When your property tax bill arrives in the mail, it’s easy to see it as just another expense. But it’s so much more than that—it’s a detailed statement of your direct investment in our community. Think of it as your contribution to the very fabric of Ottawa, funding everything from our first responders and public transit to the parks where our kids play.

This document shows exactly how you’re helping build a safer, more vibrant city.

Your Guide to Understanding the Property Tax Bill

Getting your property tax bill can feel a bit like trying to solve a puzzle. It’s dense with numbers and unfamiliar terms. But once you understand its purpose and learn to read its key elements, it transforms from an intimidating piece of paper into a clear breakdown of your civic contributions.

At its heart, the bill is the connection between your property and the essential services that make the National Capital Region such a fantastic place to live. Our goal is to help you look at your next bill with confidence, not confusion. We’ll start with the basics—the foundational terms you’ll find on every statement—before we dive into the calculations.

Foundational Terms on Your Bill

Every property tax bill uses specific identifiers to link the statement to your unique property. Getting a handle on these is the first step to making sense of it all.

- Roll Number: This is a unique 19-digit number assigned to your property by the Municipal Property Assessment Corporation (MPAC). It’s the main ID the City of Ottawa uses for anything tax-related. You can think of it as your property’s social insurance number—it’s one-of-a-kind.

- Legal Description: This isn’t your mailing address. Instead, it’s the formal, official description of your property’s location, including lot and plan numbers. This is what’s used for land registration purposes because it’s far more precise than a street address.

By getting familiar with these two key terms, you’ll have a much clearer picture of how the city identifies and manages your property for tax purposes. It’s the first piece of the puzzle.

This knowledge gives you a solid foundation for managing your finances and understanding your role as a property owner in our region. For a wider look at financial matters and quality of life here, feel free to explore our insights on what makes life in Canada unique.

Now that we've covered the fundamentals, you’re ready to see how your bill is actually calculated.

Ever wondered how the City of Ottawa lands on the exact number for your property tax bill? It’s not just pulled out of thin air. Your final bill is the result of a straightforward, two-part formula that every homeowner should understand.

Think of it like this: the City needs a certain amount of money to run—that's the total budget pie. Your property's value determines the size of your slice, and the tax rate sets the price for it. Getting a handle on your bill is all about seeing how these two key pieces fit together.

The Two Core Components of Your Tax Bill

At its heart, your property tax bill is determined by two main factors: what your property is worth and the tax rate set by the city and province. Let's break down what each of those means.

| Component | What It Is | Determined By |

|---|---|---|

| Assessed Value | The estimated market value of your property on a specific date. | The Municipal Property Assessment Corporation (MPAC). |

| Tax Rate | The percentage used to calculate the tax owed based on the assessed value. | The City of Ottawa Council and the Province of Ontario. |

These two elements work hand-in-hand. The assessment provides a fair, standardized value for your property, while the tax rate connects that value directly to the cost of funding our community's essential services.

Your Property's Assessed Value

The first piece of the puzzle is your home's assessed value. This isn't just an estimate; it's a formal valuation conducted by the Municipal Property Assessment Corporation (MPAC), a province-wide body responsible for assessing every single property in Ontario.

MPAC's main job is to figure out what your home likely would have sold for on a specific, legislated date. To do that, they look at several key factors that influence a home's real-world market price:

- Location: We all know location matters, and it’s a huge factor here. The neighbourhood you’re in plays a big role.

- Property Features: This covers everything from the size of your lot and the square footage of your house to its age and the quality of construction.

- Recent Sales: To keep things fair and accurate, MPAC analyzes what comparable properties in your area have recently sold for.

This process ensures your property is valued consistently against similar homes nearby, creating a level playing field for everyone.

MPAC uses five core factors to land on a final value, as shown in this visual from their site.

It’s a clear breakdown of how location, lot size, living area, age, and construction quality all get factored into your final assessed value.

The Municipal and Education Tax Rates

The second piece of the equation is the tax rate. This rate is set each year by both the City of Ottawa Council and the Province of Ontario.

First, the City figures out its annual budget—how much it will cost to fund everything from road repairs and libraries to police and paramedics. Based on that total, it calculates the municipal tax rate needed to raise the money.

The formula is surprisingly simple: Assessed Value x (Municipal Tax Rate + Education Tax Rate) = Your Total Property Tax

The province also sets its own education tax rate, which is dedicated to funding our school boards. Your final bill combines these two rates and applies them to your home's assessed value.

For example, if your home is assessed at $500,000 and the combined municipal and education tax rate works out to 1%, your annual property tax would be $5,000. It's a direct line connecting your property’s value to the cost of running our city and schools.

Breaking Down the Charges on Your Bill

While it’s the total amount that usually makes us gulp, your property tax bill is much more than just a single number. Think of it as an itemized receipt for your investment in our community. By taking a moment to look at the individual line items, you get a transparent picture of where every dollar is really going.

This isn’t just about paying a bill; it’s about understanding how your money funds the city and provincial services we all rely on. The breakdown gives you the clarity every homeowner deserves.

The Two Main Tax Levies

At its core, your bill is split between two main charges: the municipal levy and the education levy. They might appear on the same piece of paper, but they fund completely different operations.

- The Municipal Tax Levy: This is the big one. Set directly by the City of Ottawa, it’s the largest chunk of your bill. This money is what keeps our city running—paying for everything from road maintenance and waste collection to public transit, emergency services, libraries, and parks.

- The Education Tax Levy: This portion isn’t set by the city, but by the Province of Ontario. The funds collected from every property owner are pooled and then distributed to school boards across the province to support elementary and secondary education.

Seeing these two levies separated on your bill highlights a key distinction: you are funding both local city services and the broader provincial education system through a single payment.

Other Potential Charges and Fees

Beyond those two major levies, you might spot a few other specific fees on your bill. These are typically smaller amounts and are often tied to services or projects that benefit specific neighbourhoods rather than the entire city.

These additional line items can include:

- Stormwater Fee: This charge helps fund the management of crucial stormwater infrastructure, like the sewers and drainage systems that prevent flooding and protect our water quality. It’s a small fee for a massive, and essential, job.

- Local Improvement Charges: Did your neighbourhood recently get an upgrade like new sidewalks, fancy street lighting, or a freshly paved laneway? You might see a local improvement charge. This is the city’s way of recovering the cost of projects that directly benefit a limited number of properties.

Each of these charges represents a distinct service or project. By dissecting your bill line by line, you shift from simply paying a tax to understanding exactly what you’re paying for. It's a small step that makes you a much more engaged and knowledgeable resident.

Key Deadlines and Smart Payment Strategies

Staying on top of your property tax payments is a must if you want to avoid some pretty expensive penalties. It’s best to think of the property tax cycle like a subscription service for your city; if you miss a payment, you’re going to get hit with significant late fees. Getting a handle on the key dates and picking the right payment strategy can save you both money and a whole lot of stress.

Here in Ottawa, your property tax bill actually comes in two installments.

First, you’ll get an interim tax bill in February, with payment due in March. This bill covers 50% of your property tax from the previous year. Think of it as a down payment that keeps city services running smoothly while the new annual budget is being finalized.

Later, the final tax bill is mailed out in late spring (usually May), with the payment deadline in June. This bill is the real deal—it reflects the newly approved municipal and provincial education tax rates for the current year. It calculates your total tax owed and then subtracts what you already paid on the interim bill, leaving you with the final balance.

Choosing Your Payment Method

The City of Ottawa makes it pretty convenient to pay, offering several methods so you can choose what works best for your own financial style.

- Pre-Authorized Debit (PAD) Plans: This is the most popular “set it and forget it” option. You can set it up to withdraw funds automatically on the due date, or you can opt for a plan that spreads your total tax bill over 10 or 12 monthly payments. This makes budgeting a whole lot easier.

- Online or Telephone Banking: Just like paying any other utility bill, you can pay through your bank's online portal or by phone.

- In-Person Payments: You can still pay the old-fashioned way at any City of Ottawa Client Service Centre or at your own bank.

A word of caution: late payments are hit with a penalty of 1.25% on the unpaid amount. This is charged on the first day of default and again on the first of each month that it remains unpaid. That adds up to a 15% annual interest rate—a steep price for missing a deadline.

Plan Ahead to Avoid Penalties

A little bit of smart financial planning goes a long way in helping you avoid these costly fees. Many homeowners find it helpful to align their tax payment schedule with their personal budgets, whether that means setting aside funds monthly or just planning for the two larger payments. This kind of foresight doesn't just ensure you pay on time; it also gives you peace of mind.

Keeping these dates on your radar is just as important as planning for other major events on your calendar. And while you're organizing your schedule, you can find helpful info on other local happenings, like the upcoming Canada Day 2025 celebrations in Ottawa, to stay connected with what's going on in the city.

So, you’ve opened your property tax notice and the assessed value just doesn’t seem right. If you think your property has been overvalued, you have every right to challenge that number. The Municipal Property Assessment Corporation (MPAC) is responsible for these valuations, but they don’t always get it perfect. A successful appeal could mean real savings on your tax bill.

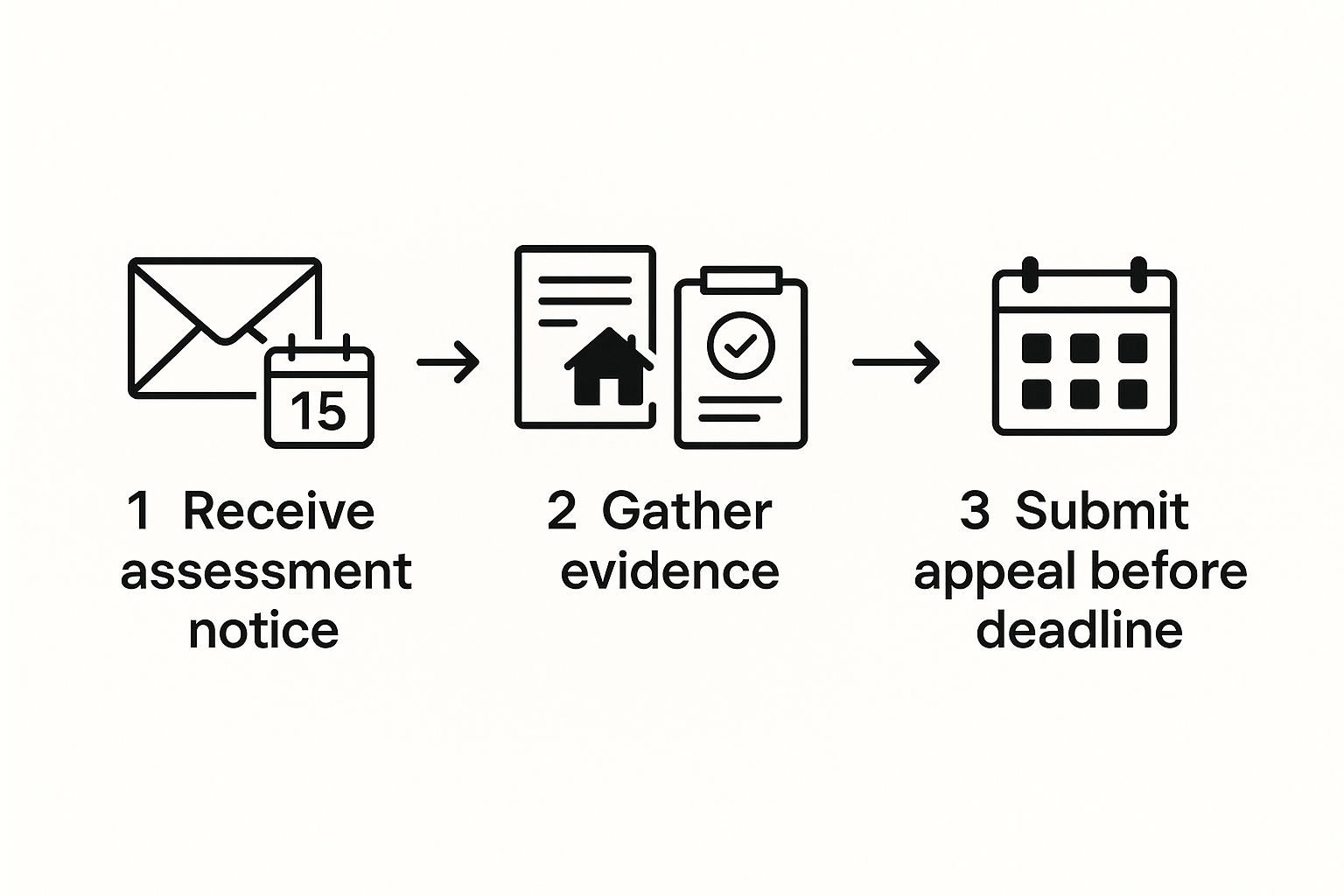

Figuring out where to start can feel a little daunting, but the process is more straightforward than you might think. It all begins with a formal request to MPAC, and if that doesn't resolve the issue, you can take your case to an independent tribunal.

The First Step: A Request for Reconsideration

Before you can launch a formal appeal, your first move is to ask MPAC to take a second look. This is officially called a Request for Reconsideration (RfR). The good news is that you can file it online through the MPAC website, and it won’t cost you a thing.

The deadline to get your RfR submitted is printed right on your Property Assessment Notice. You typically have 120 days from the notice's Issue Date to file. Sticking to these deadlines is absolutely critical. Timely communication is everything, and while it’s a different context, the recent discussions around the CFIB's plea to avoid a Canada Post strike show just how important it is to use digital channels to avoid delays.

To give your RfR a real shot at success, you need solid proof that your property is overvalued. Just saying "my taxes are too high" won't cut it.

You need to build a case based on facts. Start by gathering evidence like:

- Comparable Sales: Look up the recent sale prices of properties in your neighbourhood that are similar in size, age, and condition. If they sold for less than your assessed value, that’s a powerful piece of evidence.

- Property Issues: Make a detailed list of any major issues that could bring down your property's value. Think structural problems, significant water damage, or even a newly obstructed view.

- Professional Appraisals: Getting an independent appraisal from a certified professional can be a game-changer. It provides a credible, expert opinion to back up your claim.

Escalating to the Assessment Review Board

What happens if MPAC reviews your RfR but you still don't agree with their final decision? Your next option is to file a formal appeal with the Assessment Review Board (ARB). The ARB is an independent tribunal that operates like a court, hearing property assessment disputes from all over Ontario.

Filing an appeal with the ARB is a more formal process. It involves a fee and has its own strict deadlines, which you’ll find in the decision letter MPAC sends you after your RfR.

Here’s a quick overview of what to expect when you take your case to the ARB.

Navigating the Assessment Appeal Process

This table breaks down the main stages of the formal appeal process, helping you understand what happens and who's involved at each step.

| Stage | Action Required | Key Body Involved |

|---|---|---|

| Initial Assessment | Receive your Property Assessment Notice in the mail. | MPAC |

| Request for Reconsideration (RfR) | File an RfR online with supporting evidence before the deadline. | MPAC |

| MPAC's Decision | MPAC reviews your case and sends you a decision letter. | MPAC |

| Filing the Appeal | If you disagree with the RfR decision, file a formal appeal and pay the fee. | ARB |

| The Hearing | Prepare and present your case with all your evidence at a scheduled hearing. | ARB |

| Final Decision | The ARB makes a final, legally-binding decision on your property's assessed value. | ARB |

At this stage, your case will be presented at a formal hearing, so being organized and having all your evidence ready is essential. Success here hinges on how well you can argue your case.

Common Questions About Your Property Tax Bill

Even after breaking down all the numbers and dates, it's totally normal to have a few questions left about your property tax bill. It’s a complex part of homeownership, and frankly, a lot of people find themselves wondering about the same things year after year.

To help you get through tax season with confidence, we’ve put together answers to some of the most common questions we hear. Think of this as your go-to guide for those "what if" and "why" moments that inevitably pop up.

Why Did My Property Tax Go Up This Year?

This is easily the most common question homeowners ask, and seeing that number jump can be jarring. The reason almost always boils down to one of two things—or, more often than not, a mix of both.

First, the City of Ottawa may have increased its annual budget. Things like transit, road repairs, and emergency services cost more over time. To cover these rising expenses, the city might need to adjust the municipal tax rate. If that rate goes up, every property owner in the city will see a matching increase on their bill.

The second reason is that your property's assessed value might have gone up since the last province-wide assessment by MPAC. If your home's value grew more than the city-wide average, your slice of the overall tax "pie" gets bigger. This means your bill could be higher even if the city's tax rates didn't change much at all.

What Is the Difference Between an Interim and a Final Tax Bill?

It's helpful to think about your property tax bill like a two-part payment plan: you make a deposit first, then settle the final balance later. That’s pretty much how the interim and final tax bills work.

The interim tax bill lands in your mailbox early in the year and is basically a prepayment. It's calculated as 50% of your total property tax from the previous year. This system is smart because it gives the city the funds it needs to keep everything running while the new budget and tax rates for the current year are still being finalized.

Later on, you'll get the final tax bill. This one is calculated using the newly approved municipal and education tax rates for the current year. It lays out your total tax responsibility, subtracts what you already paid with your interim bill, and leaves you with the final amount owing.

In short, the interim bill is an educated guess to get the year started. The final bill is the precise, reconciled amount you owe based on this year's actual budget.

This two-step process ensures the city has a steady cash flow for its operations and gives officials the time they need to get the annual budget just right.

Are There Tax Relief Programs Available?

Yes, absolutely. The city offers several programs to help ease the property tax burden for certain groups of homeowners. One of the most important in Ottawa is the Property Tax Deferral Program, which is specifically for low-income seniors and low-income persons with disabilities.

This program allows eligible homeowners to postpone paying their property taxes each year. Instead of being due annually, the deferred amount becomes a lien on the property. That amount, plus any interest, gets paid back to the city only when the home is eventually sold or the ownership changes hands.

The benefits here are massive:

- Financial Relief: It offers immediate breathing room for people living on a fixed or limited income.

- Housing Stability: It helps seniors and residents with disabilities stay in their homes longer without the yearly stress of a large tax bill.

- Peace of Mind: Just knowing this option exists can provide a crucial sense of security for some of our most vulnerable neighbours.

Eligibility depends on specific income criteria, so be sure to check the City of Ottawa's website for the latest requirements and how to apply.

How Do I Update My Mailing Address for My Tax Bill?

Keeping your contact information up-to-date with the city is incredibly important. If you move, you need to formally notify the City of Ottawa of your new mailing address to make sure your tax bill and other notices find their way to you.

You can usually get this done by filling out a form on the city’s website or by contacting their revenue services department. Don't skip this step.

As the property owner, you are legally on the hook for paying your taxes on time, whether you received the bill or not. Saying it was sent to an old address won’t get you out of late payment penalties, which can add up quickly. A quick update is a simple action that can save you a lot of money and hassle.

At ncrnow, we're committed to keeping you informed about the issues that matter in Ottawa and the National Capital Region. For more local news and in-depth stories, visit us at https://ncrnow.ca.