer" has become a hotspot for people priced out of the GTA. While its popularity means costs are on the rise, it’s still a more wallet-friendly alternative to its big-city neighbour.

-

Kingston: In smaller cities like Kingston, your money simply goes further. Lower rent, cheaper transit, and a more laid-back lifestyle make for a compelling financial argument.

The bottom line is that you're constantly balancing career opportunities against living expenses. A bigger paycheque in a major city can easily be wiped out by the sky-high cost of housing and day-to-day life.

In the end, the "best" place to live is a deeply personal choice. It depends entirely on what you value, both professionally and personally. By comparing these key numbers, you can make a much smarter decision that fits your career goals and, just as importantly, your bank account.

Still Have Questions?

Figuring out the financial side of a move to Ontario can feel like putting together a giant puzzle. To help you see the full picture, we’ve tackled some of the most common questions people have about the cost of living in Ontario.

What Is a Good Salary in Ontario?

That's the million-dollar question, isn't it? The truth is, a "good" salary really hinges on where you plant your roots and how you live. If you've got your heart set on a high-energy city like Toronto, a single person will probably need to pull in over $70,000 a year to live comfortably—that means covering all your bills with enough left over for savings and a bit of fun.

But head over to a more laid-back city like Kingston or Windsor, and the numbers change. A salary between $55,000 and $60,000 could give you that same comfortable lifestyle. It’s all about balancing what you earn with the very real costs of housing, transport, and day-to-day life in your chosen community.

How Does Toronto's Cost of Living Compare to Vancouver's?

Ah, the classic showdown. Toronto and Vancouver are always neck-and-neck for the title of Canada’s most expensive city, but they have their differences. Housing is the heavyweight champion in this fight, and Vancouver's real estate market often lands an even heavier punch than Toronto's.

While daily expenses are steep in both cities, Toronto sometimes has a slight edge because of its marginally lower housing costs and a bigger job market. But let's be real: you'll need a healthy income to thrive in either one.

No matter where you land in the province, don't forget that government support can help take the edge off. It's always smart to check if you qualify for any provincial or federal programs designed to ease the financial squeeze.

What Government Programs Help with Living Costs?

Thankfully, Ontario has several programs in place to help residents manage their bills. These initiatives can be a real lifeline for individuals and families feeling the pinch.

Here are a few of the big ones:

- Ontario Trillium Benefit (OTB): Think of this as a three-in-one package. It combines several tax credits to help low-to-moderate-income folks with energy, sales tax, and property tax costs.

- Ontario Electricity Support Program (OESP): This program offers a monthly credit that’s applied directly to the hydro bills of eligible low-income households, making those winter electricity costs a little less scary.

- Rent-Geared-to-Income (RGI) Housing: For those who qualify, this program offers subsidized housing where your rent is capped at around 30% of your household's gross income.

At ncrnow, we keep you plugged into the news and trends shaping life in Ottawa and the National Capital Region. Stay in the loop by visiting us at https://ncrnow.ca.