Navigating a financial dispute can be stressful, but understanding your legal options is the first step toward resolution. If you're considering legal action for a monetary or property issue in Ontario, Small Claims Court is a powerful and accessible tool designed for exactly that purpose.

The Small Claims Court Ontario is a specific branch of the Superior Court of Justice. Its entire purpose is to handle civil disputes involving money or property up to a $35,000 limit. Think of it as the legal system's express lane—it’s designed to be faster, more accessible, and far less expensive than battling it out in the higher courts. This makes it a go-to for individuals and small businesses looking to resolve everyday conflicts without breaking the bank.

Is Small Claims Court Right For Your Case?

Before you dive in, you need to be sure you're in the right place. The court’s primary role is to create a simplified, cost-effective path for people to have their say without getting tangled in the complex rules and high costs of Superior Court.

It only deals with civil matters, not criminal ones. This means it’s all about situations where one person (the Plaintiff) is seeking money or the return of personal property from someone else (the Defendant).

What Kinds of Cases Belong Here?

The disputes that land in Small Claims Court are incredibly varied, but they almost always boil down to someone wanting their money or property back. You’d head here if you’re dealing with things like:

- Unpaid Invoices: A client ghosts you after you’ve done the work or delivered the goods.

- Breach of Contract: You had an agreement—formal or not—and the other person didn’t hold up their end, costing you money.

- Property Damage: Someone’s actions damaged your car, your fence, or other personal belongings.

- Unpaid Loans: You lent money to a friend or family member, and they haven't paid it back as promised.

- Faulty Repairs: You paid a contractor for a renovation or a mechanic for a car repair that was done poorly or not at all.

For small business owners, getting this right is essential. Your ability to sue (or be sued) can even be affected by whether your business is properly set up. If you're unsure, our guide on how to register a business in Ontario is a good place to start.

Not sure if your issue fits the bill? This table breaks down some common scenarios to help you decide.

Should You Use Small Claims Court?

| Case Type | Small Claims Court Appropriate? | Key Consideration |

|---|---|---|

| Unpaid invoice for $15,000 | Yes | Clearly a monetary dispute well within the financial limit. |

| Divorce or child custody | No | This is a family law matter and belongs in Family Court. |

| Claim for $40,000 | Maybe | You would need to waive the extra $5,000 to meet the limit. |

| Landlord-tenant dispute | No | Most of these cases go to the Landlord and Tenant Board. |

| Personal injury claim | Yes, if under $35,000 | Many personal injury cases start here if the damages are modest. |

Ultimately, this court is designed to be a practical tool. If your case fits, it empowers you to resolve financial disputes without getting stuck in a slow, complicated, and expensive legal fight.

The Monetary Limit: A Crucial Factor

The single most important rule is the monetary limit. Right now, you can sue for a maximum of $35,000, not including any interest or court costs you might be awarded.

If your claim is for more than that, you're at a crossroads. For example, say you're owed $38,000. You have two choices: either waive the extra $3,000 to stay in Small Claims Court, or take your case to the more formal and costly Superior Court. Many people choose to waive the excess because the savings in time and legal fees often make it the smarter financial move.

Newsworthy Update: As of January 1, 2020, Ontario's Small Claims Court monetary limit was raised from $25,000 to the current $35,000. This significant increase was part of a government initiative to improve access to justice, allowing more cases to be resolved through the faster, less expensive Small Claims process. It was a major policy shift aimed at reducing backlogs in the Superior Court system.

This trend of increasing the limit reflects a clear effort to make the justice system more efficient and accessible for the average person and small business owner in the province.

How to Prepare and File Your Plaintiff's Claim

Starting a lawsuit can feel like a huge step, but it's really just a series of manageable tasks. The first official move in Small Claims Court Ontario is to prepare and file what's called a Plaintiff's Claim. This document, officially known as Form 7A, is where you lay out your side of the story for the court.

Think of it as your opening statement. This isn't just about filling in blanks on a form; it’s your chance to clearly and persuasively explain what happened from the get-go.

Gather Your Evidence Before You Even Start Writing

Before you touch the claim form, your top priority is to get all your proof together. This is the bedrock of your case. Having everything organized upfront will make writing the claim a thousand times easier and much more powerful.

Start by mapping out a timeline of what happened. Then, pull together every piece of paper—or digital file—related to the dispute.

- Contracts and Agreements: This means any formal written contracts, quotes you both agreed to, or even just email chains where you hammered out the terms.

- Invoices and Receipts: Round up all the unpaid invoices, any proof of payments you made, and receipts for expenses you had to cover because of the issue.

- Written Communication: This is gold. Save every relevant text message, email, letter, and even direct messages from social media. These conversations can be incredibly strong evidence.

- Photos and Videos: If your case is about something tangible like property damage or a botched renovation, pictures and videos are extremely convincing.

Lay it all out in chronological order. This timeline will become the skeleton of your Plaintiff's Claim.

Completing the Plaintiff's Claim Form 7A

The Plaintiff's Claim form requires specific details, and you need to get them right. Simple mistakes here can cause major delays or even undermine your case down the road. You'll have to clearly state who you are (the Plaintiff) and who you are suing (the Defendant).

Getting the defendant's legal name and address perfect is absolutely critical. If you're suing a company, you must use its correct legal name, not just the name on its sign or website. This small detail can be the difference between getting paid after you win and holding a useless piece of paper.

The real meat of the form is in two sections: "What Happened?" and "How Much Money Are You Asking For?".

Pro Tip: In the "What Happened?" section, just tell the story. Keep it simple and clear. Ditch the legal jargon and emotional language. Stick to the facts: what was agreed upon, what went wrong, the dates everything happened, and the financial hit you took because of it.

Let’s walk through a classic scenario. Say you’re a freelance graphic designer who did a job for a client, but they’ve ghosted you on the final $5,000 invoice.

Your explanation could be as simple as this:

"On January 15, 2024, I entered into a written agreement with XYZ Corp. to design a new company logo for $5,000. I delivered the final logo files on February 10, 2024, and sent invoice #123 for $5,000 that same day, with a 30-day payment term. I sent email reminders on March 15 and April 1, but the defendant has not paid the outstanding amount."

That’s it. This short paragraph lays out the facts, dates, and what’s owed. It’s effective because any judge can grasp the situation in seconds.

Filing Your Claim and Paying the Fees

Once Form 7A is filled out and your evidence is neatly organized, it's time to file. The court has made this part pretty flexible, offering both online and in-person options.

You have a couple of choices here:

- Online Filing: The most straightforward way is using the Small Claims Court Online Submission Portal. You can upload your completed forms and all your supporting documents right from your computer.

- In-Person Filing: If you prefer, you can take your documents directly to the Small Claims Court courthouse. You’ll want to go to the one in the city or town where the defendant lives or where the problem originally happened.

Filing does come with a cost. You'll need to pay a court fee to have your claim issued. These fees can change, so it's smart to check the latest fee schedule on the Ministry of the Attorney General's website first. You can usually pay by credit card online, or with cash, debit, or a certified cheque if you go in person.

The Small Claims Court Ontario is specifically designed to handle these kinds of disputes efficiently. It resolves tens of thousands of cases every year, offering a quicker and more accessible path than Superior Court for civil claims. While many people handle their own cases for things like unpaid bills or contract disputes, the process still needs to be followed carefully. You can find more details on the court’s workload in these official statistics.

After you've filed, the court will issue your claim. Your next critical job is to make sure the defendant is formally served with the documents.

So, You've Been Sued. Now What?

That feeling when you're served with a Plaintiff's Claim can be a real gut punch. It’s easy to feel a mix of panic, anger, and confusion. But the absolute best thing you can do right now is take a deep breath and respond strategically, not emotionally. This is your first test in navigating Ontario's Small Claims Court.

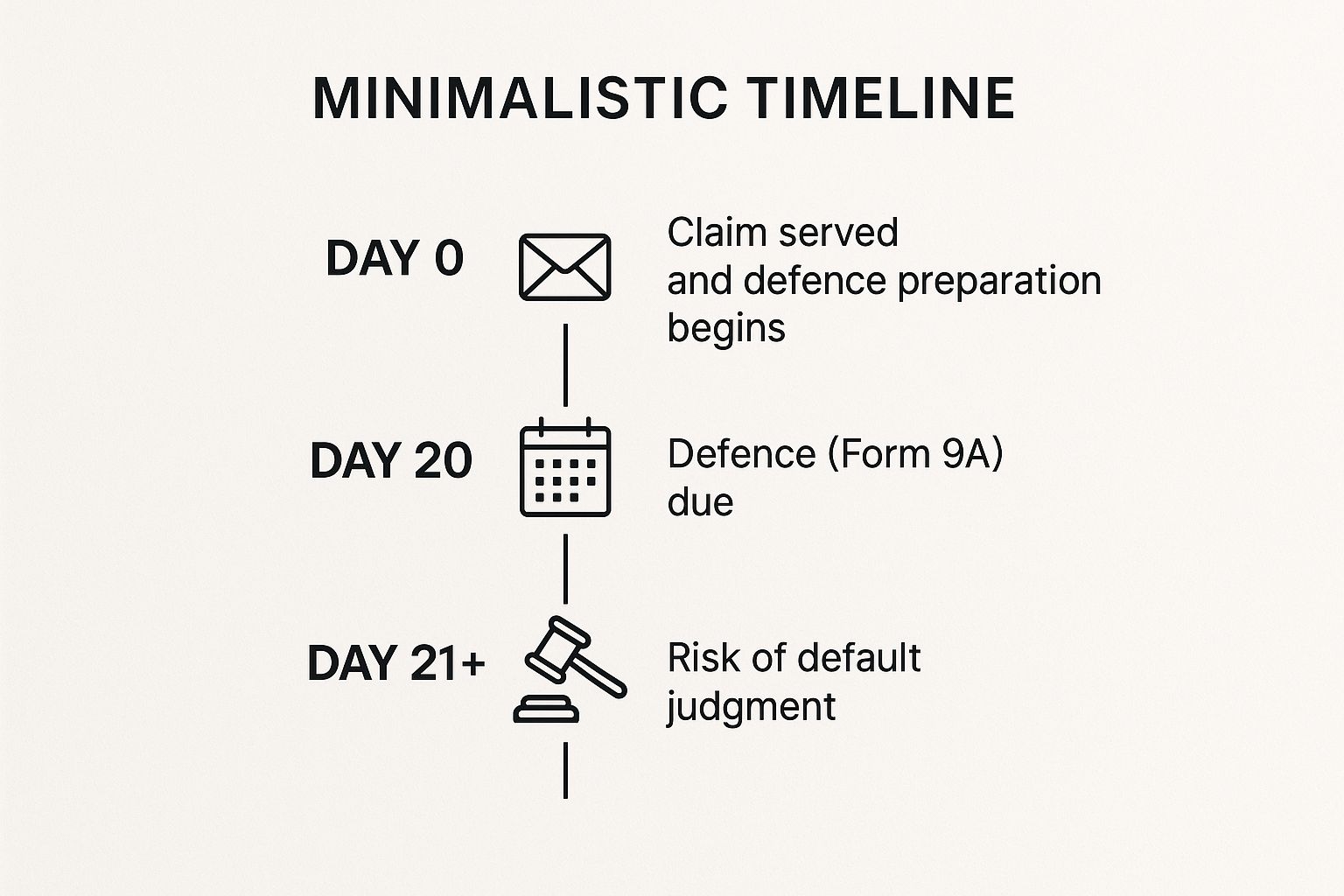

The very first thing you need to find on those papers is the date you were served. From that moment, a legal clock has started ticking.

The 20-Day Countdown You Can't Ignore

Once that claim is in your hands, you have exactly 20 days to file your response with the court. This isn't a friendly suggestion—it's a non-negotiable deadline with some pretty serious consequences. Doing nothing is, without a doubt, the worst move you can make.

If you let those 20 days slip by without filing a response, the person suing you (the plaintiff) can simply ask the court to rule in their favour. It's called a default judgment, and it means you lose automatically. You won't even get the chance to tell your side of the story. The court will just assume you agree with everything the plaintiff said and can order you to pay up.

Your First Move: The Defence (Form 9A)

Your official response is a document called a Defence, or Form 9A. This is your chance to formally push back against the allegations. You need to go through the plaintiff's claim, point by point, and state whether you admit to it, deny it, or simply don't have knowledge of it.

Think of it as your point-by-point rebuttal. A solid defence isn’t just about saying "no"; it’s about explaining why.

- Stick to the facts. Avoid getting emotional or making personal jabs.

- Be specific. If you deny something, say why. For example, if they claim you owe money for a service, your defence might explain that the work was never finished or was done so poorly it needed to be redone.

- Show your proof. If you have photos, emails, receipts, or anything else that backs up your side, attach it.

Your Defence isn't just a simple denial; it's your counter-story. It’s where you lay out the facts as you see them, backed by whatever evidence you've got. A well-crafted Defence can sometimes be persuasive enough to get the plaintiff thinking about a settlement.

The whole process is a lot like handling any other official notice—deadlines are everything, and clear communication is your best tool. It’s just as important to understand your rights here as it is when you need to figure out what to do about a parking infraction notice.

Should You File a Defendant's Claim?

Sometimes, being on the receiving end of a lawsuit is only part of the story. You might actually believe the plaintiff is the one at fault or owes you money. If that's the case, you can file what's called a Defendant's Claim (Form 10A) right along with your Defence.

This is basically your own lawsuit against the plaintiff, rolled into the same case. Imagine a contractor sues you for an unpaid bill, but their sloppy work caused thousands of dollars in water damage to your home. This is where you’d file a Defendant’s Claim for the cost of those repairs.

Filing a Defendant's Claim is incredibly efficient. It forces the court to look at the entire dispute, not just the plaintiff's version of events. It tells the judge there’s more going on here and ensures all the related issues get sorted out at once, giving you a chance to take control and make sure your whole story gets heard.

Once the initial paperwork—the claim and the defence—has been filed, your case moves into a less frantic but critically important stage. This is where the real groundwork happens. It’s all about preparation, ticking procedural boxes, and making one last formal push to settle things before a trial becomes necessary. How you handle these next steps can make or break your case in small claims court Ontario.

The entire system is actually built to encourage you to resolve the dispute yourselves. The main event at this stage is the mandatory Settlement Conference, a meeting that both the plaintiff and defendant absolutely must attend.

What to Expect at a Settlement Conference

First off, a Settlement Conference is not a trial. Think of it more as a formal, guided negotiation. It’s an informal meeting led by a deputy judge whose only job is to help you and the other side find some common ground and, hopefully, shake hands on a deal.

Crucially, the judge at this conference will not be the same one who hears your trial, if it gets that far. This is done on purpose. It allows everyone to put their cards on the table, talk frankly about settlement numbers, and explore options without fear that what you say will be used against you later.

The conference really has three main goals:

- Nailing Down the Issues: The judge will help cut through the noise and figure out what the core disagreements actually are.

- Getting a Reality Check: You'll hear an impartial, experienced opinion from the judge on the strengths and weaknesses of both sides. This can be a real eye-opener.

- Sparking Negotiation: The ultimate goal is to get a productive conversation going that leads to a solution you can both live with.

The judge can’t force you to settle, but they can offer a pretty blunt assessment of your chances at trial, which is often just the push both parties need to find a compromise.

How to Prepare for Your Settlement Conference

Showing up to this meeting unprepared is one of the biggest mistakes you can make. To get the most out of it, you need to be organized and have a clear objective. Bring a short, simple summary of your case, all your key documents, and know your bottom line—what's the absolute minimum you'll accept or the maximum you'll pay?

A Settlement Conference is your best shot at controlling the outcome. If you go to trial, a judge makes the final call, and it might be a decision neither of you likes. A negotiated settlement puts the power back in your hands.

When you're prepared, you can negotiate from a position of confidence, not desperation. Don't just wing it; have a game plan.

Speaking of plans, the clock starts ticking the second a claim is served. This timeline shows the very first deadline every defendant must respect.

As you can see, that 20-day window to file a Defence is no joke. Missing it can mean losing your case by default before you even get a chance to argue it.

Critical Deadlines You Cannot Afford to Miss

Beyond that initial 20-day sprint, the pre-trial phase is littered with other deadlines. Miss one, and you could face serious consequences, like having your evidence thrown out or your entire case dismissed.

The court takes its timelines seriously, especially as it handles increasingly larger claims. The monetary limit for Small Claims jumped from $10,000 to $25,000 in 2010, then up to $35,000 in 2020. These increases are all about improving access to justice, and a big part of that is making sure cases move along efficiently. Sticking to deadlines is how that happens. For more context, you can read about the impact of these jurisdictional changes and related reforms.

To keep things straight, here’s a quick summary of the most important timelines you’ll need to follow after a claim gets rolling.

Ontario Small Claims Court Key Deadlines

| Action Required | Deadline | Governing Form/Rule |

|---|---|---|

| Serve Plaintiff's Claim | 6 months after being issued | Rule 8.01 |

| File Defence | 20 days after being served | Form 9A |

| Serve Witnesses | At least 30 days before trial date | Rule 18.03 |

| File Documents for Trial | At least 30 days before trial date | Rule 13.05 |

There's no room for error with these dates. Mark them in your calendar, set phone reminders—whatever it takes. The court system is a machine that runs on timelines, and if you want to protect your case, you have to respect them.

Presenting Your Case and Getting a Judgment

After months of preparation, your day in court has finally arrived. This is your chance to tell your side of the story directly to the judge. It’s completely normal to feel a bit nervous, but knowing what to expect in the small claims court Ontario will give you the confidence you need to present your case clearly and effectively.

Winning at trial isn't about giving a dramatic courtroom speech you've seen in movies. It's about a clear, logical presentation. Your goal is to walk the judge through your evidence step-by-step, making your conclusion seem like the only possible one.

Mastering Courtroom Etiquette and Procedure

How you act in the courtroom really does matter. Being professional and respectful goes a long way and helps build your credibility from the moment you walk in.

First things first: always address the judge as "Your Honour." You'll need to stand whenever the judge enters or leaves the courtroom, and also any time you're speaking directly to them.

It's crucial that you never interrupt the judge or the other party. Patiently wait for your turn to speak. When it comes, speak clearly, confidently, and stick to the facts of your case. This structure isn't just for show—it ensures the process is fair and orderly, giving both sides an equal opportunity to be heard.

Structuring Your Presentation at Trial

Think of your trial presentation as telling a story backed up with solid proof. A logical, easy-to-follow narrative is far more persuasive than jumping from one complaint to another without a clear path.

You'll start with a brief opening statement. In just a minute or two, tell the judge what the case is about and what you're asking for. For instance: "Your Honour, this is a claim for $7,500. This amount is for unpaid renovation work I completed for the defendant in March 2024, as laid out in our written contract."

Next comes your evidence. This is the core of your case, where you'll call your witnesses—and yes, that includes yourself. When you testify, you'll simply tell the judge what happened from your point of view, referencing your documents as you go.

Crucial Tip: Let your evidence do the talking. Instead of just saying a contractor did a terrible job, show the judge the photos of the shoddy work. Don't just state an invoice went unpaid; present the invoice itself, along with the email chain where you sent it three times with no reply.

Questioning witnesses is a key part of the trial.

- When questioning your own witnesses (direct examination), you’ll use open-ended questions like, "Could you please describe what you saw happen next?"

- When you question the other party or their witnesses (cross-examination), you can use leading questions to pinpoint inconsistencies. For example, "Isn't it true that you never replied to my email from May 5th?"

What Happens After the Judgment

Getting a judgment in your favour is a massive win, but it might not be the end of the road. A judgment is the court's official order declaring that the other party (now called the debtor) legally owes you (the creditor) a specific amount of money.

The problem? The court doesn't actually collect the money for you. If the debtor pays up willingly, fantastic—the process is over. But if they don't, you'll have to take more steps to enforce the judgment and get what you're owed. This is a critical part of the process, much like understanding your rights after being involved in an incident requiring legal action. For more insight, you can explore information related to handling an accident on the highway and the necessary follow-up.

Enforcing Your Judgment and Collecting Your Money

If the debtor refuses to pay, don't despair. The system gives you several powerful tools to collect what's yours. You can start these enforcement actions right at the same courthouse where you won your case.

Some of the most common enforcement methods include:

- Garnishment: This allows you to legally take funds directly from the debtor's bank account or have a portion of their wages sent to you by their employer.

- Writ of Seizure and Sale of Land or Personal Property: This is a more serious step. You can place a lien on the debtor's real estate or have a court bailiff seize and sell their personal property, like a car or boat, to satisfy the debt.

To kick off any of these actions, you'll have to file more forms and pay new fees. The process often starts with an Examination Hearing. This hearing legally requires the debtor to come to court and answer questions about their finances under oath—things like where they work, where they bank, and what assets they own. The information you get here is invaluable for deciding which enforcement tool will be the most effective.

Answering Your Small Claims Court Questions

Stepping into the legal world, even a more accessible one like Small Claims Court, naturally brings up a lot of questions. People often wonder about the same things: the costs, the rules, and whether they need to hire someone to help. Getting these basics sorted out can make the whole process feel much less intimidating.

Let’s tackle some of the most common questions head-on to give you the clear, practical answers you need.

What's the Maximum Amount I Can Sue For?

This is probably the single most important rule in Small Claims Court. As of 2024, the most you can sue for is $35,000, not including any interest or court costs you might be awarded.

This limit was increased from $25,000 on January 1, 2020. This change was a significant move by the Ontario government to improve access to justice, allowing more substantial disputes to be resolved in the faster and more affordable Small Claims system.

So, what if your claim is just a little over the limit—say, for $38,000? You have a choice. You can either take the case to the much more complex and expensive Superior Court, or you can choose to waive the extra $3,000 and keep your claim in Small Claims. For many, waiving the difference is the smarter move when you factor in the savings on time and legal fees.

Do I Really Need a Lawyer or Paralegal?

One of the best things about Small Claims Court is that you don't have to hire legal help. The entire system was designed to be user-friendly enough for everyday people to represent themselves, and many do so successfully.

That being said, having a professional in your corner can be a game-changer. A licensed paralegal or lawyer can bring a lot to the table. They can help you:

- Draft a strong Plaintiff's Claim or Defence that hits all the right legal points.

- Organize your evidence so it tells a clear, persuasive story.

- Negotiate strategically at a settlement conference.

- Navigate the specific rules and procedures of the courtroom.

Ultimately, the decision comes down to two things: how complicated your case is and how confident you feel handling it yourself. For a straightforward dispute over an unpaid invoice, you might be fine on your own. But for a case with tricky legal arguments, expert guidance could be the difference between winning and losing.

How Much Will It Cost Me to File a Claim?

While it’s not free, starting a case in Small Claims Court is significantly cheaper than in Superior Court. The province sets the fees for various steps in the process, and these can be updated from time to time.

The main fees you'll face right at the start are for:

- Filing a Plaintiff's Claim: This is the fee to officially kick off your lawsuit.

- Filing a Defence: Good news for defendants—there is generally no fee to file your defence.

- Requesting a Default Judgment: If the person you're suing doesn't respond, you'll pay a fee to ask the court to rule in your favour automatically.

Other costs can pop up later, like fees for filing motions or for enforcing a judgment if you win and the other party doesn't pay. Before you start, it's always wise to check the latest fee schedule on the Ministry of the Attorney General's website to see what to expect.

For the latest updates and news affecting the Ottawa region, from court procedure changes to local business developments, trust ncrnow to keep you informed. Stay ahead of the curve with our in-depth coverage. Visit us at https://ncrnow.ca.