Investing in commercial real estate in Ottawa is a unique proposition. It offers a rare mix of stability and growth, thanks in large part to the federal government's massive footprint and a seriously booming technology sector. This one-two punch creates a resilient economic base, making the city a solid bet for investors looking for reliable, long-term returns without the wild market swings you see elsewhere.

Why Choose Ottawa for Your Next Commercial Investment?

When you start digging into Ottawa's commercial property scene, you'll find a market built on some seriously solid fundamentals. Unlike cities that live and die by a single, often cyclical industry, Ottawa’s economy is remarkably balanced. This balance fuels a consistent need for all kinds of commercial space, from downtown office towers to sprawling suburban industrial parks.

Think of the federal government as the market's ultimate anchor tenant. Its huge workforce and operational demands ensure a steady need for office space, which helps insulate the downtown core from the kind of harsh downturns that have hit other major cities. For investors, this stability is a huge draw, making the commercial real estate Ottawa market a dependable place to park their capital.

But the government is only half the story. There's a powerful second engine driving the city forward: its burgeoning tech sector.

The Twin Engines of Ottawa's Economy

They don't call it "Silicon Valley North" for nothing. Ottawa is home to hundreds of technology companies, creating a vibrant ecosystem that's hungry for specialized commercial spaces. We're talking modern offices, R&D facilities, and light industrial units—all of which add a dynamic layer of growth on top of that steady government foundation.

This dual-engine economy means Ottawa has a little something for everyone. Whether you're looking to lease to a secure government department or a fast-scaling tech startup, the market has opportunities that fit different risk appetites and investment strategies.

Ottawa’s economic structure provides a unique safety net for commercial property investors. The combination of public sector stability and private sector innovation creates a durable market that can weather economic shifts more effectively than many other Canadian cities.

Understanding the Asset Landscape

As we get deeper into this guide, it helps to know the main types of commercial properties you'll find here. Each asset class plays a different role, serves specific business needs, and comes with its own investment profile. The big three you’ll run into are:

- Office Properties: These range from the high-rise towers in the downtown core—often filled with federal tenants—to the flexible suburban office parks that are a magnet for tech companies.

- Industrial Spaces: Demand for these is through the roof, especially for light industrial buildings and warehouses that support logistics, e-commerce, and the tech sector's manufacturing side.

- Retail Centres: Think bustling urban storefronts in lively neighbourhoods like the ByWard Market, but also the large, grocery-anchored suburban plazas that serve Ottawa's growing communities.

This guide will break down each of these areas, painting a clear picture of the specific forces at play within the commercial real estate Ottawa market. By understanding these core drivers and property types, you’ll be in a much better position to spot great opportunities and make smart investment decisions.

Analyzing Ottawa's Core Commercial Asset Classes

To really get a feel for the investment potential in commercial real estate in Ottawa, you need to look past the city-wide numbers and dig into the distinct asset classes. Think of the industrial, retail, and office sectors less like different types of buildings and more like unique ecosystems, each with its own set of rules, opportunities, and challenges.

By breaking down these core components, you can start to see where the real momentum is. Each class tells a different story about the city's economic health and its future direction, pointing to specific avenues for growth.

The Industrial Sector: A Powerhouse of Demand

If there's one word to describe Ottawa's industrial real estate market, it's scarcity. Demand for industrial space consistently outpaces supply, creating a hyper-competitive landscape for tenants and a pretty sweet spot for landlords and investors. This isn't just a recent trend; it's a structural feature of the market.

This intense demand is fired up by the city’s booming tech sector, the non-stop growth of e-commerce, and a general need for modern logistics and warehousing. The result? Finding available industrial property, especially for small to mid-sized businesses, can be a real struggle.

The market fundamentals are rock solid. According to recent Q1 2024 data, Ottawa's industrial availability rate sits at an incredibly low 2.1%, a figure that highlights the intense supply crunch. This shortage is worsened by a lack of new construction, with no new buildings completed in that quarter. Smaller, light industrial buildings with features like 21-foot ceilings and loading docks are especially hot commodities, making them a prime target for savvy investors. To get a deeper understanding, you can read the full research about Ottawa's market conditions.

Retail's Resilient and Creative Evolution

While retail markets in other cities are facing some serious headwinds, Ottawa's retail sector is surprisingly vibrant, with leasing and sales activity moving at a brisk pace. Storefronts, particularly those priced under $2 million, are a rare find and tend to get snapped up almost as soon as they hit the market.

This resilience comes partly from the city's stable employment base and steady population growth, which keeps consumer spending consistent. But it’s also a story of adaptation and creativity.

A key trend we're seeing is adaptive reuse, where older, underused properties are completely transformed. A perfect example is the conversion of a former Canadian Tire store into a modern gym, which breathed new life into a huge retail footprint. This kind of innovation shows the market's ability to evolve and thrive. In another vote of confidence for the city's shoppers, Montreal’s Cozey recently opened its first pop-up store in Ottawa.

In Ottawa’s retail landscape, creativity drives value. Investors who can identify properties ripe for adaptive reuse or those located in growing suburban communities are finding significant opportunities for returns.

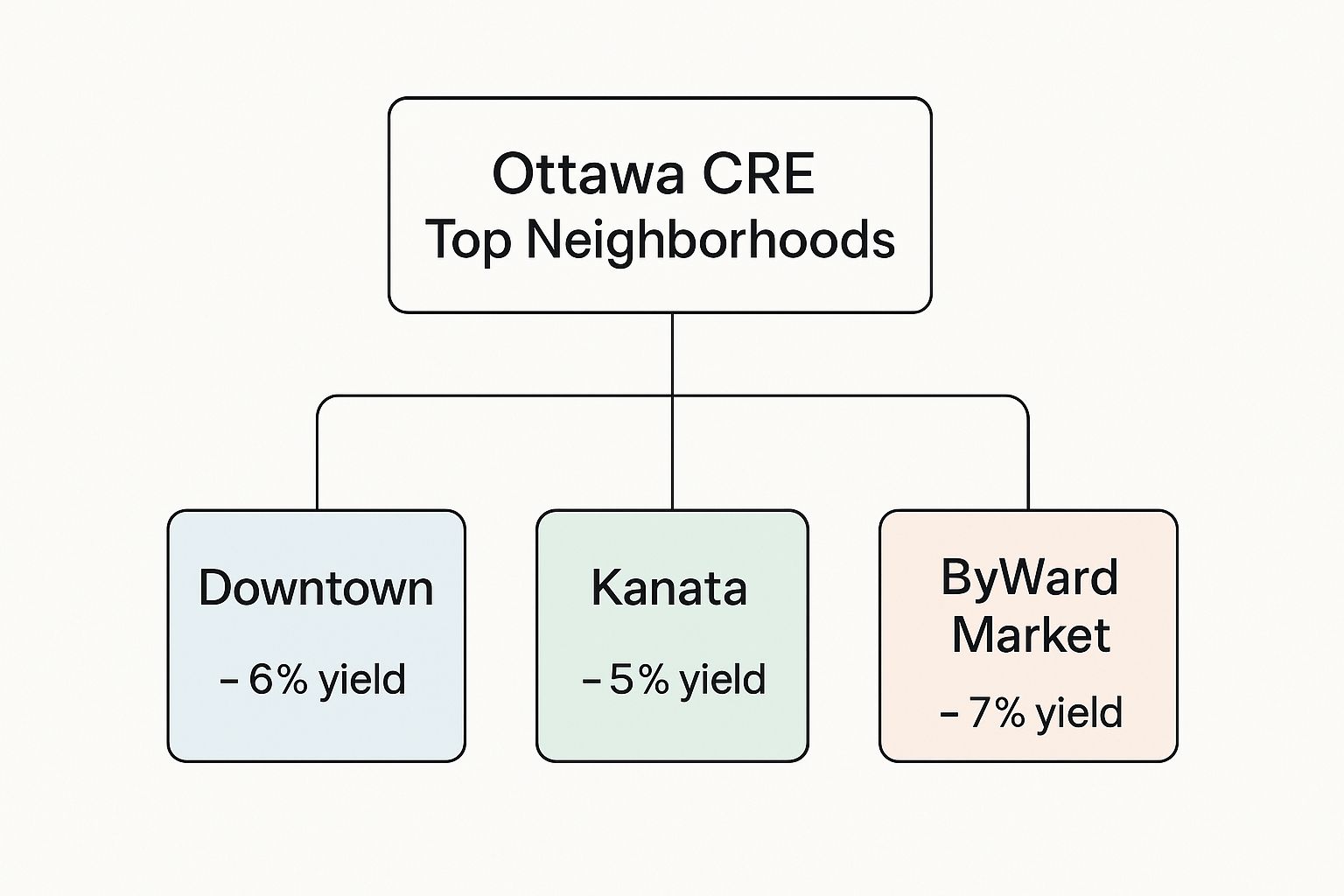

This infographic gives you a high-level look at the potential returns across some of Ottawa's key commercial neighbourhoods.

As you can see, the yield potential varies quite a bit between districts, with the bustling ByWard Market showing particularly strong returns for investors.

The Office Market's Flight to Quality

Ottawa’s office market is a bit more complicated, shaped by post-pandemic work habits and the ever-present federal government. The big theme right now is the "flight to quality," a trend where tenants are ditching older, clunky spaces in favour of modern, high-amenity buildings.

This means that Class A office towers—especially downtown ones with modern features and top-tier energy efficiency ratings—are still doing very well. They pull in premium tenants like government departments and major private companies who are willing to pay for quality environments to attract and keep top talent.

On the other hand, older Class B and C buildings are facing more of an uphill battle. But this challenge has opened up another massive opportunity: office-to-residential conversions. With government incentives encouraging these projects, outdated office towers are being repurposed into much-needed housing. It’s a creative solution that's reshaping the downtown core while giving aging assets a new lease on life. This dual-market dynamic—strong demand for the best spaces and adaptive reuse for the rest—is what defines the current state of commercial real estate in Ottawa's office sector.

To give you a clearer picture, here's a quick snapshot comparing how each of these major asset classes is performing in Ottawa right now.

Ottawa Commercial Asset Class Snapshot

| Asset Class | Key Driver | Current Trend | Investment Opportunity |

|---|---|---|---|

| Industrial | E-commerce & tech sector growth | Extremely low availability (2.1%), high demand | Acquiring smaller, light industrial properties; land development |

| Retail | Stable employment & population growth | Strong leasing, adaptive reuse of older spaces | Properties under $2M, assets suitable for conversion |

| Office | Federal government & private sector demand for modern spaces | "Flight to quality" to Class A buildings | Premium Class A properties, converting Class B/C buildings to residential |

This table neatly sums up the unique forces at play in each sector. Whether it's the intense demand for industrial space, the creative adaptation in retail, or the quality-focused shift in the office market, Ottawa presents a diverse and dynamic commercial real estate landscape for those who know where to look.

A Guide to Ottawa's Key Commercial Districts

When it comes to commercial real estate, location isn't just a factor—it's everything. It forms the very foundation of your investment. Ottawa is a mosaic of unique commercial districts, each with its own economic pulse, tenant mix, and distinct opportunities. Knowing this geographic DNA is the key to figuring out where your capital will work hardest for you.

You have to think of Ottawa not as one single market, but as a collection of specialized hubs. From the government-dominated towers of the Downtown Core to the buzzing tech campuses of Kanata, each district presents a different puzzle for investors. Picking the right spot means matching your investment goals with the true character of that neighbourhood.

The Downtown Core: The Epicentre of Stability

Ottawa’s Downtown Core is the undisputed anchor of the city’s commercial scene. This is where the federal government's massive footprint is most obvious, creating a market that’s all about stability and long-term tenants. The skyline here is dominated by Class A office towers housing government departments and major national corporations.

For an investor, this district offers a lower-risk profile. Government leases are the gold standard for a reliable income stream, making these properties hot commodities for anyone prioritizing security. Beyond the office towers, the core boasts a dense mix of street-level retail and hospitality, all catering to the huge daytime population of public servants and corporate professionals.

The Downtown Core acts as the market's centre of gravity. Its deep-rooted stability, driven by federal tenancies, provides a reliable foundation that influences the entire commercial real estate Ottawa market.

Kanata: Ottawa's Silicon Valley North

Head west, and you’ll land in Kanata, the engine room of Ottawa's tech sector. This suburban powerhouse feels a world away from the traditional vibe of downtown. Here, the landscape is defined by modern suburban office parks, R&D facilities, and light industrial spaces built for the 500+ tech companies that call it home.

Demand in Kanata is fuelled by innovation and growth. Tenants range from multinational tech giants to scrappy startups, creating a dynamic and forward-looking investment environment. The property types here reflect that focus:

- Flexible Office Parks: Modern, low-rise buildings with plenty of parking are a huge draw for tech firms looking for collaborative and easy-to-access workspaces.

- R&D and Light Industrial: These are specialized facilities that support everything from software development to advanced manufacturing.

- Retail and Services: A growing ecosystem of retail plazas and service businesses has sprung up to support the area's large, high-income workforce.

Putting your money in Kanata is a bet on the future of technology. While it can be more cyclical than the government-anchored downtown, the potential for growth is massive, making it a critical district for any serious portfolio.

The Expanding East and West Ends

Beyond the two main cores, Ottawa's suburban East and West ends—including vibrant communities like Orléans and Barrhaven—offer a diverse menu of commercial real estate opportunities. These rapidly growing areas are characterized by a blend of retail, suburban office space, and essential industrial parks that serve their expanding residential populations.

These are the districts where you'll find many of the city's grocery-anchored retail plazas, assets that have proven to be exceptionally resilient. With new retail construction on the horizon for both Barrhaven and Orléans, these communities are only becoming more important as commercial hubs. For anyone looking to build a balanced portfolio, getting to know the unique character of these areas is a must. You can dive deeper into what makes them tick by exploring some of the best neighbourhoods in Ottawa in our detailed guide.

Ultimately, your choice of district will shape every single aspect of your investment, from the quality of your tenants to long-term appreciation. Whether you prioritize the steadfast reliability of the Downtown Core, the high-growth potential of Kanata, or the community-focused opportunities in the suburbs, Ottawa has a strategic location to match every investment thesis.

Understanding the Current Investment Climate

To make smart moves in commercial real estate in Ottawa, you need to get a feel for the market's current pulse. It’s not just about spotting a great property; it's about knowing when to make your play. Right now, the market is recalibrating, influenced by bigger economic shifts that are making investors across the country think twice.

The most obvious change is a slowdown in sales. This isn't a red flag signalling a weak market, but more of a reflection of a cautious investment mood. Think of it like a seasoned driver easing off the gas when the road gets tricky. Investors are taking a beat to survey the landscape, especially with interest rates and the economy in flux.

This more deliberate pace means the days of quick, speculative flips are on the back burner. The focus has shifted to stability and properties with a proven track record.

Decoding the Market Signals

In this kind of climate, metrics like capitalization rates and rental growth become your best friends. A capitalization rate, or cap rate, is a straightforward way to size up a property's potential return. You just divide its net operating income by its current market value. A higher cap rate often points to higher potential returns, but it usually comes with more perceived risk.

Ottawa's cap rates are holding fairly steady at the moment, which tells us the market is adjusting with discipline rather than panicking. Investors are keeping a close eye on these rates, looking for that sweet spot between risk and reward in assets that promise predictable cash flow.

Rental growth is the other side of the coin. Even with fewer properties changing hands, sectors with strong rental growth—like industrial and certain kinds of retail—are still hot tickets. This is a great sign that tenant demand is solid, which is exactly what long-term investors want to see.

A Cautious but Strategic Sentiment

The mood among investors right now can be summed up as cautiously optimistic. The era of rapid-fire deals has been replaced by a more measured approach that puts due diligence and asset quality first.

You can see this shift clearly in the latest transaction data. Commercial real estate sales in Ottawa have cooled significantly, with recent reports indicating a substantial drop in transaction volumes compared to averages seen since 2019. That trend mirrors what's happening across Canada. As a result, investors are deploying their capital more carefully, favouring stable, income-producing assets. You can read more about this trend in Ottawa's market on CoStar.com.

In a market defined by caution, the smartest investments are often the most stable ones. Properties with strong tenant covenants, long lease terms, and locations in resilient districts are drawing the most attention from serious investors.

This careful approach extends to financial planning, especially when it comes to operational costs. Knowing how to forecast your expenses is critical. For instance, you can learn more about how to handle a commercial property tax bill in Ottawa in our guide, a key piece of the puzzle for managing any investment.

Identifying Risks and Rewards

Every market climate has its own unique mix of risks and rewards. To successfully navigate Ottawa's current landscape, you need to understand both.

Potential Risks to Consider:

- Interest Rate Volatility: Future swings in borrowing costs could shake up financing and property values.

- Slower Economic Growth: A broader economic slowdown might dampen tenant demand in more cyclical sectors.

- Office Market Bifurcation: The gap between shiny Class A office spaces and older buildings keeps getting wider, creating headaches for owners of lower-tier properties.

Key Rewards and Opportunities:

- Reduced Competition: A slower market means fewer bidding wars. This gives well-capitalized buyers a better chance to negotiate favourable terms.

- Focus on Quality: The "flight to quality" is real. It creates strong demand for best-in-class assets, rewarding those who own or acquire premium properties.

- Sector-Specific Strength: The industrial and grocery-anchored retail sectors are showing incredible resilience, offering stable, long-term growth potential.

Ultimately, the current investment climate for commercial real estate in Ottawa rewards patience and smart thinking. It's a market for investors who do their homework and prioritize solid fundamentals over chasing short-term wins. By understanding these dynamics, you'll know when to act boldly and when to play it safe.

Navigating Ottawa's Zoning and Legal Landscape

Finding the perfect property is just the first step. To truly succeed in commercial real estate Ottawa, you have to master the city’s regulatory playbook. This is the web of rules that dictates what you can build, where you can build it, and how your property can be used. Think of it as the unwritten code that determines your investment’s ultimate fate.

Ignoring this landscape is the fastest way to sink a promising project before it even starts. Knowing the rules isn't just about dodging fines; it’s about seeing a property’s hidden potential and guaranteeing its future value. Every smart investor needs to speak the language of municipal planning.

Decoding the City of Ottawa Official Plan

At the very top of Ottawa’s development pyramid sits the Official Plan. This isn't just some dusty document; it’s the city’s roadmap for the future. It lays out the grand vision for everything from land use and urban density to transit and green spaces, shaping what Ottawa will look like for decades.

The Official Plan is the high-level guide for all development, setting the tone for the nitty-gritty zoning by-laws. For investors, it’s a crystal ball, revealing which areas are earmarked for growth and what kinds of projects the city wants to see. Line up your project with this vision, and you’re already on the path to a smoother approval process. To see how it all comes together, you can dig into the City of Ottawa Official Plan in our overview.

Ottawa’s Official Plan is your strategic map. It reveals the city’s long-term priorities, helping you anticipate future zoning changes and identify properties in areas primed for government-supported growth and investment.

This master plan is the "why" behind the zoning by-laws, which are the legally binding "how" for every single piece of land in the city.

Getting Practical with Zoning By-Laws

If the Official Plan is the 30,000-foot view, zoning by-laws are the boots on the ground. These are the specific, enforceable rules that control exactly how you can use a property. They are what make or break a project's real-world feasibility.

Here are the key zoning details you absolutely have to get right:

- Permitted Uses: This defines what kind of business can operate on the site (e.g., retail, industrial, office). You can’t just open a restaurant in a spot zoned for light industrial use without going through a formal—and often lengthy—rezoning process.

- Building Height and Setbacks: These rules dictate your building's physical footprint. They control everything from how tall your structure can be to how far it must sit from the property lines.

- Density and Lot Coverage: This is all about scale. These rules govern how much of the lot you can build on and the total allowable floor space, which directly impacts your project's size and profitability.

Getting these details wrong is an expensive lesson. Assuming you can add a second story to a retail building without checking the height restrictions could kill your project on the spot.

Essential Due Diligence Checklist

Before you even think about signing on the dotted line, thorough due diligence is non-negotiable. This is your chance to uncover any hidden problems that could turn your investment into a nightmare. It’s about checking every detail and making sure there are no surprises waiting for you.

Your due diligence checklist must include these crucial steps:

- Title Search: This confirms who legally owns the property and, more importantly, flags any claims against it like liens or easements that could limit how you use it.

- Environmental Site Assessment (ESA): This is a must, especially for industrial sites. An ESA checks for things like soil or groundwater contamination from previous tenants. Finding an environmental problem after you buy can lead to clean-up costs that are simply astronomical.

- Survey and Building Inspection: A recent survey confirms the exact property boundaries, while a professional building inspection will spot any structural flaws or expensive repairs hiding in plain sight.

By carefully navigating Ottawa’s legal and zoning framework, you turn what could be a regulatory headache into a real competitive edge, making sure your investment is safe, sound, and set up for success.

Future Trends and Emerging Opportunities

If you want to understand where Ottawa's commercial real estate market is heading, you have to look past the day-to-day noise. The city isn’t just sitting back; it's being actively shaped by massive infrastructure projects and a much smarter, more disciplined approach to new construction. These aren’t small tweaks—they're fundamental shifts poised to redraw the investment map, creating fresh pockets of value for those who know where to look.

Getting ahead of these trends is everything. It’s about positioning your portfolio for the next wave of growth, not just reacting to what’s happening now. Two major catalysts are already paving the way: the expansion of public transit and a more controlled construction cycle.

Infrastructure as a Catalyst for Growth

Big infrastructure projects are like magnets for development and value. In Ottawa, there's no bigger game-changer on the horizon than the continued expansion of the Light Rail Transit (LRT) network. As new lines push further into suburban communities, they are completely changing the commercial real estate game along those corridors.

Think of the LRT as a new artery, pumping economic life into areas that might have been overlooked before. Suddenly, properties near new transit stations are becoming hot commodities for a whole range of uses:

- Transit-Oriented Retail: Cafes, small grocers, and service shops that depend on foot traffic will find prime real estate right next to LRT stops.

- Suburban Office Hubs: Companies can offer their teams an easier commute by setting up satellite offices near transit, making these locations incredibly attractive.

- Mixed-Use Developments: The land around LRT stations is practically tailor-made for integrated projects that mix residential units with ground-floor commercial space, creating lively, self-sustaining communities.

This transit build-out is unlocking value by making areas more accessible and convenient. It’s a direct shot in the arm for demand, especially for commercial properties you can walk to from a new station.

A Disciplined Construction Cycle

While a construction boom might look exciting from the outside, a more measured and disciplined development pipeline often creates a much healthier, more sustainable market. Right now, Ottawa is benefiting from exactly that. The supply of new commercial properties is tapering off, which prevents the market from getting waterlogged with too much inventory—and that's fantastic news for existing property owners.

A disciplined construction pipeline is a powerful stabilizer. It allows existing inventory to be absorbed, which tightens availability and gives landlords more leverage, ultimately leading to stronger rental growth and higher investor returns over the long term.

This careful management of new supply is especially important in today's more cautious investment climate. While investment volumes in Canadian commercial real estate have shown weakness, Ottawa's controlled development signals a potential tightening of supply down the road. That could really boost returns as demand starts to outpace what’s available. You can dig deeper into these national market trends on AltusGroup.com.

Spotlighting Emerging Opportunities

Beyond these big-picture trends, a few specific opportunities are bubbling up that savvy investors should have on their radar. One of the most resilient and promising sectors is grocery-anchored retail. These centres, with a major supermarket as the anchor tenant, have proven to be rock-solid investments, drawing consistent foot traffic no matter what the economy is doing.

Another key area to watch is the growing demand for mixed-use developments. As Ottawa continues to densify, there's a real push for projects that blend living, working, and shopping into one seamless space. These developments create dynamic, walkable neighbourhoods that appeal to both residents and commercial tenants, marking a major path for future growth in the city. By keeping an eye on these emerging trends, you can position your portfolio for what's coming next.

A Few Common Questions About Investing in Ottawa

Diving into the commercial real estate Ottawa market can feel a bit overwhelming, especially if you're new to the city or looking to diversify your portfolio. A lot of the same questions pop up, so let’s tackle them head-on.

Think of this as your quick-start guide to the practical side of investing in Ottawa's unique landscape.

What Is a Typical Cap Rate in Ottawa?

That's the million-dollar question, and the honest answer is: it depends. Capitalization rates, or "cap rates," swing quite a bit based on the type of property, its location, and its overall quality.

For example, a prime downtown office building with the federal government as a long-term tenant is about as low-risk as it gets. You'll see those trade at lower cap rates, maybe in the 5% to 6% range, because they're a safe bet. On the flip side, something with a bit more hustle, like a multi-tenant industrial building in a hot area or a well-placed retail plaza, can fetch higher cap rates—often between 6% and 7.5%. It really comes down to analyzing each deal on its own merits, because the market is always in motion.

Is Industrial Real Estate a Good Investment Here?

Without a doubt. Ottawa's industrial market is one of its star players right now. Vacancy rates are incredibly low—currently around 2.1% based on recent reports—and the demand just doesn't quit. This squeeze is fuelled by the city's booming tech sector and the ever-growing needs of e-commerce logistics.

What does this mean for an investor? It's a landlord's market, plain and simple. You've got serious potential for rent growth and long-term value appreciation. Smaller, light industrial spaces with modern perks like high ceilings and great loading access are especially hot commodities.

Honestly, the biggest challenge is just finding available industrial property. If you can lock down a well-located asset, you've found something truly valuable.

How Does the Federal Government Impact the Market?

The federal government isn't just a player in Ottawa's commercial real estate market; it's the anchor. As the city's largest employer and tenant, its presence casts a huge shadow of stability over everything, especially the downtown office sector.

This creates a steady, reliable demand for Class A office space, which helps insulate the core from the wild swings you see in other major cities. But that stability doesn't stop there. It trickles down, supporting the countless retail shops and restaurants that serve the massive federal workforce. In short, the government creates a solid economic foundation that benefits every type of commercial property in the city.

Ready to dig deeper into the opportunities in Ottawa's dynamic market? The team at ncrnow is always tracking the latest news and insights to keep you ahead of the curve. Discover more on ncrnow.ca and make your next investment your best one.